Two big New York issuers came to market on Wednesday as municipal bonds were little changed in secondary action.

The market felt “sideways” as investors awaited several new issue pricings, according to a New Jersey trader.

He pointed to the New York City Transitional Finance Authority offering and the Idaho Idaho Health Facilities Authority deal for St. Luke’s Hospital as two new deals that will pique interest among the hungry retail crowd.

“These deals should be retail friendly and will look cheap,” compared to other comparable deals in recent weeks, the trader said. “I think there are a few maturities on the long end that will get some good attention, especially the 4% coupons,” he said.

Extra yield will also be available and at more attractive levels — especially the Idaho hospital deal where the preliminary pricing offers yields 115 basis points higher than the generic triple-A general obligation scale published by Municipal Market Data, he noted. In addition, he said, the deal should be about 10 basis points wider than where a West Virginia hospital deal came a few weeks ago.

“That will definitely look cheaper and retail will be biting,” he said, noting the lack of volume so far in 2018 has heightened demand. “It’s the dog days of summer,” he said. “The appetite is still there and there is still money to spend.”

Primary market

JPMorgan Securities priced the New York City Transitional Finance Authority’s $850 million of Fiscal 2019 Series A Subseries A1 tax-exempt future tax secured subordinate bonds.

The TFA also competitively sold $300 million of taxable bonds.

Barclays Capital won the $165.725 million of Fiscal 2019 Series A Subseries A3 future tax secured subordinate bonds with a true interest cost of 3.8884%.

Goldman Sachs won the $134.275 million of Fiscal 2019 Series A Subseries A2 future tax secured subordinate bonds with a TIC of 3.5369%.

The financial advisors are Public Resources Advisory Group and Acacia Financial Group; the bond counsel is Norton Rose.

The deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

Bank of America Merrill Lynch priced the Dormitory Authority of the State of New York’s Series 2018A tax-exempt and Series 2018B taxable revenue bonds for the Montefiore Obligated Group. The deal is rated Baa2 by Moody’s and BBB by S&P.

JPMorgan priced the Idaho Health Facilities Authority’s Series 2018B revenue bonds for St. Luke’s Health System on Wednesday. The deal is rated A3 by Moody’s and A-minus by S&P.

In the competitive arena, Johnson County, Kan., sold $246.24 million of Series 2018A unlimited tax general obligation bonds. BAML won the bonds.

The deal is rated AAA by Fitch. The financial advisor is Springstead; the bond counsel is Gilmore & Bell.

Virginia sold $106.975 million of Series 2018 unlimited tax GOs. Citigroup won the deal with a TIC of 2.8350%.

The deal is rated triple-A by Moody’s, S&P and Fitch. The financial advisor is Public Resources Advisory Group; the bond counsel is Christian & Barton.

Since 2008, the state has sold about 2.1 billion of debt, with the most issuance occurring in 2009 when it sold $412.5 million. The state didn’t come to market in 2017.

Wednesday’s sales

New York

Kansas

Bond Buyer 30-day visible supply at $8.08B

The Bond Buyer's 30-day visible supply calendar decreased $1.22 billion to $8.08 billion for Wednesday. The total is comprised of $3.44 billion of competitive sales and $4.64 billion of negotiated deals.

Secondary market

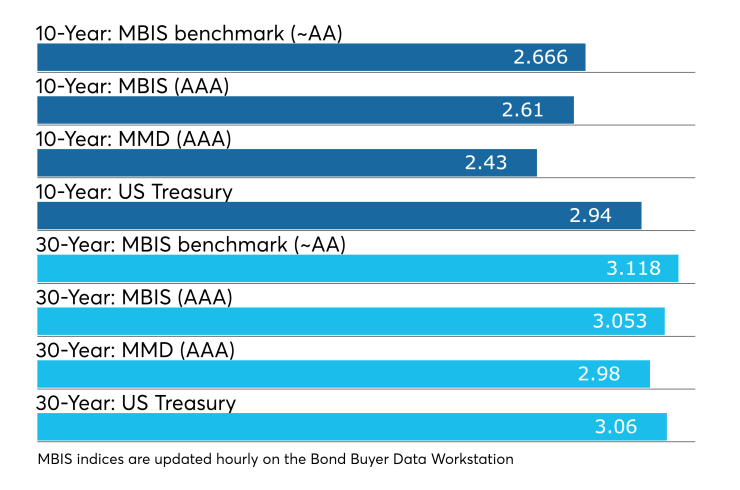

Municipal bonds were mostly stronger on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one- to 17 and 26- to 30-year maturities, rose less than a basis point in the 20-year and 22-year maturities and remained unchanged in the 18- to 19-year, 21-year and 23- to 25-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS’ AAA scale falling less than one basis point in the one- to 16-year and 24- to 30-year maturities, rising less than a basis point in the 17- to 20-year and 22-year maturities and remaining unchanged in the 21-year and 23-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed both the 10-year muni general obligation yield and the yield on the 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stocks traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 96.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,333 trades on Tuesday on volume of $12.77 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 17.702% of the market, Lone Star State taking 11.858% and the Empire State taking 11.03%.

Treasury sells $18B 2-year FRNs

The Treasury Department Wednesday auctioned $18 billion of two-year floating rate notes with a high discount margin of 0.043%, at a 0.043% spread, a price of par. The bid-to-cover ratio was 2.79.

Tenders at the high margin were allotted 92.77%. The median discount margin was 0.035%. The low discount margin was zero. The index determination date is July 23 and the index determination rate is 1.970%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.