Puerto Rico bonds plunged on Wednesday after President Donald Trump suggested the commonwealth’s debt needed to be “wiped out” to help the island recover from the devastation caused by Hurricane Maria.

“We are going to work something out. We have to look at their whole debt structure,” Trump told Fox News late Tuesday. “You know they owe a lot of money to your friends on Wall Street. We’re gonna have to wipe that out. That’s gonna have to be — you know, you can say goodbye to that. I don’t know if it’s Goldman Sachs but whoever it is, you can wave good-bye to that.”

Prices for Puerto Rico bonds dropped in active trading.

“Early Wednesday, prices for Puerto Rico’s general obligation 2035 maturity 8% coupon bond declined more than 10 points on multiple round lot trades observed,” according to the bond pricing service IHS Markit. “This is a 19% decline from [the] previous day's close.”

Markit said the bonds were moving up and down quite a bit in morning trade, but by later in the day the GOs were seen coming off lows to trade at 37.50 to yield 22.21%.

Municipal Bond Information Services said trading activity was brisk, noting that approximately 2,000 of its bids wanted out of a total of 8,000, or about 25%, were for Puerto Rican bonds on Wednesday.

“This is an unusually high number,” MBIS said, which added that about 1,200 of the 120,000 offerings on Wednesday were for Puerto Rican bonds. “This is a relatively low number based on a number of bids wanted.”

According to the Municipal Securities Rulemaking Board’s EMMA website, the Puerto Rico Commonwealth benchmark Series 2014A general obligation 8s of 2035 were fell to a low price of 30.25 cents on the dollar compared to a low of 44 on Tuesday.

Activity was heavy with $170.13 million of bonds being bought or sold in 80 trades compared to $3.6 million in seven trades on Tuesday.

On Wednesday morning, White House Budget Director Mick Mulvaney walked back some of the president’s remarks, saying Trump’s suggestion should not be taken literally.

"I think what you heard the president say is that Puerto Rico is going to have to figure out a way to solve its debt problem," Mulvaney said. "We are not going to bail them out. We are not going to pay off those debts. We are not going to bail out those bondholders."

Randy Smolik, MMD’s Senior Market Analyst, said that was hard to believe that the U.S. government would recommend that Puerto Rico bondholders be left penniless, but that the possibility of a bigger haircut was now being discounted by the market.

“While in Puerto Rico [on Tuesday] surveying the damage caused by Hurricane Maria, President Trump commented in an interview that Puerto Rico’s debt would have to be wiped out,” ICE Data Services said in a Wednesday report. “Market participants are unsure as to what exactly that would mean to the bondholders, but the bonds are down significantly on the news, falling further into distressed levels.”

Among other actively traded issues reported on EMMA on Wednesday, the Commonwealth’s Series 2012A public improvement refunding 5s of 2035 were trading at a low price of 98.154 cents on the dollar in 43 trades totaling $4.034 million compared to a low price of 102.336 in 10 trades totaling $360,000 on Tuesday.

The Commonwealth Highway and Transportation Authority’s Series 2005L revenue refunding 5.25s of 2035 were trading at a low price of 98.108 cents on the dollar in 19 trades totaling $1.42 million compared to a low price of 98 in 19 trades totaling $2.32 million on Tuesday.

The Puerto Rico Housing Finance Authority’s Series 2008 subordinate capital fund modernization program non-AMT 5.125s of 2027 were trading at a low price of 100.285 cents on the dollar in 19 trades totaling $5.52 million compared to a low price of 101.207 in six trades totaling $200,000 on Tuesday.

The Commonwealth Aqueduct and Sewer Authority’s Series 2008A senior lien revenue 5.125s of 2047 were trading at a low price of 98.664 cents on the dollar in 15 trades totaling $1.23 million compared to a low price of 99.124 in 23 trades totaling $725,000 on Tuesday.

Secondary market

Top-quality municipal bonds finished unchanged on Wednesday.

The yield on the 10-year benchmark muni general obligation was steady from 2.01% on Tuesday, while the 30-year GO yield was flat from 2.82%, according the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Wednesday. The yield on the two-year Treasury rose to 1.48% from 1.47%, the 10-year Treasury yield was unchanged from 2.33% and the yield on the 30-year Treasury bond increased to 2.88% from 2.87%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 86.2% compared with 86.3% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 98.0% versus 98.2%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 43,744 trades on Tuesday on volume of $11.38 billion.

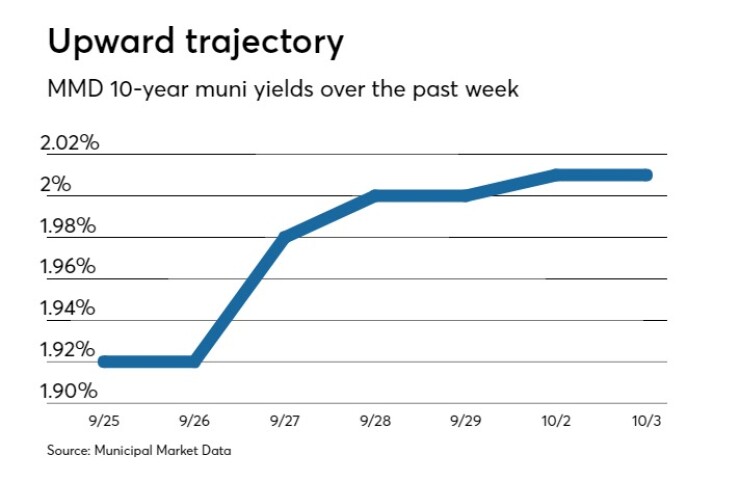

MMD yields trend upward

Yields on top-rated municipal securities have been trending upward over the past week, according to a read of MMD’s 10-year muni GO.

On Tuesday, the 10-year yield ended at 2.01%. This compared to a reading of 1.92% on Sept. 25 which jumped to 1.98% on Sept. 27 and broke the 2% barrier the next day.

Geo-political worries such as in North Korea and Spain along with the natural disasters in Puerto Rico and the Virgin Islands combined to keep munis in demand over the past week.

Primary market

The primary took a breather a day after the Dormitory Authority of the State of New York sold about $1.7 billion of bonds and a day before the authority returns to the market to sell another $300 million-plus.

RBC Capital Markets is set to price the authority’s $301.48 million of school districts and financing program revenue bonds in five series on Thursday.

The Series 2017 F, G, H, I and J bonds carry various ratings ranging from Aa2 and Aa3 from Moody’s to A-plus from S&P and AA-minus from Fitch.

NYS comptroller releases Q4 bond sale calendar

A tentative schedule for planned bond sales from New York State, New York City, and their major public authorities during the fourth quarter, was released on Tuesday by state comptroller Thomas DiNapoli.

The planned sales total $8.02 billion and include $6.09 billion of new money and $1.93 billion of refundings or reofferings as follows:

- $5.54 billion scheduled for October, of which $3.68 billion is new money and $1.86 billion is refundings or reofferings;

- $930 million scheduled for November, of which $860 million is new money and $70 million is refundings or reofferings; and

- $1.55 billion scheduled for December, all of which is new money.

The anticipated fourth quarter sales compare with sales of $8.58 billion in the third quarter and $7.57 billion during the fourth quarter of 2016.

The prospective fourth quarterly calendar includes anticipated bond sales by the following issuers: DASNY; Long Island Power Authority; Metropolitan Transportation Authority; New York City Housing Development Corp.; New York City Municipal Water Finance Authority; New York City Transitional Finance Authority, New York State Energy and Research Development Authority; New York State Environmental Facilities Corp.; New York State Housing Finance Agency; State of New York Mortgage Agency; Triborough Bridge and Tunnel Authority; and the Utility Debt Securitization Authority.

Continued muni outperformance seen

Limited supply and persistent demand may lead to continued outperformance in the municipal bond market in the near term, according to Bill Merz, senior research analyst at U.S. Bank Wealth Management.

“While longer-term municipal debt is attractive versus corporate bonds, munis are quite expensive for shorter maturities,” he wrote in a Tuesday market comment.

The steep municipal curve may offer taxable investors attractive incremental compensation for extending duration, he said.

“We encourage a focus on higher-quality credits since structural problems in Puerto Rico and Illinois persist and may trigger periodic, renewed scrutiny of other weak credits,” Merz wrote. “We encourage using an active approach to manage risks from individual credits.”