Municipal issuers sold billions of dollars of new paper Tuesday, even as the market weakened for a second day amid climbing Treasury yields.

“The market seems to be handling the supply OK, but is a bit weaker as a result of treasuries [being] off for a few days in a row, plus all the talk of 10-year Treasury testing and possibly breaking 3.00%,” said one New York trader.

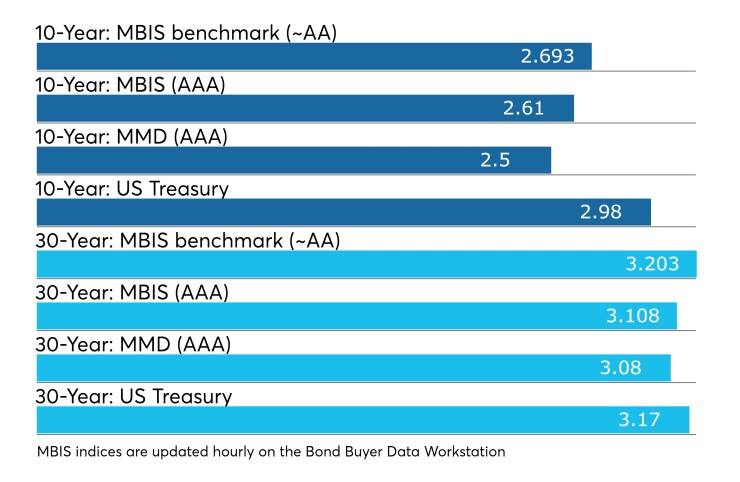

The 10-year Treasury yield touched 3% in morning trade and ended the day hovering around 2.99%.

Citigroup priced the New York Transportation Development Corp.’s $1.38 billion of special facilities revenue bonds. The issue is redevelopment financing for Delta Airlines’ Terminals C and D at LaGuardia Airport.

“Looking at the Delta pricing and something that jumped out at me was that it is only [about] 10 to 15 basis points cheaper then the recent NJ tobacco deal, which was rated BBB versus Delta at BBB-minus, so looks to represent some value, considering the NJ TOB deal tightened up post issuance,” the trader said.

The offering is subject to the alternative minimum tax and is rated Baa3 by Moody’s Investors Service and BBB-minus by Fitch Ratings.

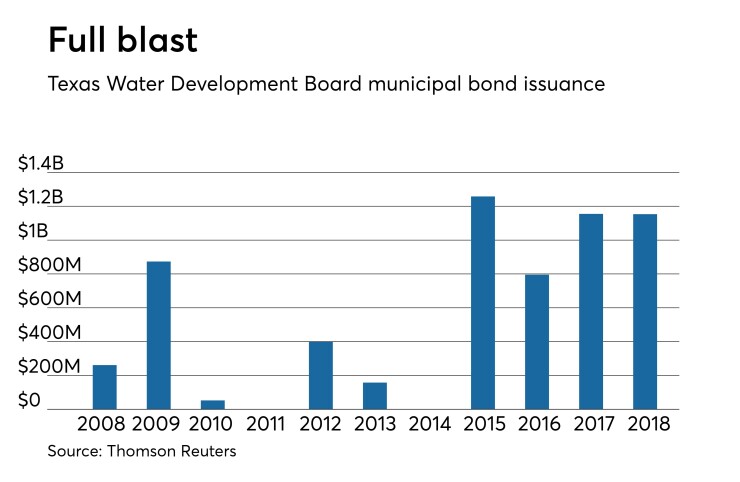

JPMorgan Securities priced the Texas Water Development Board’s $824.67 million of Series 2018 Master Trust State Water Implementation Revenue Fund for Texas revenue bonds.

The deal is rated AAA by S&P Global Ratings and Fitch.

Since 2008, the TWDB has sold about $6.1 billion of securities, with the most issuance occurring in 2015 when it sold $1.26 billion. The board did not come to market in 2011 or 2014.

Ramirez & Co. priced the Port Authority of New York and New Jersey’s $413.13 million of 209th Series consolidated bonds for retail investors ahead of the institutional pricing on Wednesday.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

In the competitive arena, Massachusetts sold $525 million of general obligation bonds in two sales.

Morgan Stanley won the $250 million of Series C consolidated loan of 2018 GOs with a true interest cost of 3.9221%.

Citigroup won the $275 million of Series D consolidated loan of 2018 GOs with a TIC of 3.8%.

The deals are rated Aa1 by Moody’s, AA, by S&P and AA-plus by Fitch.

West Contra Costa Unified School District will sold $125 million of Series E 2010 election and Series D 2012 election GOs, which were won by BAML with a TIC of 3.68%.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and AAA by Fitch.

Portland, Ore., sold $191.93 million of Series 2018A second lien sewer system revenue bonds. JPMorgan Securities won the deal with a TIC of 3.4357%.

Tuesday’s bond sales

New York:

Texas:

Massachusetts:

West Contra Costa USD:

Portland, Ore.:

Secondary Market

A recent bounce in supply and outperformance by municipals have provided positive market conditions lately, according to George Friedlander, managing partner at Court Street Group Research LLC.

Volume last week was solid at $7.45 billion -- which far surpassed the year to date weekly average of $4 .75 billion through the end of March, he wrote in an April 20 municipal perspective published on Monday.

Despite Treasury 10 and 30-year yields rising seven to eight basis points, municipals ended the week on April only four to five basis points higher, Friedlander noted.

There is heavy demand from separately-managed accounts inside of 10 years, with banks looking out further, and institutional demand strong for long secondary paper with 4% to 5% coupons.

“Direct retail still isn’t interested in the higher-premium paper that 4-5% coupons generate,” he wrote.

The third week of mutual fund outflows, he noted, was not surprising in the midst of tax time and after many investors experienced heavy capital gains in stocks last year and some may have used muni bond fund sales to pay tax liabilities.

Still, Friedlander said the firm has butterflies in its stomach.

“We remain just a bit nervous. Munis are still not cheap enough, in our view, to attract direct retail investors in the 10 to 15-year range,” he wrote.

Only shorter intermediates are cheap compared with last year’s trading levels, and munis due in 10 years “only pay 85% as much as Treasuries, versus a 95% level the day of the election -- before the election-induced muni market crash started,” Friedlander wrote.

“Munis in 30 years are yielding 98% as much as Treasuries, versus a 99.6% ratio on election day,” he continued, “By contrast, 5-year paper started this cycle at 72% of Treasuries, got as low as 63% or so in late summer, and now are near their highs for the cycle, at 78.7% after a modest relative rally.”

Friedlander said he believes munis are relatively cheap on shorter maturities.

In the 10-year range, he believes munis are overvalued; and, on the very long end, munis seem “pretty fairly valued.”

“We continue to wonder what will happen if new-issue supply continues to gradually inch higher, as we anticipate,” Friedlander wrote. “Such a trend will ultimately be likely we think, as private activity bonds become more prevalent after the 2017 rush to market when their outlook was uncertain in Congress.”

He forecast that refunding issuance will slowly ease higher, as more issues get inside the period three months before the first call date, when they qualify as current refundings.

“Although we expect fund flows to return to positive territory now that tax day is past, we don’t view this as a certainty,” he wrote. “We will be closely watching flows over the next several weeks to see whether a rebound in demand for funds is starting.”

Treasury sells 4-week, year bills

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.200% high yield, a price of 97.775556.

The coupon equivalent was 2.268%. The bid-to-cover ratio was 3.39. Tenders at the high rate were allotted 90.02%. The median yield was 2.180%. The low yield was 2.150%.

Treasury also auctioned $45 billion of four-week bills at a 1.680% high yield, a price of 99.869333.

The coupon equivalent was 1.706%. The bid-to-cover ratio was 3.16. Tenders at the high rate were allotted 31.54%. The median rate was 1.650%. The low rate was 1.640%.

Treasury also auctioned $32 billion of two-year notes with a 2 3/8% coupon at a 2.498% yield, a price of 99.761494.

The bid-to-cover ratio was 2.61.

Tenders at the high yield were allotted 71.80%.

The median yield was 2.470%. The low yield was 2.395%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.