DALLAS – In the largest deal in its history and the second-largest municipal bond sale of the year, the North Texas Tollway Authority will restructure its debt under one indenture with $2.6 billion of toll revenue bonds.

“It’s monumental,” NTTA chief financial officer Horatio Porter said of the deal scheduled for retail pricing Oct. 11 and institutional the next day.

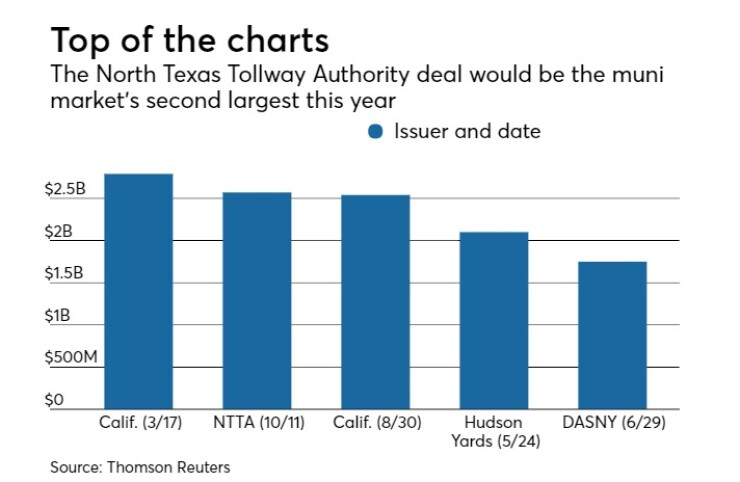

The sale would trail only California’s $2.79 billion general obligation bond pricing on March 7 among the muni market's largest deals this year. NTTA will bump California’s Aug. 30 sale of $2.54 billion of GO bonds to third place if the amount holds.

The NTTA deal would dwarf any other this year from Texas, where combined state and local bond volume fell 36% in the first half of the year.

“With year-to-date TX issuance running at a 38.8% deficit as of the end of August versus the same time last year, I would typically expect a refunding deal of this nature to be well received, particularly because we have been seeing a strong response to major primary new deal supply of recent,” wrote Greg Saulnier, muni research analyst at Thomson Reuters’ Municipal Market Data.

Coming ahead of the NTTA deal is $1 billion of revenue bonds from the Texas Water Development Board, which Saulnier said could slake some demand.

“That being said, it may also work as a barometer to gauge how the market feels about Texas paper in general in the wake of Hurricane Harvey,” Saulnier added.

The refunding will allow NTTA to merge its Special Project System created in 2011 with its main system bonds. In the wake of the global financial crisis in 2008, the SPS indenture backed by a separate revenue stream was designed to preserve NTTA’s credit ratings on existing bonds as it took up a state mandate to begin financing new projects in Fort Worth and suburbs to the west of Dallas.

To finance the SPS projects, NTTA was granted a new form of insurance from the Texas Department of Transportation called a “toll equity loan agreement” or TELA that earned double-A ratings for the bonds. The TELA, set to expire in 2022, will close five years early with the new bonds.

“Refunding all of our Special Project System debt with NTTA System bonds allows us to combine two well performing assets in one system, achieve significant debt-service savings, and seal our contract obligations to the Texas Department of Transportation,” Porter said. The deal will reduce maximum annual debt service by $2 million.

Porter’s finance team estimates net present value savings of 11.2% or $291 million.

Mitchell Gold, managing director at book runner Bank of America Merrill Lynch, and BAML director Allegra Ivey are lead bankers on the deal. JPMorgan executive director Douglas Hartman is lead banker for the co-senior manager.

Michael Newman, senior vice president at First Southwest Co./Hilltop Securities, is NTTA’s municipal advisor with co-advisors from Estrada Hinojosa and the RSI Group.

McCall Parkhurst & Horton and Mahomes Bolden are co-bond counsel.

The bonds will come in two series. The $1.79 billion Series A are first-tier, with ratings of A1 from Moody’s Investors Service and A from S&P Global Ratings. The $776.6 million of second-tier Series B carry ratings a notch lower from both agencies.

Porter said the fact that NTTA was able to maintain its ratings while combining the two systems was a significant achievement nearly a decade after the global financial crisis that led to creation of the SPS.

After this issuance, NTTA will have $7.3 billion of first tier debt, $1.7 billion of second tier debt, $129 million of unrated federal highway loan under the Intermodal Surface Transportation Efficiency Act, and $400 million of subordinate debt.

In a separate report on the toll-road sector, Moody’s cited NTTA’s 31.6% growth in annual revenue as the highest in the U.S. in 2016. Florida’s Miami-Dade County Expressway Authority, rated A2 with a positive outlook, had the highest annual growth in transactions, 28.6% for the same period, analysts said.

Despite expansion work on NTTA’s original Dallas North Tollway that has led to intermittent closures on some weekends, transactions on the main system were up 0.9% for the trailing twelve months ended June 2017, though revenues were down slightly, according to Moody’s. On the Special Projects System tollways, transactions were up 8.7% and revenue rose 11% during the same period, analysts noted.

“Driven by large population and economic advances, and supported by lower gas prices, revenue performance on the legacy NTTA system has outperformed consultant's forecasts consistently since 2010,” Moody’s said.

The refunding lowers a debt-service peak of $706 million in 2036 to $576 million and keeps debt service flat from 2026 to 2036, after which it falls sharply.

“Debt service coverage ratios over the next five years will be consistent with its A1 rated peers, however leverage will remain elevated over the period,” Moody’s said. “NTTA’s ability to fund its five-year growth needs without additional debt and minimal reduction in liquidity additionally supports the rating.”

The NTTA's legacy toll roads include the Dallas North Tollway, President George Bush Tollway, and the Sam Rayburn Tollway. Those toll roads north of Dallas serve the fastest growing areas of the region and will produce at least 75% of revenue for the foreseeable future, according to a consultant’s study.

The Sam Rayburn Tollway, the $5 billion project that NTTA struggled to finance during the 2008 financial crisis, has proven a boon to Dallas’ northern suburbs, attracting a headquarters for JP Morgan Chase & Co. with 6,000 employees, Liberty Mutual Insurance with 5,000 employees and Toyota North America with 4,000 employees.

“All are in the process of moving substantial operations to developments near the intersection of the DNT and SRT,” Moody’s noted. “The DNT, which connects to downtown Dallas, is well positioned to capture growth from these new developments as many new arrivals to the area look to live in the more urbanized areas in the northern portions of the city.”

Nationwide, “toll revenue growth has exceeded expense growth over a sustained period, resulting in a build-up of retained cash and an improved ability to manage expenses,” according to Moody’s.

“We expect the sector to benefit from improved financial flexibility as a result of growth in liquid reserves and strong expense management,” analysts said.

“Government-owned toll roads in the U.S. overall continue to demonstrate financial stability, with steady traffic growth, sustained revenue gains above inflation and improvement in liquidity, according to our fiscal 2016 sector medians.”