Activity remained light Tuesday as investors reacted to the rally in U.S. Treasurys, as traders looked for confirmation that new yield levels are here to stay.

“Munis did their best to follow Treasurys most of the day,” a Florida trader said. “Trading activity between customers and dealers the last few weeks has been on the low side and today there is more of a deer in the headlight approach as people are watching the big move and are reluctant to follow the lower yields after a sustained rise earlier this year.”

He said it will take some time for investors to analyze the new levels and new primary deals coming later in the week may provide the needed insight.

“We will see when deals get priced [on Wednesday] how the market reacts and if we can get a validations of where levels are at and if customers will transact,” he added. “We need distribution of paper before customers get comfortable with committing capital at these levels.”

The trader said investors will be looking at the muni-to-Treasury ratios and the sustainability of the Treasury rally “to make sure they are not getting lured into a short-term flight to quality.”

Earlier in the day, muni traders returned to their desks and saw a rally in the Treasury market and a cloud of concern over geopolitical turmoil in Italy.

“It’s Tuesday and this took everyone by surprise,” one New York trader said, noting the 10-year Treasury benchmark opened at 2.82% after some desks were bearish over the past week or so.

Treasurys have rallied alongside a number of core-European bonds as the political crisis in Italy and Spain deepened, triggering risk-off trading across capital markets.

“Between the equity market being off big again and what’s happening in Italy, people are buying some items," the trader said. "The secondary is kind of quiet and people are marking their inventory.”

The lack of new issue volume will continue to affect the municipal market this week as the geopolitical concerns and the Treasury rally may cause municipals to naturally underperform slightly, according to another New York trader at a large Wall Street firm.

“Treasurys are putting in a very impressive performance and there’s not a lot around this week calendar-wise,” the second New York trader said. “The headlines will be dominated by geopolitical posturing in Italy and Spain.”

He added, “investors have concerns, so we will underperform a little against Treasury, and that is to be expected.”

Secondary market

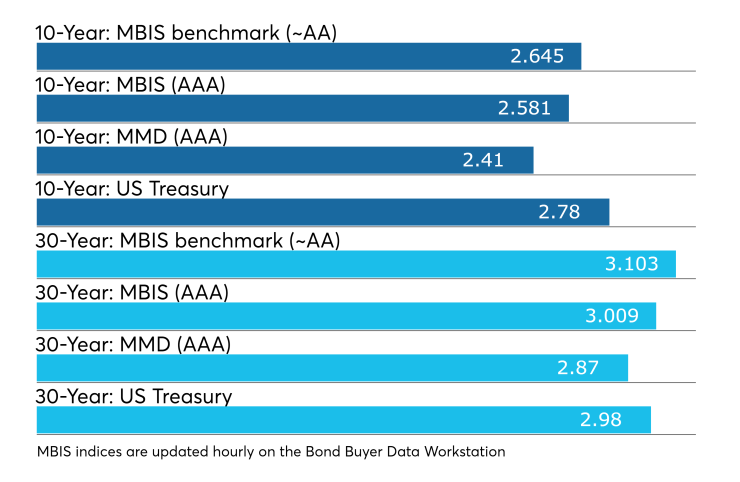

Municipal bonds were stronger on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as five basis points in the one- to 30-year maturities. High-grade munis were also stronger with yields calculated on MBIS’ AAA scale falling by as much as five basis points across the curve.

Municipals were also stronger all along Municipal Market Data’s AAA benchmark scale, which showed yields falling eight basis points in the 10-year general obligation muni and dropping eight basis points in the 30-year muni maturity.

Treasury bonds were stronger as stock prices slumped.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 87.0% while the 30-year muni-to-Treasury ratio stood at 97.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 20,387 trades on Friday on volume of $5.77 billion.

Prior week's actively traded issues

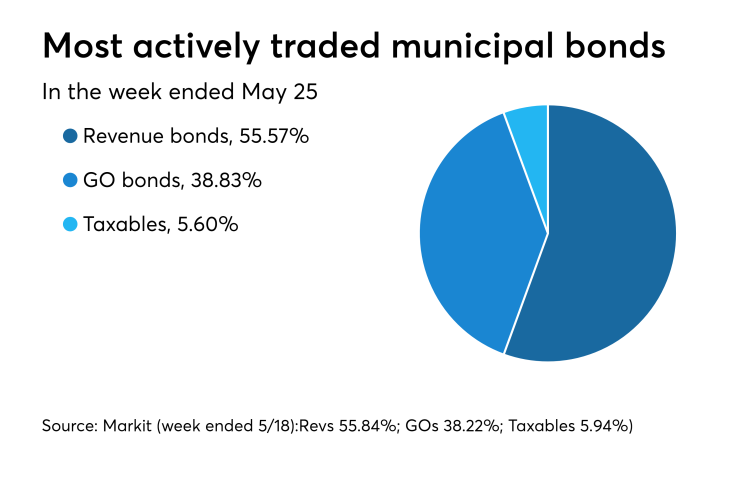

Revenue bonds comprised 55.57% of new issuance in the week ended May 25, down from 55.84% in the previous week, according to

Some of the most actively traded bonds by type were from Illinois and California issuers. In the GO bond sector, the Chicago Board of Education 5s of 2035 traded 43 times. In the revenue bond sector, the Regents of the University of California 5s of 2048 traded 50 times. And in the taxable bond sector, the Illinois 5.1s of 2033 traded 17 times.

Primary market

On Wednesday, Bank of America Merrill Lynch is expected to price the South Carolina State Port Authority’s $325 million of Series revenue bonds subject to the AMT.

Wells Fargo Securities is expected to price Anchorage, Alaska’s $184.86 million of general obligation bonds for retail investors on Wednesday ahead of the institutional pricing on Thursday.

BAML is set to price Fort Collins, Colo.’s $130 million of electric utility enterprise revenue bonds on Wednesday.

In the competitive arena on Wednesday, the Brainerd Independent School District No. 181, Minn., is selling $143.58 million of GOs under the Minnesota credit enhancement program.

Also on Wednesday, the Las Vegas Valley Water District, Nev., is competitively selling $100 million of GO water improvement bonds which are additionally secured by pledged revenues.

Prior week's top underwriters

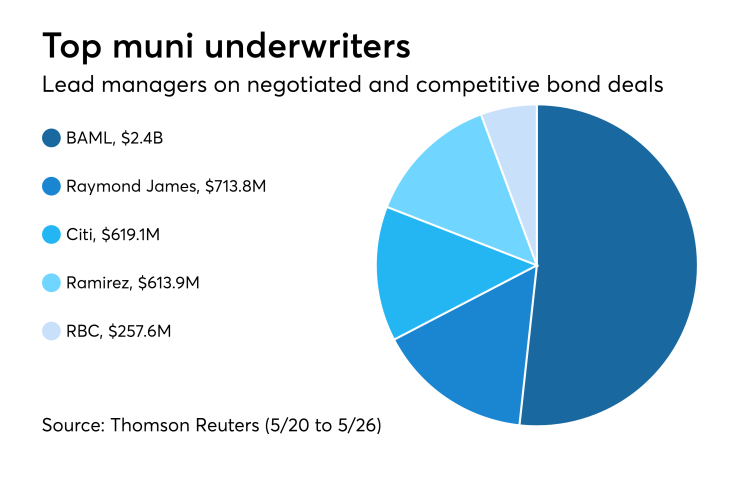

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Raymond James & Associates, Citigroup, Ramirez & Co. and RBC Capital Markets, according to Thomson Reuters data.

In the week of May 20 to May 26, BAML underwrote $2.36 billion, Raymond James $713.8 million, Citi $619.1 million, Ramirez $613.9 million and RBC $257.6 million.

Treasury auctions $40B 4-week bills

The Treasury Department auctioned $40 billion of four-week bills at a 1.750% high yield, a price of 99.863889.

The coupon equivalent was 1.777%. The bid-to-cover ratio was 3.25.

Tenders at the high rate were allotted 11.42%. The median rate was 1.720%. The low rate was 1.690%.

Treasury sells bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the three-months incurred a 1.895% high rate, unchanged from 1.895% the prior week, and the six-months incurred a 2.030% high rate, off from 2.080% the week before.

Coupon equivalents were 1.931% and 2.080%, respectively. The price for the 91s was 99.520986 and that for the 182s was 98.973722.

The median bid on the 91s was 1.860%. The low bid was 1.830%. Tenders at the high rate were allotted 83.43%. The bid-to-cover ratio was 2.82. The median bid for the 182s was 2.005%. The low bid was 1.975%. Tenders at the high rate were allotted 75.95%. The bid-to-cover ratio was 3.10.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.