The early bird caught the New York City general obligation bonds, which were offered to retail buyers at the outset of a busy week in the primary market.

This week’s volume is estimated at $7.5 billion. The calendar is composed of $5.8 billion of negotiated deals and $1.7 billion of competitive sales.

RBC Capital Markets priced New York City’s $809.555 million of general obligation bonds for retail. The deal includes Fiscal 2019 Series A and B tax-exempt GOS and Fiscal 1994 Series H, Subseries H3 GOs. The deal will be priced for institutions on Wednesday after a second day of retail orders are held. Also on Wednesday, the city is competitively selling $60 million of taxable Fiscal 2018 Series C GOs.

Proceeds from the sale will be used to refund outstanding bonds, with the exception of proceeds from around $41 million of the tax-exempt fixed rate bonds, which will be used to convert outstanding floating-rate bonds into fixed-rate bonds. The deals are rated Aa2 by Moody’s Investors Service, and AA by S&P Global Ratings and Fitch Ratings.

On Monday, Jefferies priced the New York Triborough Bridge and Tunnel Authority’s $270 million of Series 2018B general revenue refunding bonds for retail investors. Proceeds will be used to refund outstanding bonds of MTA Bridges and Tunnels and pay costs of financing, legal and miscellaneous expenses.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll Bond Rating Agency.

On Tuesday, JPMorgan Securities is expected to price the Wisconsin Health and Educational facilities Authority’s $1.23 billion issue for the Advocate Aurora Health Credit Group. The deal is rated Aa3 by Moody’s and AA by S&P and Fitch.

Bank of America Merrill Lynch is set to price the California Statewide Communities Development Authority’s $366 million of Series 2018A revenue bonds for the Loma Linda Medical Center on Tuesday. The deal is rated BB-minus by S&P and BB by Fitch.

Piper Jaffray is expected to price Houston’s $320 million of Series 2018D combined utility system first lien revenue refunding bonds on Tuesday. The deal is rated Aa2 by Moody’s and AA by Fitch.

In the competitive arena on Tuesday, Minnesota is offering $619.37 million of GOs in three sales: $397.37 million if Series 2018 various purpose bonds; $206 million of Series 2018B trunk highway bonds; and $16 million of Series 2018C taxable various purpose bonds. Public Resources Advisory Group is the financial advisor and Kutak Rock is the bond counsel. The deals, which are selling on Tuesday, are rated AAA by S&P and Fitch.

Michigan is selling $149.2 million of environmental program GOs on Tuesday. Robert W. Baird is the financial advisor and Dickinson Wright is the bond counsel. The deal is rated Aa1 by Moody’s and AA by S&P and Fitch.

Monday’s bond sales

New York

Looking at the supply/demand dynamic, Stephen Winterstein, managing director at Wilmington Trust, said that the latest Investment Company Institute report showed a $472 million inflow into municipal bond funds for the week ending July25.

“As of that date, the S&P Municipal Bond Index’s mid-week 5-day performance was -0.128%,” he wrote in a Monday market comment. “Looking forward to the 31st ICI Municipal Bond Mutual Fund Flows report for 2018, the next one [on Aug. 8] will cover the five trading days ending on Aug. 1, when the S&P Municipal Bond Index generated a -0.153% return. All in, investors have reallocated a net total of $14.250 billion into municipal bond funds thus far in 2018.”

Prior week's top underwriters

The top municipal bond underwriters of last week included Citigroup, Goldman Sachs, JPMorgan Securities, Wells Fargo Securities and Stifel, according to Thomson Reuters data.

In the week of July 29 to Aug. 4, Citi underwrote $940.5 million, Goldman $777.1 million, JPMorgan $718.5 million, Wells Fargo $499.8 million, and Stifel $259.2 million.

Secondary market

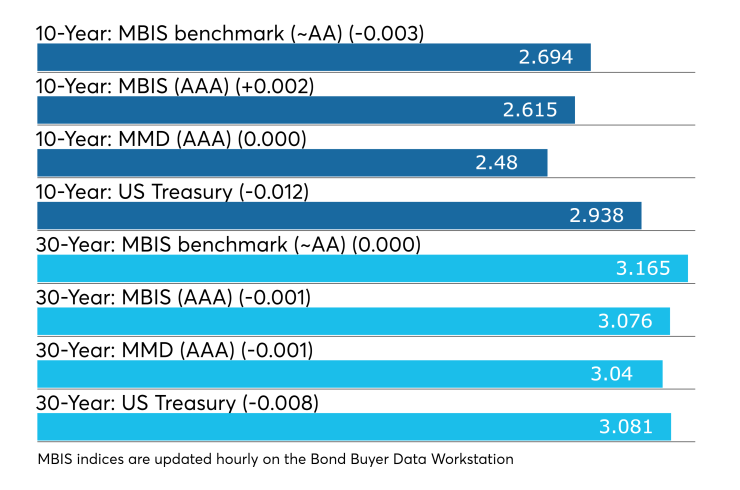

Municipal bonds were mostly stronger on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to three-year maturities and less than a basis point in the four- to 25-year maturities; yields remained unchanged in the 26- to 30-year maturities.

High-grade munis were mixed, with yields calculated on MBIS’ AAA scale falling as much as two basis points in the one- to three-year maturities and less than one basis point in the four- to seven-year and 18- to 30-year maturities, rising less than a basis point in the nine- to 16-year maturities and remaining unchanged in the eight-year and 17-year maturities.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on the 30-year muni maturity fell one basis point.

Treasury bonds were stronger as stocks traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.5% while the 30-year muni-to-Treasury ratio stood at 98.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Bond Buyer 30-day visible supply at $10.6B

The Bond Buyer's 30-day visible supply calendar decreased $465.8 million to $10.60 billion for Tuesday. The total is comprised of $2.81 billion of competitive sales and $7.79 billion of negotiated deals.

Prior week's actively traded issues

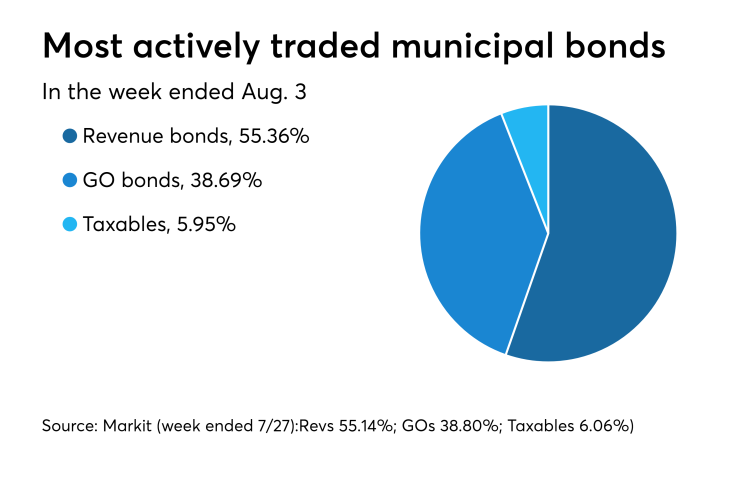

Revenue bonds comprised 55.36% of new issuance in the week ended Aug. 3, up from 55.14% in the previous week, according to

Some of the most actively traded munis by type were from Puerto Rico, California and New York issuers.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 22 times. In the revenue bond sector, the Los Angeles 4s of 2019 traded 73 times. And in the taxable bond sector, the DANY 4.946s of 2048 traded 69 times.

Previous session's activity

The Municipal Securities Rulemaking Board reported 33,430 trades on Friday on volume of $11.36 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 16.813% of the market, the Lone Star State taking 12.011%, the Empire State taking 10.906%.

Prior week's top FAs

The top municipal financial advisors of last week included PFM Financial Advisors, Public Resources Advisory Group, RBC Capital Markets, George K. Baum & Co. and Hilltop Securities, according to Thomson Reuters data.

In the week of July 29 to Aug. 4, PFM advised on $1.1 billion, PRAG $676.4 million, RBC $272.5 million, Baum $157.8 million, and Hilltop $120.5 million.

Treasury action

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 2.010% high rate, up from 2.000% the prior week, and the six-months incurred a 2.180% high rate, up from 2.160% the week before. Coupon equivalents were 2.048% and 2.235%, respectively. The price for the 91s was 99.491917 and that for the 182s was 98.897889.

The median bid on the 91s was 1.980%. The low bid was 1.955%. Tenders at the high rate were allotted 56.17%. The bid-to-cover ratio was 2.54.

The median bid for the 182s was 2.150%. The low bid was 2.120%.Tenders at the high rate were allotted 23.74%. The bid-to-cover ratio was 2.66.

Treasury also said it will sell $70 billion of four-week discount bills Tuesday. There are currently $92.995 billion of four-week bills outstanding.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.