Issuers in the Northeast sold $102.9 billion of municipal bonds in 2015, almost 9% above the previous year despite a late dip.

Fourth-quarter issuance was off almost 19% from the previous year leading up the Federal Reserve's Dec. 15 quarter point interest rate hike.

Bond sales peaked in the second quarter at $32.3 billion, a 37% year-over-year bump, and were up 26% in the first half of the year, according to data from Thomson Reuters.

Northeast borrowings mirrored a national trend, though other regions saw greater gains, led by the Southeast, which rose 39% for the year.

The Northeast's issuers still sold more municipal bonds than those of any other region.

The region consists of 11 states, the District of Columbia, Puerto Rico and the Virgin Islands.

In 2014, Northeast issuance was up 1% from 2013.

"Despite historically low interest rates and older infrastructure, that doesn't seem to entice many northeastern states and communities into the debt market," said Howard Cure, director of municipal research at New York City-based Evercore Wealth Management. "A large percentage of the volume in the Northeast was probably driven by refunding opportunities."

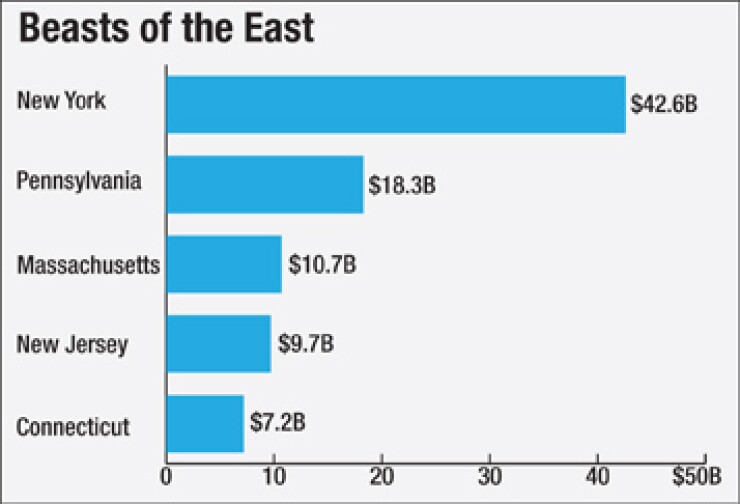

Northeast states with the biggest 2015 issuance were New York with $42.6 billion, Pennsylvania with $18.3 billion, Massachusetts with $10.7 billion, New Jersey with $9.7 billion and Connecticut with $7.2 billion.

Janney Capital Markets municipal analyst Alan Schankel said the early-year volume spike was due to high refunding activity driven by issuer concerns about losing potential savings if interest rates rose. Many of these concerns were gone in the second half.

"Towards end of year, concerns about rising rates diminished so perhaps that took pressure off of rushing to market with refundings," said Schankel.

Rhode Island had the largest 2015 volume increase in the Northeast, up 81% to almost $1.7 billion, led by a $621 million sale of tobacco settlement asset-backed bonds in March.

The Rhode Island Health and Education Building Corporation also came to market with two transactions totaling $193.2 million.

New Hampshire also saw a spike from its 2014 issuance with a 77.5% jump to $1.1. billion.

Municipal bond sales in Pennsylvania jumped 69% in 2015 compared to the previous year.

The Commonwealth government sold $2.2 billion, making it the fifth-largest northeast issuer.

Its $1.2 billion GO deal in May was the region's fourth-largest in 2015 and the largest from outside New York.

The Pennsylvania Higher Education Facilities Authority issued $1.3 billion, making it the region's eight-biggest issuer, and the Pennsylvania Turnpike Authority sold $759.7 million.

The Keystone State still has an unsigned budget for fiscal 2016 with Gov. Tom Wolf signing three-fourths of a $30 billion spending plan in late December to free up funds for school districts and social service agencies.

Maine issuance went up 40% in 2015 to almost $1.4 billion despite continued resistance from Gov. Paul LePage to authorizing some voter-approved land conservation and waterfront bonds.

The Maine State Housing Authority issued $171 million including $138 million in mortgage purchase bonds in August. The Maine Turnpike Authority also came to market with $130 million of revenue refunding bonds in February.

The Northeast's most populous state, New York, had a 13.4% issuance rise in 2015 after a 9% drop the previous year. The region's three largest issuers were from the Empire State, led by the Dormitory Authority of the State of New York at $4.6 billion, followed by the New York City Transitional Finance Authority at $3.3 billion and the New York state government at $2.3 billion. DASNY was also tops in the nation among issuers for 2015.

"DASNY's reliability as a partner has made us a leader in the municipal bond market," said DASNY president and CEO Gerrard P. Bushell. "It helps us deliver for the institutions that anchor communities and drive New York's economy."

The state's fourth-largest issuer, and the Northeast region's seventh-largest, was the New York City Municipal Water Finance Authority, selling more than $1.4 billion.

New York's Metropolitan Transportation Authority was also active in 2015 issuing more than $1.1 billion, making it the region's ninth largest issuer for the year.

MTA officials cited better transparency, a more suitable match of assets and linked debt liability, and low-cost short-term financing. The MTA is one of the nation's largest municipal issuers with roughly $36 billion in debt outstanding.

New Jersey's municipal bond volume dropped 14% last year from 2014.

The Garden State did however have the biggest single issuance in 2015 with a $2.1 billion deal from the New Jersey Economic Development Authority in August.

The New Jersey Education Facilities Authority issued $483.3 billion for the year.

Bank of America Merrill Lynch retained its first place standing as the region's biggest senior manager measured by par value, credited by Thomson Reuters with almost $10.3 billion of volume.

Citi replaced JPMorgan in second place. JPMorgan moved to third place, followed by Morgan Stanley and RBC Capital Markets in the fourth and fifth spots, respectively.

Hawkins Delafield & Wood finished atop the rankings again as the top bond counsel firm in the Northeast, credited with $6.9 billion, with Orrick, Herrington & Sutcliffe shifting from fourth to second place. Sidley Austin slipped from second place in 2014 to third last year with Locke Lord moving from fifth to fourth. Nixon Peabody, which finished third in last year's rankings, did not place in the top 10 for 2015.

In the financial advisor category, the first, second and third place firms remained Public Financial Management followed by Public Resources Advisory Group and FirstSouthwest.

Acacia Financial placed fourth with AC Advisory in fifth after flip flopping placements from last year's rankings.

Paul Burton contributed to this story