Puerto Rico issues rallied on Thursday after the main parties reached a restructuring deal on Puerto Rico Sales Tax Financing Corp. bonds. The Puerto Rico Oversight Board, the government of Gov. Ricardo Rosselló, COFINA senior bondholders’ representatives, COFINA subordinate bondholders’ representatives, and bond insurers agreed to the deal.

“The agreement reduces COFINA’s sales-tax backed debt by 32%, resulting in a savings of $17.5 billion in debt service,” ICE Data Services said in a Thursday market comment. “Puerto Rico has been in bankruptcy court since last spring in an attempt to restructure its $120 billion in debt and pension obligations. The deal reduces Puerto Rico’s debt by $7 billion and gives the commonwealth access to $360 million of sales tax revenue. On the news, most Puerto Rico bonds are significantly higher, led by the COFINA bonds.”

In late trading on Thursday, the benchmark Commonwealth Series 2014A 8% general obligation bonds of 2035 were trading at a high of 52.125 cents on the dollar, up froma high of 44.812 cents on Wednesday and a high of 43.25 cents on Tuesday, according to the Municipal Securities Rulemaking Board’s EMMA website. Trading volume rose to $85.37 million in 51 trades from $30.73 million in 22 trades on Wednesday and $33.51 million in 21 trades on Tuesday.

The COFINA Series 2010C 5.25% first subordinate revenue bonds of 2041 were trading at a high of 53 cents on the dollar compared with highs of 41.625 cents on Wednesday and 40.5 cents on Tuesday, according to EMMA. Trading volume surged to $35.3 million in 33 trades from $700,000 in 15 trades on Wednesday and $70,000 in five trades on Tuesday.

The COFINA Series 2010A 5.375% first subordinate revenue bonds of 2039 were trading at a high of 52.875 cents on the dollar compared with a highs of 40.755 cents on Wednesday and 41.25 cents on Tuesday, according to EMMA. Trading volume jumped to $15.9 million in 14 trades from $60,000 in three trades on Wednesday and $695,000 in three trades on Tuesday.

The COFINA Series 2010A 5.5% first subordinate revenue bonds of 2042 were trading at a high of 52.75 cents on the dollar compared to highs of 41.1 cents on Wednesday and 41.015 cents on Tuesday, according to EMMA. Trading volume climbed to $23.255 million in 21 trades from $170,000 in two trades on Wednesday and $185,000 in five trades on Tuesday.

The COFINA Series 2011A-1 5% first subordinate revenue bonds of 2043 were trading at a high of 53 cents on the dollar compared with a highs of 41.5 cents on Wednesday and 37.5 cents on Tuesday, according to EMMA. Trading volume totaled $10.435 million in 24 trades, up from $1.47 million in 13 trades on Wednesday and $15,000 in three trades on Tuesday.

The COFINA Series 2009B 6.35% first subordinate revenue bonds of 2039 were trading at a high of 53 cents on the dollars, up from highs of 40.25 cents on Wednesday and 40.255 cents on Tuesday, according to EMMA. Trading volume soared to $14.67 million in 24 trades from $120,000 in two trades on Wednesday and $280,000 in seven trades on Tuesday.

Secondary market

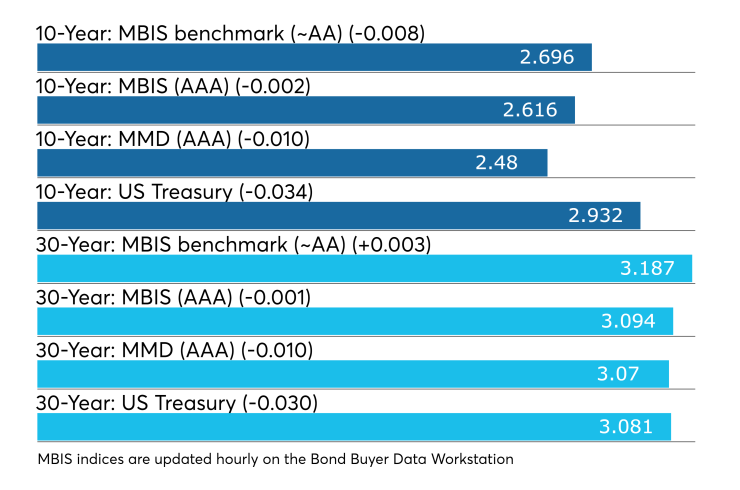

Municipal bonds were mixed on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell six basis points in the one-year maturity and fell less than a basis point in the two-year and five to 15-year maturities, rose less than a basis point in the three- and four-year and 19- to 30-year maturities and remained unchanged in the 16- to 17-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale falling three basis points in the one-year maturity and falling less than a basis point in the five- to 10-year and 25- to 30-year maturities, rising less than a basis point in the two- to four-year and 11- to 21-year maturities and remaining unchanged in the 22- to 24-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on the 30-year muni maturity falling one basis point.

Treasury bonds were stronger as stocks traded little changed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 84.6% while the 30-year muni-to-Treasury ratio stood at 99.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary market

Loop Capital Markets priced the Cook County, Ill., $155.32 million of Series 2018 sales tax revenue bonds on Thursday. The deal is rated AAA by S&P Global Ratings and Kroll Bond Rating Agency.

In the competitive sector on Thursday, Citigroup and RBC Capital Markets won the Woodbridge Township, N.J.’s $152.608 million of bond anticipation notes. The deal is rated SP1-plus by S&P.

Traders said strong demand followed new bond issues this week as many deals across the country received positive feedback — despite the summer doldrums and due to the anemic supply.

One deal included the Michigan Finance Authority’s issue, which will finance a portion of Wayne County’s new criminal justice center project. The tax-exempt fixed rate bonds mature over 30 years with an interest rate of 3.91%.

On Thursday, Goldman Sachs received the written award on the Finance Authority’s $288.625 million of Series 2018 senior lien distributable state aid revenue bonds for the Charter County of Wayne Criminal Justice Center.

“The market demand allowed us to price these bonds at a very good interest rate, which will help us keep our borrowing costs low,” Wayne County Chief Financial Officer Henry Dachowitz said in a release Wednesday. “We presented a very strong credit profile to the market.

Moody’s Investors Service has assigned an Aa3 rating to both the county’s 2018 bonds and the state’s intercept program. Annual debt service is expected to be about $14 million to $19 million, according to the release.

Thursday’s sales

Illinois

New Jersey

Michigan

Bond Buyer 30-day visible supply at $8.82B

The Bond Buyer's 30-day visible supply calendar decreased $1.50 billion to $8.82 billion for Thursday. The total is comprised of $1.66 billion of competitive sales and $7.16 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,673 trades on Wednesday on volume of $15.698 billion.

New York, California and Texas were the states with the most trades, with the Empire State taking 13.387% of the market, the Golden State taking 13.218% and the Lone Star State taking 9.821%.

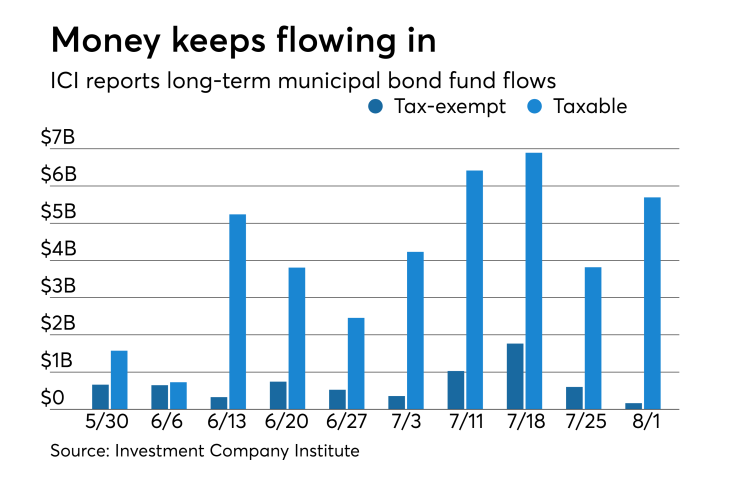

ICI: Long-term muni funds get $164M inflow

Long-term tax-exempt municipal bond funds saw an inflow of $164 million in the week ended Aug. 1, the Investment Company Institute reported.

This followed an inflow of $600 million into the tax-exempt mutual funds in the week ended July 25 and inflows of $1.765 billion, $1.028 billion, $356 million, $525 million, $742 million, $326 million, $648 million, $661 million, and $185 million in the nine prior weeks.

Taxable bond funds saw an estimated inflow of $5.694 billion in the latest reporting week, after seeing an inflow of $3.817 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $477 million for the week ended Aug. 1 after inflows of $3.834 billion in the prior week.

Tax-exempt money market fund outflows

Tax-exempt money market funds saw outflows of $1.33 billion, lowering total net assets to $130.16 billion in the week ended Aug. 6, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $3.09 billion to $131.48 billion in the prior week.

The average, seven-day simple yield for the 201 weekly reporting tax-exempt funds rose to 0.80% from 0.58% the previous week.

The total net assets of the 832 weekly reporting taxable money funds rose $25.20 billion to $2.697 trillion in the week ended Aug. 7, after an outflow of $3.67 billion to $2.671 trillion the week before.

The average, seven-day simple yield for the taxable money funds was unchanged from 1.56% from the prior week.

Overall, the combined total net assets of the 1,033 weekly reporting money funds rose $23.87 billion to $2.827 trillion in the week ended Aug. 7, after outflows of $6.76 billion to $2.803 trillion in the prior week.

Treasury announces auction details

The Treasury Department announced these auctions:

- $26 billion of 364-day bills selling on Aug. 14;

- $45 billion of 182-day bills selling on Aug. 13; and

- $51 billion of 91-day bills selling on Aug. 13.

Treasury sells $18B 30-year bonds

The Treasury Department Thursday auctioned $18 billion of 30-year bonds with a 3% coupon at a 3.090% high yield, a price of 98.248216. The bid-to-cover ratio was 2.27.

Tenders at the high yield were allotted 57.33%. The median yield was 3.048%. The low yield was 2.588%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.