Municipal bonds finished mixed in secondary trading Wednesday, while a big North Carolina bond deal priced Massachusetts sold several large note offerings in the primary.

Primary market

Bank of America Merrill Lynch priced the state of North Carolina’s $225.04 million of Series 2017 grant anticipation revenue vehicle refunding bonds on Wednesday.

The issue was priced to yield 0.79% with a 4% coupon in 2018 to 1.49% with a 5% coupon in 2023.

The deal is rated A2 by Moody’s Investors Service, AA by S&P Global Ratings and A-plus by Fitch Ratings.

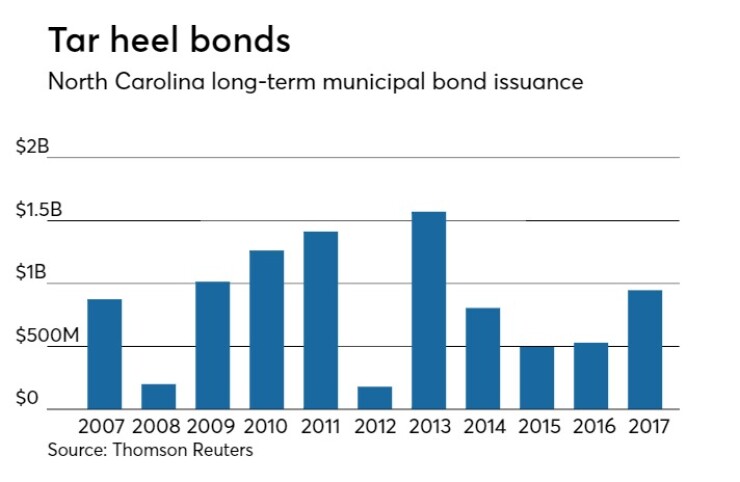

Since 2007 the Tar Heel State has sold $9.29 billion of securities, with the most issuance occurring in 2013 when it sold $1.57 billion. The state saw a low year of issuance in 2008 when it sold only $200 million.

With Wednesday’s sale, North Carolina has now sold more bonds this year than in the previous three years.

In the short-term competitive sector, Massachusetts sold $1.5 billion of revenue anticipation notes in three separate offerings.

The $500 million of Series 2017A RANs were won by four firms. Goldman Sachs won $300 million consisting of $100 million with a bid of 2% and a premium of $815,000, an effective rate of 0.837988%; $100 million with a bid of 2% and a premium of $822,000, an effective rate of 0.828008%; and $100 million with a bid of 2% and a premium of $872,000, an effective rate of 0.756719%. JPMorgan Securities won $150 million with a bid of 2% and a premium of $1,233,000, an effective rate of 0.828008%. Jefferies won $25 million with a bid of 2% and a premium of $205,500, an effective rate of 0.828008%. And Citigroup won $25 million with a bid of 2% and a premium of $207,249.99, an effective rate of 0.818027%.

The $500 million of Series 2017B RANs were won by five firms. BAML won $335 million with a bid of 2% and a premium of $3,011,650, an effective rate of 0.866440%; Morgan Stanley won $50 million with a bid of 2% and a premium of $442,500, an effective rate of 0.862588%, $25 million with a bid of 2% and a premium of $222,000, an effective rate of 0.858732%; Citi won $25 million with a bid of 2% and a premium of $224,250, an effective rate of 0.847165% and $15 million with a bid of 2% and a premium of $138,850, an effective rate of 0.866440%; Barclays Capital $25 million with a bid of 2% and a premium of $222,000, an effective rate of 0.858732%; and Williams Capital won $25 million with a bid of 2% and a premium of $221,250, an effective rate of 0.862588%.

The $500 million of Series 2017C RANs were won by five firms. JPMorgan won $300 million with a bid of 2% and a premium of $2,925,000, an effective rate of 0.884404%; Morgan Stanley won $50 million with a bid of 2% and a premium of $487,000, an effective rate of 0.885549% and $30 million with a bid of 2% and a premium of $292,200, an effective rate of 0.886693; Citi won $25 million with a bid of 2% and a premium of $247,500, an effective rate of 0.867241% and $20 million with a bid of 2% and a premium of $196,200, an effective rate of 0.886693%; Stifel won $25 million with a bid of 2% and a premium of $243,750, an effective rate of 0.884404%; and Barclays Capital won $25 million with a bid of 2% and a premium of $245,000, an effective rate of 0.878683% and RBC Capital Market won $25 million of the bid with an effective rate of 0.874107%.

All three deals are rated MIG1 by Moody’s, SP1-plus by S&P and F1-plus by Fitch.

Morgan Stanley received the written award on the Kentucky Turnpike Authority’s $174.34 million of Series 2017AB economic development road revenue refunding bonds for revitalization projects.

The $146.92 million of 2017 Series B bonds were priced as 3 1/2s to yield 1% in 2018 and priced to yield from 1.56% with a 5% coupon in 2022 to 2.54% with a 5% coupon in 2028.

The $27.42 million of 2017 Series A bonds were priced to yield from 1.56% with a 2% coupon in 2022 to 3.10% with a 5% coupon in 2037.

The deal is rated Aa3 by Moody’s and AA-minus by S&P.

In the competitive bond arena, the Ft. Mill School District No. 4 of York County, S.C., sold $119.08 million of Series 2017B GOs.

Citi won the bonds with a true interest cost of 2.71%. The issue was priced to yield from 0.81% with a 5% coupon in 2018 to 3.15% with a 3% coupon in 2036.

The deal is rated Aa1 by Moody’s and AA by S&P.

Secondary market

The yield on the 10-year benchmark muni general obligation fell one basis point to 1.94% from 1.95% on Tuesday while the 30-year GO yield was steady at 2.74%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were mixed on Wednesday. The yield on the two-year Treasury rose to 1.36% from 1.34% on Tuesday, the 10-year Treasury yield was flat from 2.26% and the yield on the 30-year Treasury bond decreased to 2.84% from 2.87%.

The 10-year muni to Treasury ratio was calculated at 85.8% on Wednesday, compared with 86.6% on Tuesday, while the 30-year muni to Treasury ratio stood at 96.2% versus 96.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 40,200 trades on Tuesday on volume of $9.85 billion.