New Mexico’s general obligation bonds were downgraded to Aa2 from Aa1 by Moody’s Investors Service Monday.

The rating agency cited pension and Medicaid pressures for its second downgrade of New Mexico in two years. The outlook is stable at the new rating, which affects $260 million of outstanding general obligation bonds.

The state’s senior-lien transportation revenue bonds remain at Aa1 because of greater levels of security backing the debt, according to Moody's.

New Mexico’s “extremely large pension liabilities” include the Public Employees' Retirement System and an indirect obligation to the Educational Employees' Retirement System.

“The need to assist districts in addressing their EERS pension liabilities represents a significant financial pressure for the state,” analyst Kenneth Kurtz wrote. “That pressure is compounded by spending challenges associated with a large Medicaid caseload, a revenue structure more concentrated and volatile than most similarly-rated states, an economy that has lagged the nation's, below-average wealth levels, and financial reporting practices which, while improving, are weaker than typical for a U.S. state.”

It is Moody's first rating change for a U.S. state in 2018.

New Mexico is the 36th-largest state by population, at 2.1 million. Its state gross domestic product, $97.1 billion, is the 37th-largest. It is the sixth-largest producer of crude oil in the nation.

New Mexico's per capita personal income is equal to 77.4% of the U.S. level, according to Moody's, and its poverty rate is among the highest for U.S. states.

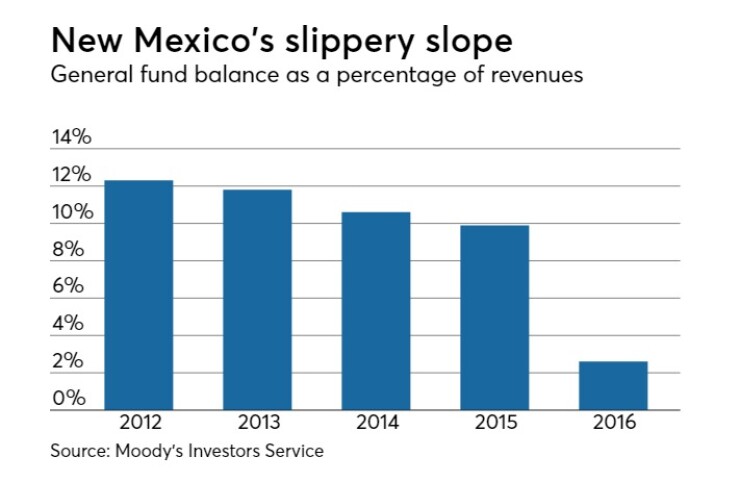

The state lost its triple-A rating on Oct. 25, 2016, when Moody’s lowered the GO rating to Aa1, citing “depletion of general fund reserves following a very large and unanticipated shortfall in tax revenues for fiscal 2016 and 2017.”

S&P Global Ratings retains a negative outlook on New Mexico’s AA rating.

New Mexico issued $307 million of GO bonds a year ago.

The state’s economic activity and state revenues vary considerably based on the prices of oil and gas, the levels of production, and the amount of new drilling, according to Moody’s. The oil market has experienced a steady rebound this year, four years after a steep reduction in energy-related employment and state revenues.

Eight days before the latest downgrade, Gov. Susana Martinez touted the state’s economic revival in an

“New Mexico’s tax revenues are rising rapidly, the state’s economy is expanding and diversifying, and we have made important progress in protecting the long-term stability of our state budget,” Martinez wrote. “That’s a far cry from the nearly half-billion-dollar budget deficit I inherited when I took office in 2011.”

Term limits prevent Martinez, a Republican, from running in 2018.

State tax revenues rose by $560 million or more than 16% through the first eight months of the current fiscal year, she said.

“As a result, we have replenished our reserves – holding over 10% of our $6.3 billion state budget as savings – and have a strong credit rating,” she said. “A year ahead of expectations, we will also divert in excess of $20 million in oil and gas revenues to our new stabilization fund that was created in 2017 to help New Mexico guard against future downturns in the energy markets or the national economy.”

Calling the economic outlook “positive,” Martinez said the state’s unemployment rate has fallen 2.5% since 2011, with 9,000 jobs added in the last 12 months.