Top-rated municipal bonds were weaker at mid-session, according to traders, as New York City hit the market with negotiated and competitive sales totaling over $1 billion.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as one basis point from 1.87% on Wednesday, while the 30-year GO yield gained as much as one basis point from 2.75%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Thursday. The yield on the two-year Treasury rose to 1.36% from 1.35% on Wednesday, the 10-year Treasury yield was flat from 2.19% and the yield on the 30-year Treasury bond decreased to 2.78% from 2.79%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.3%, compared with 85.8% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 98.5% versus 98.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,017 trades on Wednesday on volume of $9.91 billion.

Primary market

Siebert Cisneros Shank & Co. priced New York City’s $857.59 million of Fiscal 2018 Subseries B-1 and Series 1 general obligation bonds for institutions after a two-day retail order period.

The $550 million of the Subseries B-1 GOs were priced to yield 0.91% with a 3% coupon in 2019 and 1.05% with a 4% coupon in 2020 and from 2.36% with a 5.25% coupon in 2030 to 3.23% with a 4% coupon in 2041; a 2042 maturity was priced as 3 1/4s to yield 3.38%.

The $307.59 million of Series 1 GOs were priced as a remarketing to yield from 1.03% with 2% and 4% coupons in a split 2020 maturity to 2.61% with a 5% coupon in 2033.

In the competitive arena, the city sold $250 million of taxable GOs in two separate offerings.

Bank of America Merrill Lynch won the $190.62 million of Fiscal 2018 Subseries B-2 taxables with a true interest cost of 2.62%. The issue was priced at par to yield from 1.66% in 2020 to 2.90% in 2027.

Jefferies won the $59.38 million of Fiscal 2018 Subseries B-3 taxables with a TIC of 3.05%.

The deals are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

The negotiated sector went back to school on Thursday.

Bank of America Merrill Lynch priced the Board of Regents of the University of Texas System’s $246.07 million of Series 2017B revenue financing system bonds.

The issue was priced as 5s to yield 1.98% in 2027, at par as a step coupon bond to yield 2.50% in 2043, and as 3 3/8s to yield 3.50% and 4s to yield 3.22% in a split 2044 maturity.

The 2043 step coupon bond bears interest ranging from 2.50% in the 2017-2020 period to 5.10% in 2037-2043.

The deal is rated triple-A by Moody’s, S&P and Fitch.

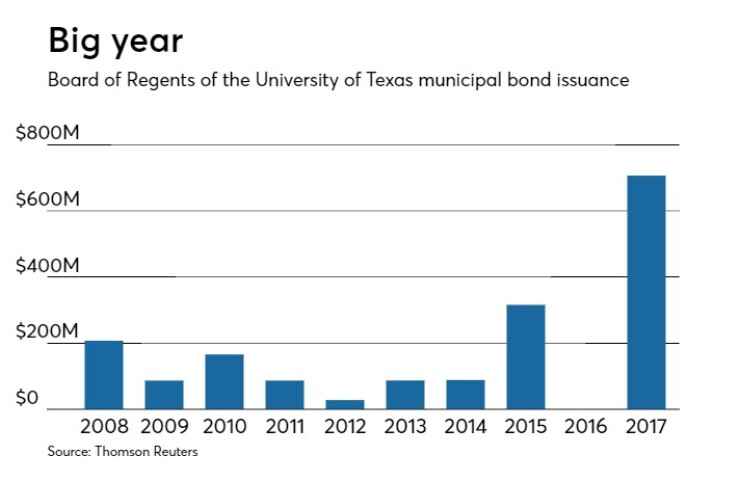

Since 2008, the Regents have sold about $2.23 billion of securities, with the most issuance before this year occurring in 2015 when it sold $316 million. It did not come to market at all in 2016 and Thursday’s sale will make 2017 the highest issuance year for the past decade.

Morgan Stanley is expected to price the Board of Governors of the Colorado State University System’s $111.94 million of system enterprise revenue bonds.

The deal, which is backed by the Colorado State Intercept Program, is rated Aa2 by Moody’s and AA-minus by S&P.

And JPMorgan Securities is expected to price the Board of Governors of the University of North Carolina’s $110 million of Series 2017 taxable general revenue refunding bonds for the University at Chapel Hill.

The deal is rated triple-A by Moody’s, S&P and Fitch.

RBC Capital Markets received the official award on the Regents of the University of Minnesota’s $410.05 million of tax-exempt Series 2017A general obligation bonds and Series 2017B GO refunding bonds.

The $117.095 million of Series 2017A bonds were priced to yield from 0.79% with a 4% coupon in 2018 to 2.80% with a 5% coupon in 2042.

The $292.955 million of Series 2017B bonds were priced to yield from 0.70% with a 2% coupon in 2017 to 3.125% at par in 2036.

The deal is rated Aa1 by Moody’s and AA by S&P.

Bank of America Merrill Lynch priced the Reedy Creek Improvement District, Fla.’s $194.87 million of Series 2017A ad valorem tax bonds.

The issue was priced to yield from 0.89% with a 5% coupon in 2019 to 2.89% with a 5% coupon in 2037.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.94 billion to $8.32 billion on Thursday. The total is comprised of $4.36 billion of competitive sales and $3.97 billion of negotiated deals.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $692.4 million, lowering total net assets to $127.99 billion in the week ended Sept. 11, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $1.27 million to $128.69 billion in the previous week.

The average, seven-day simple yield for the 228 weekly reporting tax-exempt funds slid to 0.34% from 0.35% the previous week.

The total net assets of the 835 weekly reporting taxable money funds increased $24.36 billion to $2.582 trillion in the week ended Sept. 12, after an inflow of $6.57 billion to $2.558 trillion the week before.

The average, seven-day simple yield for the taxable money funds remained at 0.67% for the fifth week in a row.

Overall, the combined total net assets of the 1,063 weekly reporting money funds increased $23.7 billion to $2.710 trillion in the week ended Sept. 12, after inflows of $5.30 million to $2.686 trillion in the prior week.