Municipal bonds finished narrowly mixed on Thursday as the last of the week’s hefty supply was coming to market.

Primary market

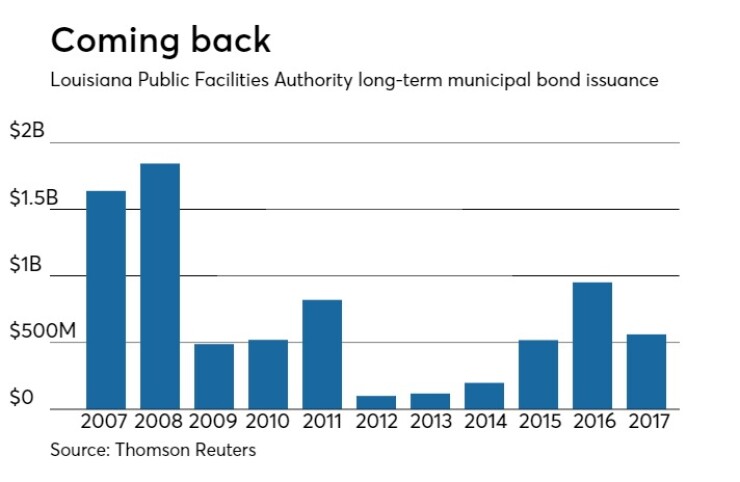

Citigroup priced the Louisiana Public Facilities Authority’s $421.56 million of Series 2017 refunding revenue bonds for the Ochsner Clinic Foundation.

The bonds were priced to yield from 1.29% in 2019 to 4.03% with a 4% coupon in 2037. A split 2042 maturity was priced as 4s to yield 4.07% and as 5s to yield 3.77%; a 2046 maturity was priced as 5s to yield 3.82%.

The deal is rated A3 by Moody’s Investors Service and A-minus by Fitch Ratings.

Since 2007, the Louisiana PFA has issued roughly $7.91 billion of securities, with the most issuance occurring in 2008 when it sold $1.84 billion of bonds. The authority saw a low year of issuance in 2012, when it sold $100 million.

Siebert Cisneros Shank priced the Oakland Unified School District, Calif.’s $221.44 million of Series 2017A Measure B and Series 2017B Measure J and Series 2017C general obligation refunding bonds.

The $112.14 million of Series 2017A GOs were priced to yield from 0.88% with a 4% coupon in 2018 to 2.00% with a 5% coupon in 2025.

The $24.49 million of GO refunding bonds Measure B bonds were priced to yield from 0.88% with a 4% coupon in 2018 to 2.89% with a 5% coupon in 2032.

The $84.81 million of Measure J bonds were priced to yield from 0.88% with a 4% coupon in 2018 to 3.18% with a 5% coupon in 2038.

The deal is rated Aa3 by Moody’s, AA-minus by S&P Global Ratings and AAA by Fitch.

Bank of America Merrill Lynch priced the city and county of Denver’s $185.39 million of Series 2017A water revenue bonds and Series 2017B green bonds. The bonds are being issued through Denver’s Board of Water Commissioners.

The $143.66 million of green bonds were priced to yield from 1.17% with a 5% coupon in 2020 to 2.54% with a 5% coupon in 2029. A term bond in 2042 was priced to yield 3.46% with a 4% coupon and a term bond in 2047 was priced to yield 3.16% with a 5% coupon.

The $41.735 million of Series 2017B bonds were priced to yield from 2.54% with a 5% coupon in 2029 to 3.55% with a 3.5% coupon in 2038.

The deal is rated triple-A by Moody’s, S&P Global Ratings and Fitch.

BAML priced the Hayward Area Recreation and Park District, Alameda County, Calif.’s $125 million of election of 2016 general obligation bonds.

The bonds were priced to yield from 0.84% with a 5% coupon in 2018 to 3.48% with a 4% coupon in 2037. A term bond in 2042 was priced to yield 3.19% with a 5% coupon and 3.76% with a 3.625% coupon in a split maturity. A term bond in 2046 was priced to yield 3.65% with a 4% coupon.

The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Secondary market

The yield on the 10-year benchmark muni general obligation fell one basis point to 2.16% from 2.17% on Wednesday, while the 30-year GO yield was unchanged from 3.01%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Thursday. The yield on the two-year Treasury was unchanged from 1.34% on Wednesday, while the 10-year Treasury yield gained to 2.40% from 2.38%, and the yield on the 30-year Treasury bond increased to 3.04% from 3.01%.

The 10-year muni to Treasury ratio was calculated at 90.1%, compared with 90.0% on Wednesday, while the 30-year muni to Treasury ratio stood at 99.1%, versus 99.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,147 trades on Wednesday on volume of $14.2 billion.

Tax-exempt money market fund inflows

Tax-exempt money market funds experienced inflows of $1.17 billion, bringing total net assets to $129.72 billion in the week ended May 8, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an inflow of $62.3 million to $128.56 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds decreased to 0.37% from 0.41% from the previous week.

The total net assets of the 856 weekly reporting taxable money funds decreased $5.24 billion to $2.490 trillion in the week ended May 9, after an inflow of $9.50 billion to $2.496 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.44% from 0.43% in the prior week.

Overall, the combined total net assets of the 1,088 weekly reporting money funds decreased $4.07 billion to $2.620 trillion in the week ended May 9, after inflows of $9.26 billion to $2.624 trillion in the prior week.