Municipal bond traders returned to their desks on Tuesday after the long holiday weekend, ready to see almost $6 billion of muni bonds hit the screens as the Treasury Department gets set to auction a record $258 billion of securities this week.

Treasury sold $51 billion of three- month bills, $45 billion of six-month bills and plans to sell $55 billion of four-week bills, $15 billion of re-opened two-year floating rate notes, $28 billion of two-year notes, $35 billion of five-year notes, and $29 billion of seven year notes.

Tender rates for the 91-day and 182-day discount bills were higher, as the three-months incurred a 1.630% high rate, up from 1.570% in the prior week and the six-months incurred a 1.820% high rate, up from 1.785% the week before. Coupon equivalents were 1.659% and 1.862%, respectively. The price for the 91s was 99.587972 and that for the 182s was 99.079889.

The median bid on the 91s was 1.600%. The low bid was 1.560%. Tenders at the high rate were allotted 59.37%. The bid-to-cover ratio was 2.74. The median bid for the 182s was 1.800%. The low bid was 1.780%. Tenders at the high rate were allotted 87.18%. The bid-to-cover ratio was 3.11.

Primary Market

Ipreo estimates this week’s muni volume at $5.8 billion, comprised of $4.5 billion of negotiated deals and $1.3 billion of competitive sales.

Bank of America Merrill Lynch priced the

The tax-exempts are rated Aa2 by Moody’s Investors Service and AAA by Fitch Ratings while the taxables are rated Aa2 by Moody’s and F1-plus by Fitch.

Jefferies priced New York City’s

Additionally, the city will competitively sell on Thursday $250 million of taxable fixed-rate bonds in two separate offerings consisting of $188.11 million and $61.89 million GOs.

New York City is rated Aa2 by Moody’s and AA by S&P Global Ratings and Fitch.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,772 trades on Friday on volume of $9.73 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 14.713% of the market, the Lone Star State taking 13.516%, and the Empire State taking 9.023%.

Prior week's actively traded issues

Revenue bonds comprised 57.35% of new issuance in the week ended Feb. 16, up from 56.69% in the previous week, according to

General obligation bonds made up 37.21% of total issuance, down from 37.40%, while taxable bonds accounted for 5.44%, down from 5.91% a week earlier.

Some of the most actively traded bonds by type were from Puerto Rico and Pennsylvania issuers.

In the GO bond sector, the Puerto Rico Commonwealth benchmark 8s of 2035 traded 100 times. In the revenue bond sector, the Pennsylvania Commonwealth Financing Authority tobacco 4s of 2039 traded 144 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.05s of 2036 traded 19 times.

Bond Buyer 30-day visible supply at $7.14B

The Bond Buyer's 30-day visible supply calendar increased $152.9 million to $7.14 billion on Tuesday. The total is comprised of $2.50 billion of competitive sales and $4.64 billion of negotiated deals.

Previous week's top underwriters

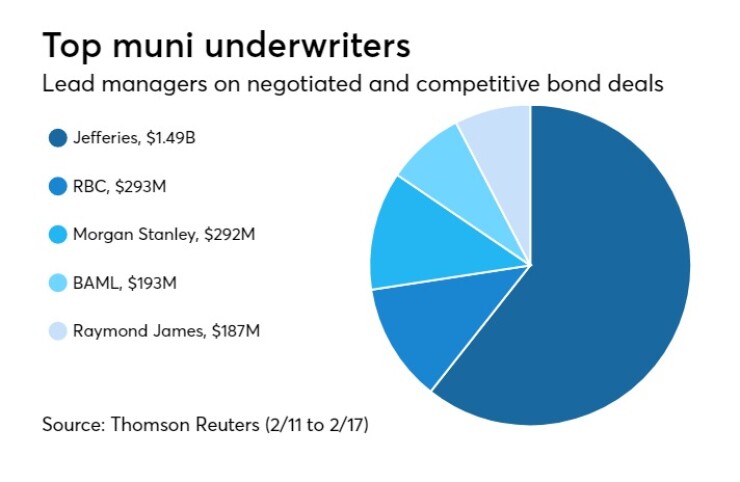

The top municipal bond underwriters of last week included Jefferies, RBC Capital Markets, Morgan Stanley, Bank of America Merrill Lynch and Raymond James, according to Thomson Reuters data.

In the week of Feb. 11 to Feb. 17, Jefferies underwrote $1.49 billion, RBC $293.2 million, Morgan Stanley $292.4 million, BAML $193.0 million and Raymond James $187.2 million.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.