Underwriters priced the New York Metropolitan Transportation Authority’s $2.2 billion advance refunding deal for institutions on Tuesday.

In secondary trading, municipals turned weaker.

Primary market

Bank of America Merrill Lynch priced the N.Y. MTA’s $2.2 billion of Series 2017C transportation revenue refunding green bonds for institutions on Tuesday. On Monday, the bonds were offered to retail buyers, who ordered about $770 million of the bonds, according to a market source.

On Tuesday, the $1.974 billion of Series 2017C-1 current interest bonds were priced to yield from 1.88% with a 5% coupon in 2023 to 3.37% with a 4% coupon in 2039.

The $202.986 million of Series 2017C-2 capital appreciation bonds were priced to yield 2.96% in 2027, 3.14% in 2029, 3.30% in 2032, 3.36% in 2033 and from 3.57% in 2039 to 3.61% in 2046.

On Monday, the $1.997 billion of Series 2017C-1 CIBs were priced for retail to yield 1.27% with a 5% coupon in 2018 and from 1.88% with a 5% coupon in 2023 to 3.36% with a 4% coupon in 2039. The $199.998 million of Series 2017C-2 capital appreciation bonds were priced for retail to yield 2.95% in 2027, 3.13% in 2029 and from 3.56% in 2039 to 3.63% in 2046.

A market sources said several of the maturities were oversubscribed during the retail order period.

The deal is rated A1 by Moody’s Investors Service, AA-minus by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

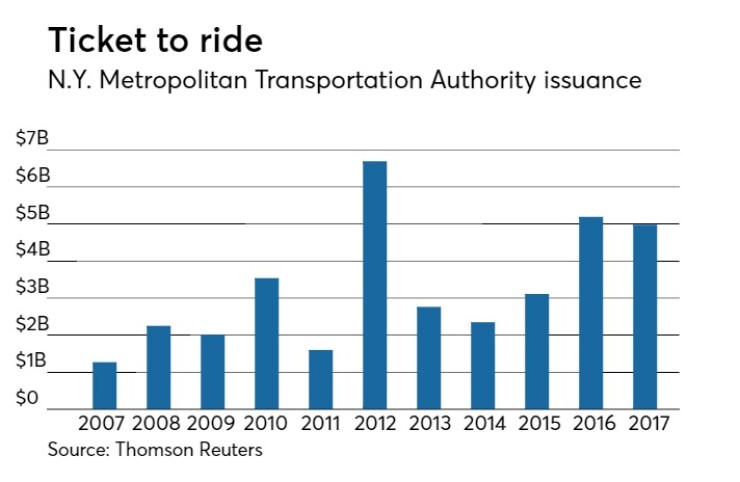

Since 2007, the MTA has sold about $35.76 million of debt, with the most issuance occurring in 2012 when it sold $6.69 billion. It sold the least amount of bonds in that period in 2007, when it issued $1.27 billion of securities.

Also on Tuesday, Wells Fargo Securities is expected to price the Virginia Transportation Board’s $479.41 million of Series 2017 federal transportation grant anticipation revenue and refunding notes. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

RBC Capital Markets is set to price Colorado’s $268.84 million of Building Excellent Schools Today certificates of participation. The deal is rated Aa2 by Moody’s and AA-minus by S&P.

JPMorgan Securities is expected to price the Louisiana Local Government Environmental Facilities and Community Development Authority’s $250 million of revenue refunding bonds on Tuesday. The deal is rated Baa3 by Moody’s and BBB by S&P and Fitch.

The competitive arena saw the biggest deal of the week when Orange County, N.Y., sold $73.23 million of public improvement serial bonds in three separate offerings.

Citigroup won the $55.51 million of Series 2017A bonds with a true interest cost of 2.5097%; Citi also won the $13.21 million of Series 2017B bonds with a TIC of 1.6159%; and Robert W. Baird won the $4.52 million of Series 2017C taxable bonds with a TIC of 2.5097%. The deals are rated Aa3 by Moody’s.

Growing supply seen

The remaining municipal new issue calendar for 2017 is expanding as issuers eye the possible passage of tax reform legislation, according to John Miller, co-head of fixed income at Nuveen Asset Management.

“New issuance for the balance of the year is estimated at $50 to $60 billion, as issuers rush to meet the year-end deadline before proposed tax laws take place in 2018,” Miller wrote in a market comment on Tuesday. “However, this is offset by approximately $72 billion expected to return on Dec. 1 and Jan. 1 via bond calls, maturities and coupons.”

Miller noted that high-yield muni issuance was $2.5 billion last week, one of the biggest weeks of 2017.

“Issuers are looking to lock in the ability to advance refund existing municipal debt or issue private activity bonds,” he wrote. “This issuance would reduce potential supply in 2018, and would likely put short term upward pressure on municipal yields and cause a temporary increase in municipal-to-Treasury ratios.”

But he said, “fundamentally, fixed income has a firm tone, and we believe any municipal market volatility will not be a long-term trend.”

It’s still a bit unclear as to what effect the Congressional tax reform proposals involving advance refundings and private activity bonds are having on upcoming issuance, Gerard Faulkner, director of operations for CUSIP Global Services, said on Tuesday.

“We have seen an uptick in advance refundings, but are unsure if this is directly related to the tax reform legislation being debated in Washington or if it’s the result of the ongoing low interest rate environment,” Faulkner said.

“We haven’t got a heads up from issuers letting us know there would be a large increase in private activity bond or advance refunding issuance,” he said, “but we stand ready to handle any amount that may be coming.”

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $3.75 billion to $10.58 billion on Tuesday. The total is comprised of $4.03 billion of competitive sales and $6.55 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as two basis points from 2.01% on Monday, while the 30-year GO yield increased as much as two basis points from 2.70%, according to a read of Municipal Market Data’s triple-A scale.

U.S. Treasuries were mixed on Tuesday. The yield on the two-year Treasury rose to 1.77% from 1.75% on Monday, the 10-year Treasury yield fell to 2.36% from 2.37% and the yield on the 30-year Treasury decreased to 2.77% from 2.79%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.9% compared with 85.0% on Friday, while the 30-year muni-to-Treasury ratio stood at 96.8% versus 96.2%, according to MMD.

MBIS 10-year muni at 2.290%, 30-year at 2.804%

The MBIS municipal non-callable 5% GO benchmark scale was stronger in midday trading.

The 10-year muni benchmark yield dipped to 2.290% on Tuesday from the final read of 2.291% on Monday, according to

The MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.