A Pennsylvania tobacco deal was increased in size and oversubscribed Tuesday, allowing underwriters to cut yields on the week’s biggest offering.

“It’s a riot,” said one trader. “It’s many times oversubscribed. There was no way it wasn’t going to be repriced."

Investors said the deal fared well based on several factors, including the issue’s security pledge, timing and partial insurance.

Jefferies priced and repriced the Commonwealth Financing Authority’s $1.52 billion of Series 2018 tobacco master settlement payment revenue bonds to lower yields by as much as 20 basis points. The deal was originally sized at $1.39 billion and set to price the week of Jan. 29 before it was delayed until this week.

The issue was repriced as 5s to yield from 2.14% in 2020 to 3.81% in 2035. A 2039 term bond was priced at 99.50 as 4s to yield approximately 4.035%. Earlier in the day, the issue was priced as 5s to yield from 2.34% in 2020 to 4.03% in 2035. A 2039 term bond was priced at 98.50 as 4s to yield approximately 4.106%.

“This deal was priced absurdly cheap,” said one Mid-Atlantic trader. “The bonds are an appropriations pledge from the state of Pennsylvania regardless of the Tobacco language. Not surprisingly, it was bumped 20 basis points today.”

The deal is rated A1 by Moody’s Investors Service A by S&P Global Ratings and A-plus by Fitch Ratings except for the $418.66 million 2039 maturity which is insured by Assured Guaranty Municipal and rated AA by S&P.

John Mousseau, managing director at Cumberland Advisors, said part of the deal’s allure was that it has a pledge for appropriation from the state.

“It’s clearly a superior pledge than the old type of tobacco issues,” he said on Tuesday. He also said it will benefit from its timing, with the market starved for product since the first of the year.

Mousseau added that one of the tranches with AGM insurance gives an element of value to the deal.

“This is important even for investors in the non-insured bonds in the deal because you know that if there was an issue, AGM would be working to remedy things and that helps all bondholders,” he said.

Some sources said the tobacco bonds were attractively priced.

“Investors are being fairly compensated at these levels, especially considering the additional security beyond the MSA credit itself,” said Peter Delahunt, managing director at Raymond James & Associates.

“Liquidity in the muni market is currently stressed, which may necessitate some additional spread to encourage the involvement of anxious investors during a volatile period in the market with a bias toward higher rates,” he said.

Portfolio managers were divided over in the deal, with some saying they will consider it and others saying they avoid the tobacco sector altogether.

"It's a sector we look at," said Ronald Schwartz, senior portfolio manager at Seix Investment Advisors, in an interview last week.

While he hasn't purchased any tobacco credits recently and doesn't own any of the authority's tobacco bonds in the $1.4 billion of tax-exempt mutual funds and separately managed accounts he oversees for high net worth individuals, he is interested.

"Obviously, the yield is going to be the attractive part," Schwartz said. "We will do the credit work and see if there's enough yield on a relative basis to buy it."

Meanwhile, Jonathan Law, portfolio manager with Advisors Asset Management, said he typically avoids tobacco bonds because they don't fit the investment-grade objective he maintains for the $325 million in tax-exempt separately managed account assets he oversees.

"Most of them are below investment grade and we’re not a fan of the sector overall," he said of the bonds in an interview last week. "We know it plays a big part in high-yield, but we have some clients that want socially responsible investments, and there's also broad trends that obviously indicate people are smoking less and there's less taxes available, so it's not a deal we'd consider at this point."

Also on Tuesday a taxable corporate CUSIP deal came from Community Health Network Inc. in Indiana.

Wells Fargo Securities priced the $202 million of Series 2018A bonds at par to yield 4.79% in 2053 and to yield 4.94% in 2058.

The deal is rated A2 by Moody’s and A by S&P.

Bank of America Merrill Lynch priced the Board of Governors of Wayne State University of Mich.’s $122.23 million of Series 2018A general revenue bonds.

The issue was priced to yield from 1.54% with a 5% coupon in 2019 to 3.29% with a 5% coupon in 2038. A 2043 term bond was priced as 5s to yield 3.47% while a 2048 term was priced as 4s to yield 3.89%. The deal is rated Aa3 by Moody’s and A-plus by S&P.

Also on Tuesday a taxable corporate CUSIP deal came from Community Health Network Inc. in Indiana. Wells Fargo Securities priced the $202 million of Series 2018A bonds at par to yield 4.79% in 2053 and to yield 4.94% in 2058. The deal is rated A2 by Moody’s and A by S&P.

In the competitive arena on Tuesday, the Mounds View Independent School District No. 621, Minn., sold $153.58 million of Series 2018A general obligation school building bonds.

Morgan Stanley won the bonds with a true interest cost of 3.449%. The issue was priced to yield from 1.39% with a 5% coupon in 2019 to 3.47% with a 4% coupon in 2043. The bonds are insured by the Minnesota School District Credit Enhancement Program. The deal is rated AA-plus by S&P.

Secondary market

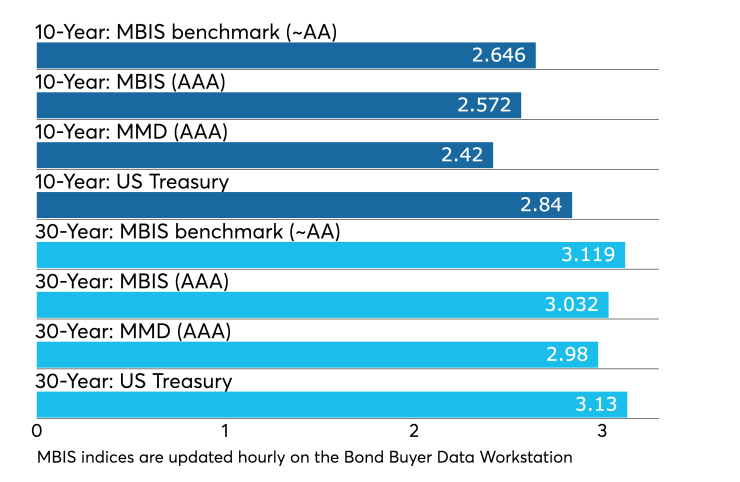

Municipal bond yields have been on the rise since the beginning of the year.

On Jan. 1, the MBIS municipal non-callable 5% GO benchmark 10-year yield stood at 2.278%, rising to 2.528% by the end of the month and 2.663% at Monday's close.

On Jan. 1, the MBIS municipal non-callable 5% AAA 10-year yield stood at 2.278%, rising to 2.525% by the end of the month and 2.662% at Monday's close.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,625 trades on Monday on volume of $7.63 billion. California, Texas and New York were the three states with the most trades, with the Golden State taking 16.786% of the market, the Empire State taking 12.584% and the Lone Star State taking 10.271%.

Treasury auctions 4-week bills

The Treasury Department Tuesday auctioned $50 billion of four-week bills at a 1.360% high yield, a price of 99.894222.

The coupon equivalent was 1.380%. The bid-to-cover ratio was 3.27. Tenders at the high rate were allotted 88.13%. The median rate was 1.330%. The low rate was 1.290%.

Treasury also sold $50 billion 55-day cash management bills, dated Feb. 16, due April 12, at a 1.560% high tender rate.

The bid to cover ratio was 2.54. Tenders at the high rate were allotted 69.64%. The median rate was 1.510%. The low rate was 1.450%. The coupon equivalent was 1.585%. The price was 99.761667.

Gary Siegel and Aaron Weitzman contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.