Top-rated municipal bonds were stronger at mid-session, according to traders, who were looking ahead to Tuesday when the first of the week’s new issues head into the market.

Secondary market

The yield on the 10-year benchmark muni general obligation fell as much as one basis point from 1.86% on Friday, while the 30-year GO yield decreased as much as one basis point from 2.69%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were mixed on Monday. The yield on the two-year Treasury was unchanged from 1.34% on Friday, the 10-year Treasury yield dipped to 2.12% from 2.14% and the yield on the 30-year Treasury bond decreased to 2.69% from 2.71%.

On Friday, the 10-year muni to Treasury ratio was calculated at 86.8%, compared with 86.6% on Thursday, while the 30-year muni to Treasury ratio stood at 99.2% versus 98.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 33,887 trades on Friday on volume of $8.92 billion.

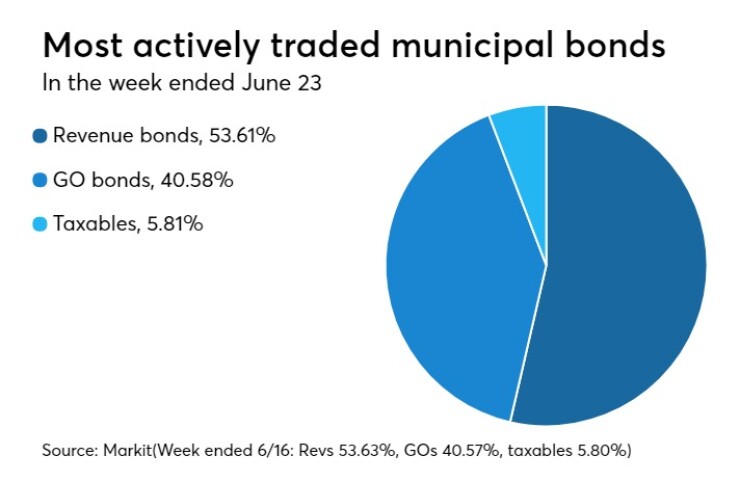

Prior week's actively traded issues

Revenue bonds comprised 53.61% of new issuance in the week ended June 23, down from 53.63% in the previous week, according to

Some of the most actively traded bonds by type were from New York and California issuers. In the GO bond sector, the Los Angeles 5s of 2018 were traded 106 times. In the revenue bond sector, the New York MTA 2s of 2018 were traded 79 times. And in the taxable bond sector, the California Housing Finance Agency 3.656s of 2029 were traded 32 times.

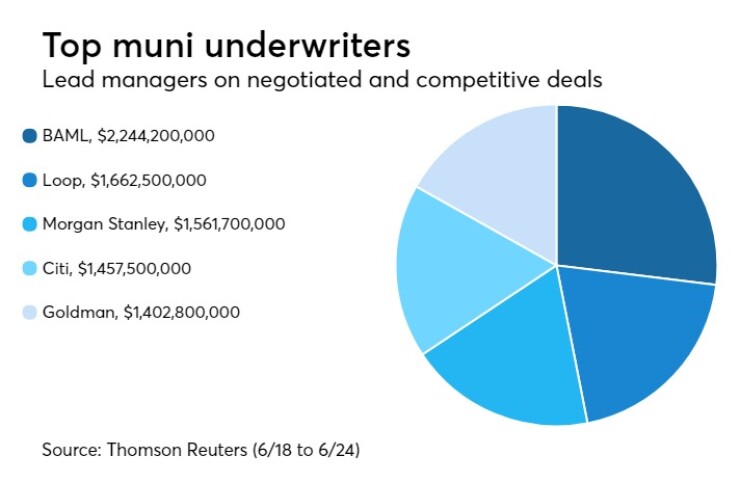

Previous week's top underwriters

The top negotiated and competitive municipal bond underwriters of last week included Bank of America Merrill Lynch, Loop Capital Markets, Morgan Stanley, Citigroup, and Goldman Sachs, according to Thomson Reuters data.

In the week of June 18 to June 24, BAML underwrote $2.24 billion, Loop $1.66 billion, Morgan Stanley $1.56 billion, Citi $1.46 billion, and Goldman $1.40 billion.

Primary market

The upcoming calendar is estimated at $6.82 billion, composed of $5.16 billion of negotiated deals and $1.66 billion of competitive sales.

The sector is quiet on Monday, but action kicks off on Tuesday when Morgan Stanley prices the Dormitory Authority of the State of New York’s $1.72 billion of Series 2017A general purpose state personal income tax revenue bonds for retail investors.

The DASNY deal, which is set to be priced for institutions on Wednesday, is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings.

Also on Tuesday, Wells Fargo Securities is expected to price the Missouri Health and Educational Facilities Authority’s $375 million of taxable educational facilities revenue bonds for the Washington University.

The deal is rated Aa1 by Moody’s.

In the competitive arena on Tuesday, the city of Los Angeles, Calif., will sell $169.41 million of general obligation bonds in two separate offerings.

The sales consist of $86.59 million of Series 2017A taxable GOs and $82.82 million of Series 2017B tax-exempt refunding GOs.

The deals are rated Aa2 by Moody’s, AA by S&P and AA-minis by Fitch Ratings.

Richmond, Va., is selling $226.73 million of GOs in two separate offerings.

The sales consist of $182.8 million of Series 2017B GO public improvement and refunding bonds and $43.93 million of Series 2017C taxable public improvement refunding bonds.

The deals are rated Aa2 by Moody’s and AA-plus by S&P and Fitch.

The New York City Municipal Water Finance Authority is selling $164 million of Fiscal 2018 Series AA water and sewer system second general resolution revenue bonds.

The state of Utah is selling $146.33 million of Series 2017 GOs.

The deal is rated triple-A by Moody’s, S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $100.5 million to $8.19 billion on Monday. The total is comprised of $2.38 billion of competitive sales and $5.81 billion of negotiated deals.