Municipal bond buyers will have to make due with a smaller-than-average new issue calendar next week as issuers remain wary as the Federal Reserve gathers for a monetary policy meeting.

Most analysts expect the Federal Open Market Committee will raise interest rates when their two-day meeting concludes on Wednesday. The Fed is seen hiking the federal funds rate target 25 basis points to a range of 1.75% to 2%, with at least one more increase and possibly two to follow later this year.

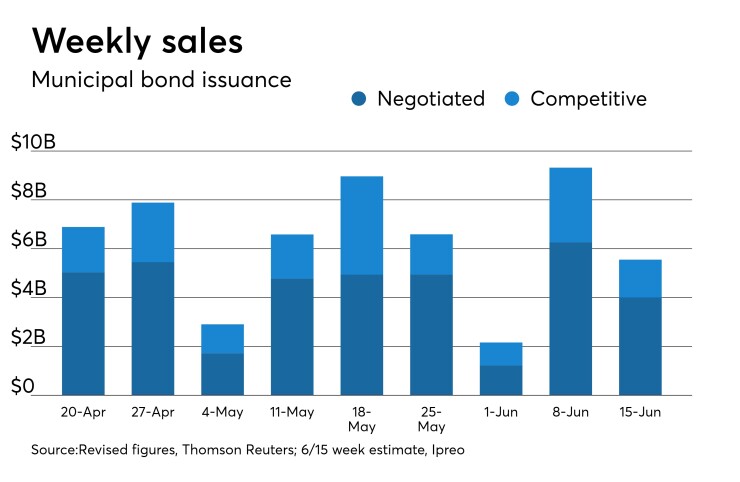

Ipreo estimates weekly volume at $5.55 billion, down from a revised total of $9.32 billion this week, according to updated data from Thomson Reuters. Next week’s calendar is composed of $4 billion of negotiated deals and $1.55 billion of competitive sales.

Primary market

New York issuers are the headliners of next week’s slate.

On Thursday, the N.Y. Metropolitan Transportation Authority is slated to competitively sell $1.6 billion of transportation revenue bond anticipation notes in two sales consisting of $800 million of Series 2018B-1 and $800 million of Series 2018B-2.

The New York City Housing Development Corp. will sell $553.09 million of Series 2018C multi-family housing revenue sustainable neighborhood bonds. JPMorgan is expected to price the bonds on Tuesday. The deal is rate Aa2 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

The New York City Municipal Water Finance Authority is set to issue $370.08 million of Fiscal 2018 Series FF water and sewer system second resolution revenue bonds. Raymond James & Associates is set to price the bonds on Monday. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch Ratings.

Citigroup is slated to price the Massachusetts Development Finance Agency’s $436 million of Series 2018J revenue bonds for Caregroup on Wednesday. The deal is rated Baa1 by Moody’s and A-minus by S&P.

In the competitive arena, Wayne County, Mich., is selling $156.29 million of Series 2018 taxable limited tax general obligation revenue notes.

Bond Buyer 30-day visible supply at $8.06B

The Bond Buyer's 30-day visible supply calendar increased $146.4 million to $8.06 billion on Friday. The total is comprised of $3.62 billion of competitive sales and $4.44 billion of negotiated deals.

Puerto Rico bonds trade higher

Puerto Rico bonds traded up on favorable news.

A lawyer representing Puerto Rico’s non-bondholding creditors, Puerto Rico’s Oversight Board, and other parties and a lawyer representing the Puerto Rico Sales Tax Financing Corp. (COFINA) reached an agreement to settle the commonwealth-COFINA dispute. On Thursday night, the COFINA lawyer announced the terms. According to an industry source, the deal would mean the forgiveness of about $6 billion of about $18 billion of COFINA debt with substantially better recoveries for COFINA seniors than for COFINA subordinates.

In active trading on Friday, the benchmark Puerto Rico Commonwealth Series 2014 GO 8s of 2035 were trading at a high price of 42.4 cents on the dollar compared to 41 cents on Thursday, according to the MSRB’s EMMA website. Volume totaled $42.23 million in 24 trades compared to $24.16 million in seven trades on Thursday.

The COFINA Series 2007B revenue 6.05s of 2036 traded at a high price of 84.25 cents on the dollar compared to 79.5 cents on Thursday, according to EMMA. Volume totaled $44.56 million in 46 trades compared to $25.84 million in 77 trades on Tuesday.

The COFINA Series 2011C senior current interest revenue 5s of 2040 [CUSIP: 74529JNU5] traded at a high price of 84 cents on the dollar compared to 78 cents on Thursday, according to EMMA. Volume totaled $47.99 million in 14 trades compared to $7.71 million in 62 trades on Thursday.

The COFINA Series 2011C senior current interest revenue 5.25s of 2040 [CUSIP: 74529JNX9] traded at a high price of 84 cents on the dollar compared to 78 cents on Thursday, according to EMMA. Volume totaled $23.86 million in 17 trades compared to $20.94 million in 32 trades on Thursday.

The COFINA Series 2011C senior current interest revenue 5s of 2022 traded at a high price of 80.5 cents on the dollar compared to 74.6 cents on Thursday, according to EMMA. Volume totaled $10.1 million in six trades compared to $660,000 in two trades on Thursday.

The COFINA Series 2010C first subordinate capital appreciation bonds of 2037 traded at a high price of 10.9 cents on the dollar on Friday compared to 6.951 cents on May 30, according to EMMA. Volume totaled $26.45 million in 10 trades compared to $200,000 in two trades on May 30.

Secondary market

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point across the curve.

High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point in the one- to 30-year maturities.

Municipals were unchanged according to Municipal Market Data’s AAA benchmark scale, which showed yields steady in the 10-year general obligation muni and flat in the 30-year muni maturity.

Treasury bonds were stronger as stock prices were little changed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 84.0% while the 30-year muni-to-Treasury ratio stood at 96.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,085 trades on Thursday on volume of $14.97 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 19.399% of the market, the Empire State taking 10.834% and the Lone Star State taking 9.4%.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 8 were from Connecticut, California and Puerto Rico issuers, according to

In the GO bond sector, the Connecticut 4s of 2036 traded 32 times. In the revenue bond sector, the California Municipal Finance Authority 5s of 2047 traded 76 times. And in the taxable bond sector, the Puerto Rico Sales tax Financing Corp.6.05s of 2036 traded 37 times.

Week's actively quoted issues

Puerto Rico, Connecticut and New York and New Jersey names were among the most actively quoted bonds in the week ended June 8, according to Markit.

On the bid side, the Puerto Rico Sales tax Financing Corp.’s taxable 6.05s of 2036 were quoted by 57 unique dealers. On the ask side, the Connecticut GO 5s of 2026 were quoted by 164 dealers. And among two-sided quotes, the Port Authority of New York and New Jersey taxable 4.458s of 2062 were quoted by 26 dealers.

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds again showed confidence and once again put cash into the funds in the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $189.487 million of inflows in the week ended June 6, after inflows of $77.249 million in the previous week.

Exchange traded funds reported inflows of $115.358 million, after inflows of $165.757 million in the previous week. Ex-ETFs, muni funds saw $74.129 million of inflows, after outflows of $88.509 million in the previous week.

The four-week moving average remained positive at $176.621 million, after being in the green at $171.080 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $113.984 million in the latest week after inflows of $165.844 million in the previous week. Intermediate-term funds had inflows of $153.045 million after inflows of $129.236 million in the prior week.

National funds had inflows of $183.181 million after inflows of $328.046 million in the previous week. High-yield muni funds reported inflows of $147.159 million in the latest week, after inflows of $224.989 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.