Municipal bonds finished mixed on Monday, traders said, as they prepared for the week’s $7.66 billion new issue calendar.

Secondary market

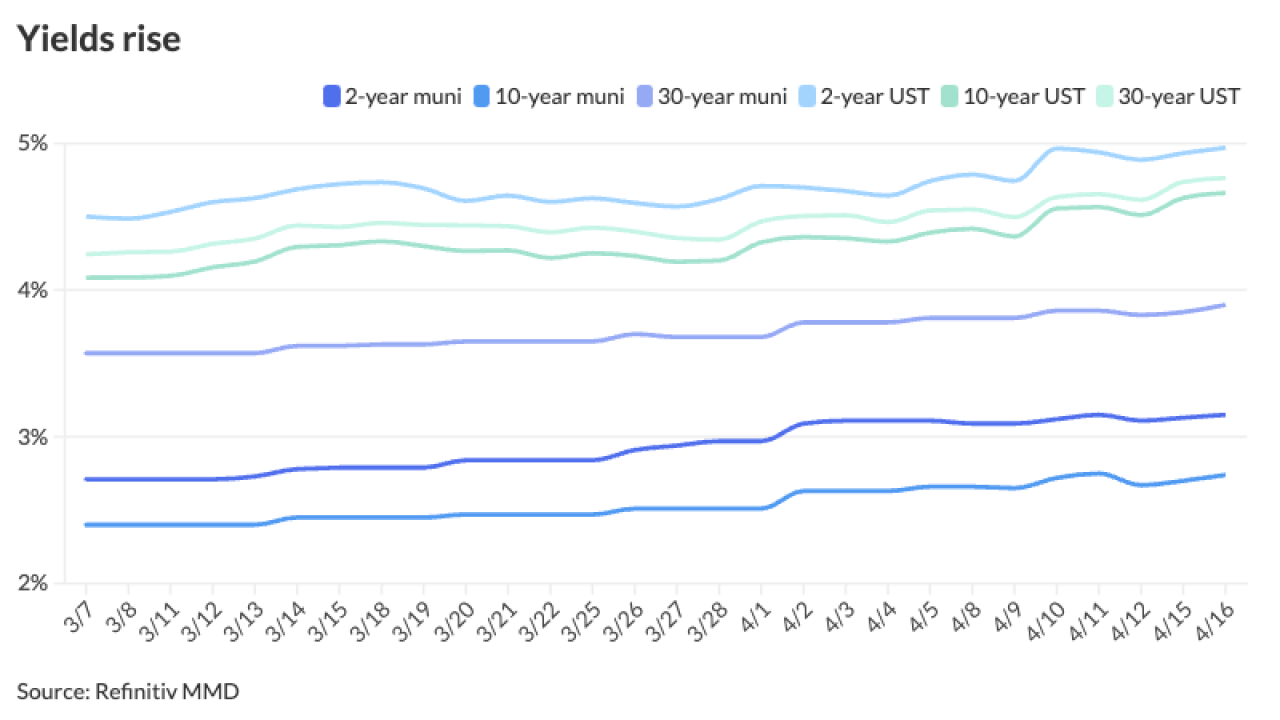

The yield on the 10-year benchmark muni general obligation fell one basis point to 1.99% from 2.00% on Friday, while the 30-year GO yield was unchanged from 2.79%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were mixed on Monday. The yield on the two-year Treasury rose to 1.36% from 1.34% on Friday, the 10-year Treasury yield dropped to 2.31% from 2.32% and the yield on the 30-year Treasury bond decreased to 2.89% from 2.91%.

The 10-year muni to Treasury ratio was calculated at 86.4% on Monday, compared with 86.2% on Friday, while the 30-year muni to Treasury ratio stood at 96.5% versus 95.9%, according to MMD.

The Municipal Securities Rulemaking Board reported 35,437 trades on Friday on volume of $10.48 billion.

BlackRock: Munis not adrift despite a shallow June dip

“The broad municipal bond index edged down in June -- its first negative performance month since the post-election sell-off,” according to BlackRock’s July 2017 municipal market update from Peter Hayes, head of the municipal bonds group, Sean Carney, head of municipal strategy, and James Schwartz, head of municipal credit research. “The U.S. Treasury and municipal curves flattened as yields rose (and prices fell) more on the short end than the long end in response to global central banks taking a more hawkish tone late in the month and the Fed reiterating its intention to continue on its path of interest rate normalization.”

The firm, which manages $118 billion in municipal assets on behalf of clients, said new issuance once again largely underwhelmed expectations at just $36.8 billion, down 23% year-over-year and 6% below June’s 10-year average.

“Meanwhile, demand for the asset class remained steady, reflecting continued investor appetite for income, diversification and attractive yield,” the report said. “Municipal bond mutual funds brought in $3.3 billion, notching the largest inflow month this year and bringing year-to-date inflows to $12.7 billion. Long-term and high yield funds garnered the bulk of inflows given investors’ focus on yield.”

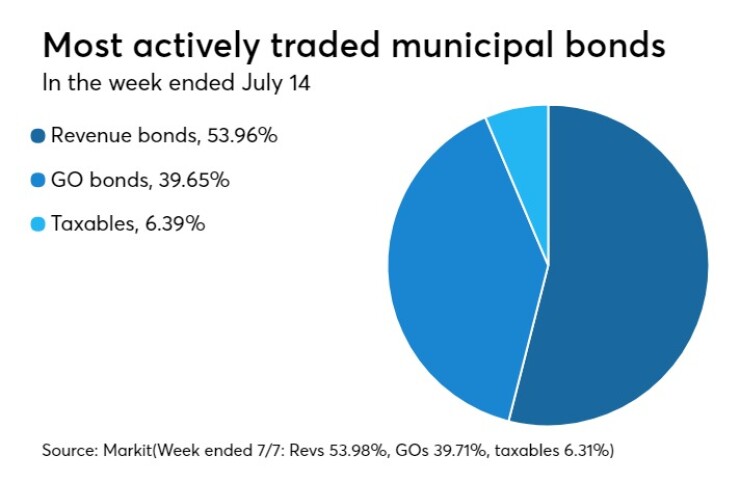

Prior week's actively traded issues

Revenue bonds comprised 53.96% of new issuance in the week ended July 14, down from 53.98% in the previous week, according to

Some of the most actively traded bonds by type were from Illinois and New York issuers.

In the GO bond sector, the Chicago Board of Education 7s of 2046 were traded 73 times. In the revenue bond sector, the New York City TFA 4s of 2036 were traded 106 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 56 times.

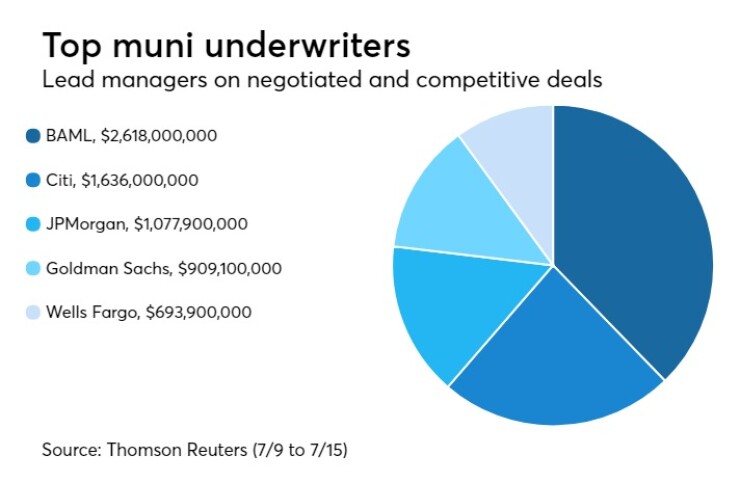

Previous week's top underwriters

The top negotiated and competitive municipal bond underwriters of last week included Bank of America Merrill Lynch, Citigroup, JPMorgan Securities, Goldman Sachs and Wells Fargo Securities, according to Thomson Reuters data.

In the week of July 9 to July 15, BAML underwrote $2.62 billion, Citi $1.64 billion, JPMorgan $1.08 billion, Goldman $909.1 million, and Wells $693.9 million.

Primary market

This week’s slate is composed of $3.99 billion of negotiated deals and $3.67 billion of competitive sales.

On Tuesday, the Dormitory Authority of the State of New York plans four separate competitive sales of state sales tax revenue bonds totaling $1.35 billion.

The offerings consist of $473.08 million of Series 2017A Group C bonds, $448.74 million of Series 2017A Group B bonds, $354.68 million of Series 2017A Group A bonds and a taxable sale of $72.77 million of Series 2017B bonds.

The deals are rated triple-A by S&P Global Ratings.

The state of New Mexico is competitively selling $383.36 million of bonds in two separate sales consisting of $307.56 million Series 2017A capital projects general obligation bonds and Series 2017B GO refunding bonds and $75.8 million of Series 2017A severance tax bonds.

The GOs are rated Aa1 by Moody’s Investors Service and AA by S&P and the severance tax bonds are rated Aa2 by Moody’s and AA-minus by S&P.

In the negotiated sector, Loop Capital Markets is expected to price the New Jersey Turnpike Authority’s $597.72 million of Series 2017B turnpike revenue bonds and Series 2017C taxable turnpike revenue bonds on Tuesday.

The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch Ratings.

Morgan Stanley is set to price the San Diego Regional Airport Authority’s $310.43 million of subordinate airport revenue bonds consisting of Series 2017A bonds not subject to the alternative minimum tax bonds and Series 2017B non-AMT bonds.

And Barclays Capital is expected to price the Connecticut Health and Educational Facilities Authority’s $250 million of Series 2014A revenue bonds as a remarketing for Yale University.

The deal is rated triple-A by Moody’s and S&P.

BAML looks at July issuance

Month to date issuance was $7.9 billion as of July 13, a 14% decrease from the same period last year, according to a Bank of America Merrill Lynch report released on Monday.

Year-to-date issuance was $206.6 billion, down roughly $29.4 billion from last year, BAML said.

The “BAML Muni Master Index returned 3.479% for the year to date through July 13, outperforming the Treasury Master Index and underperforming the U.S. Corporate IG Master Index with total returns of 1.706% and 3.919% respectively,” municipal research strategist Sophie Yan wrote in the report.

“The best performance in munis for the year has been in the 22-plus year maturities and the BBB-rated sector,” she wrote.

Jacob Schneider contributed to this report.