More supply swept into the municipal bond market on Thursday as JPMorgan Securities won a sale from a rarely seen New York issuer and Morgan Stanley priced a big Florida deal.

JPMorgan took the New York Local Government Assistance Corp.’s $257.82 million of Series 2018A senior lien refunding bonds with a true interest cost of 1.5293%.

In the negotiated sector, Morgan Stanley priced the Miami-Dade County Educational Facilities Authority, Fla.’s $233.57 million of Series 2018A revenue bonds for the University of Miami.

An overall mostly quiet mood continued to hang over the municipal market on Thursday morning.

“The equity market caught a big bid, so we are just staying very quiet,” said a New York trader. He said the market had a slightly better tone with the long end seeing better bids — albeit by one or two basis points.

“We are slightly up on the day, mostly out five years and beyond,” he said. “The front end is very quiet.”

He added, “there is non-stop demand from asset managers inside of 10 years, but that is nothing different.”

Thursday’s bond sales

N.Y. LGAC sale

U. of Miami deal

ICI: Long-term muni funds see $214M inflow

Long-term municipal bond funds saw an inflow of $214 million in the week ended March 7, the Investment Company Institute reported on Wednesday.

This followed inflows of $110 million into the tax-exempt mutual funds in the week ended Feb. 14 and $481 million in the week ended Feb. 21 and outflows of $640 million in the week ended Feb. 14 and $588 million in the week ended Feb. 7.

Taxable bond funds saw estimated inflows of $1.31 billion in the latest reporting week, after experiencing inflows of $5.07 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $5.26 billion for the week ended March 7 after inflows of $16.74 billion in the prior week.

Tax-exempt money market funds saw outflows

Tax-exempt money market funds experienced outflows of $600.6 million, lowering total net assets to $135.39 billion in the week ended March 13, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $1.61 billion to $135.99 billion in the previous week.

The average, seven-day simple yield for the 198 weekly reporting tax-exempt funds increased to 0.67% from 0.64% the previous week.

The total net assets of the 831 weekly reporting taxable money funds decreased $4.76 billion to $2.672 trillion in the week ended March 12, after an outflow of $2.64 billion to $2.677 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 1.09% from 1.06% from the prior week.

Overall, the combined total net assets of the 1,029 weekly reporting money funds decreased $5.36 billion to $2.807 trillion in the week ended March 12, after outflows of $4.24 billion to $2.813 trillion in the prior week.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,785 trades on Wednesday on volume of $12.83 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 19.161% of the market, the Empire State taking 11.868% and Lone Star State taking 7.675%.

Bond Buyer 30-day visible supply at $7.59B

The Bond Buyer's 30-day visible supply calendar decreased $819.6 million to $7.59 billion on Thursday. The total is comprised of $3.38 billion of competitive sales and $4.21 billion of negotiated deals.

Treasury releases auction details

The Treasury Department on Thursday announced the following auctions for next week:

- $45 billion of 182-day bills selling on March 19;

- $51 billion of 91-day bills selling on March 19; and

- $11 billion of 9-year 10-month TIPs selling on March 22.

Gary Siegel contributed to this report.

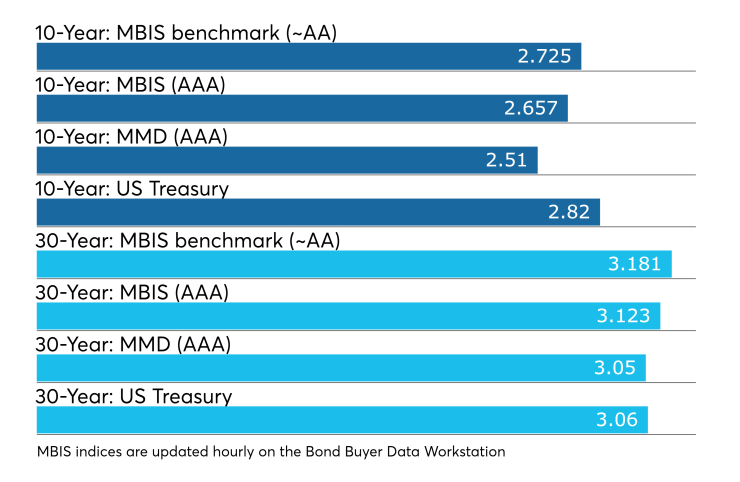

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.