Top-rated municipal bonds ended weaker on Tuesday, according to traders, as deals from New York City, Philadelphia and the Port of Seattle hit the market.

Primary market

Bank of America Merrill Lynch held a second day of retail orders on New York City’s $820.45 million of Fiscal 2018 Series A general obligation bonds ahead of the institutional pricing on Wednesday.

On Tuesday, the bonds were priced for retail to yield from 0.90% with a 4% coupon in 2018 to 2.26% with a 5% coupon in 2028.

The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings. All three rating agencies assign a stable outlook.

The city will competitively sell $60 million of Fiscal 2002 Series A Subseries A10 taxable GOs as a remarketing on Wednesday.

Citigroup priced the Port of Seattle’s $688.51 million deal consisting of $423.34 million of tax-exempt intermediate lien revenue and revenue refunding bonds and $265.17 million of Series 2017B taxable intermediate lien revenue refunding bonds.

The $16.73 million of Series 2017A tax-exempt revenue refunding bonds not subject to the alternative minimum tax were priced as 5s to yield 2.13% in 2027 and 2.26% in 2028.

The $313.38 million of Series 2017C tax-exempt revenue AMT bonds were priced as 5s to yield from 1.17% in 2019 to 3.16% in 2037. A split 2042 maturity was priced as 5s to yield 3.23%; a 2042 spilt maturity was priced as 5s to yield 3.23% and as 5 1/4s to yield 3.14%.

The $93.23 million of Series 2017D tax-exempt revenue AMT bonds were priced as 5s to yield from 1.09% in 2018 to 2.43% in 2027.

The $265.17 million of Series 2017B taxables were priced at par to yield from 1.27% in 2017 to 3.571% in 2032 and 3.755% in 2036.

The deal is rated A1 by Moody’s, A-plus by S&P and AA-minus by Fitch.

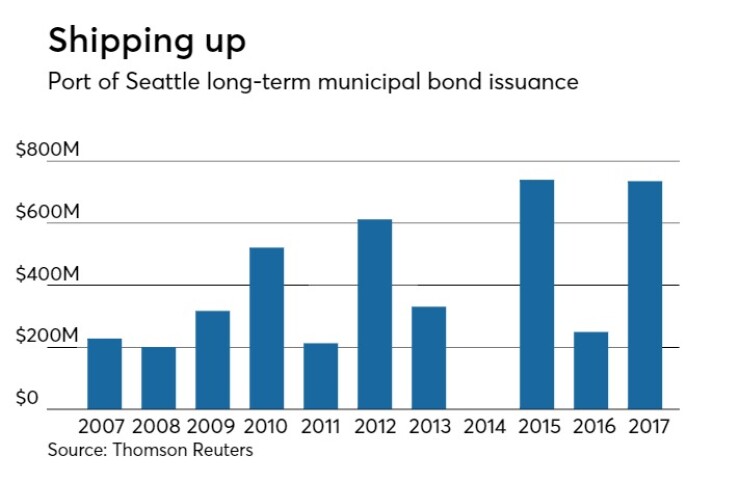

Since 2007, the port has sold $4.15 billion of securities, with the largest issuance occurring in 2015, when it sold $739 million. It did not come to market in 2014.

Barclays Capital priced and repriced Philadelphia’s $175.05 million of water and wastewater bonds on Tuesday.

The issue was repriced as 2s to yield 0.82% in 2017 and as 5s to yield from 1.19% in 2020 to 2.92% in 2034.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

“[The Philadelphia deal] priced attractively. Some of that is to be expected in a weaker market,” said one Mid-Atlantic trader. “Treasury yields are up considerably today, long yields are up more than short, as muni issuance continues to be slim.”

JPMorgan Securities priced the Belton Independent School District, Texas' $117.44 million of Series 2017 unlimited tax school building bonds on Tuesday.

The issue was priced to yield 0.87% with a 2% coupon in 2018 and 0.96% with a 3% coupon in 2019 and to yield from 1.19% with a 3% coupon in 2021 to 2.85% with a 5% coupon in 2039. A 2042 maturity was priced as 5s to yield 2.92% and a 2047 maturity was priced as 4s to yield 3.34%.

The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by S&P and Fitch.

In the competitive arena on Tuesday, Alexandria, Va., sold $99.36 million of unlimited tax general obligation capital improvement bonds in two separate sales.

BAML won the $94.93 million of Series 2017A tax-exempt GOs with a true interest cost of 2.50%. The issue was priced to yield from 0.82% with a 5% coupon in 2018 to 3.09% with a 3.25% coupon in 2037.

Wells Fargo Securities won the $4.43 million of Series 2017B taxable GOs with a TIC of 3.08%. Both deals are rated triple-A by Moody's and S&P.

Secondary market

The yield on the 10-year benchmark muni general obligation rose three basis points to 1.93% from 1.90% on Monday, while the 30-year GO yield gained four basis points to 2.73% from 2.69%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were weaker on Tuesday. The yield on the two-year Treasury gained to 1.39% from 1.36% on Monday, the 10-year Treasury yield rose to 2.33% from 2.25% and the yield on the 30-year Treasury bond increased to 2.91% from 2.83%.

The 10-year muni to Treasury ratio was calculated at 83.0% on Tuesday, compared with 84.4% on Monday, while the 30-year muni to Treasury ratio stood at 93.9% versus 95.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 33,300 trades on Monday on volume of $5.29 billion.

BAML: Muni issuance down on year

As of July 20, municipal bond issuance was $216.8 billion for the year, down 11.4% from the same period last year, according to Sophie Yan, municipal research strategist at BAML. Of the total issuance, 52.2% was related to refundings versus 61.3% during the same time in 2016.

For the year to date, the BAML Muni Master Index returned 4.110%, outperforming the Treasury Master Index, but underperforming the U.S. Corporate IG Master Index, which had total returns of 2.211% and 4.680%, respectively.

As of July 20, the BAML Muni Master Index‘s Option-Adjusted Spread -- the measurement of the spread of a fixed-income security rate and the risk-free rate of return adjusted to take into account an embedded option -- was 21 basis points, Yan wrote in BAML’s weekly market report.

For month-to-date, the spreads on Chicago GOs and the Chicago BOE have narrowed by 34 basis points and 41 basis points, respectively, while Illinois narrowed by 19 basis points, according to Yan.

Jacob Schneider contributed to this report.