The municipal market and its participants are prepped and ready for what should be the busiest day of the week, as the two largest negotiated deals hit the market.

With some nervousness in the overall fixed-income market due to Treasury weakness and 10-year auctions scheduled for today (regular notes) and tomorrow (TIPs), the municipal market’s outperformance led to strong demand on new issues Wednesday morning, according to a New York trader.

“Munis’ technicals are better,” he said at noon, noting the 10-year muni to Treasury ratio is “as expensive as it has been since January.”

While there is more supply in the Treasury market, “munis are softer overall, but our market is hanging in better than Treasuries,” he added.

Primary market deals are seeing decent support and the calendar is manageable in the face of the imminent reinvestment season, which is helping keep a positive climate in the tax-exempt market, the trader said.

“There was good retail demand yesterday on the larger deals pricing today,” he added, pinpointing the New York State Dormitory Authority deal, the state of Oregon, and Massachusetts Water deals as prime selections for mom-and-pop retail investors.

“They are visible names and should continue to get some good support,” he said.

The seasonal reinvestment season phenomenon, he said, is adding to the support.

“We clearly have more potential money coming in to the market than being sold, and that provides a positive tone,” he explained.

“We have had a rough year so far, and this is the first week of good, solid support,” he added. “The 10-year ratio is as expensive as it’s been since January and that is reflection of good performance.”

Raymond James & Associates priced the Dormitory Authority of the State of New York’s $585.795 million of Series 2018 A, B, C, D and E school districts financing program revenue bonds for institutional investors on Wednesday after a retail order period on Tuesday.

The Series A bonds are rated Aa3 by Moody’s Investors Service and AA-minus by Fitch Ratings, with the exception of the 2033-2034, 2038, 2043 and 2047 maturities which are insured by Assured Guaranty Municipal Corp. and rated AA plus by S&P Global Ratings.

The Series B bonds are rated Aa2 by Moody’s and AA-minus by Fitch; the Series C bonds are rated AA by S&P and AA-minus by Fitch; and the Series D bonds are rated Aa1 by Moody’s and AA-minus by Fitch.

The Series E bonds are insured by AGM and rated AA by S&P,, with the exception of the 2019 maturity which is uninsured and rated Aa3 by Moody’s and AA-minus by Fitch.

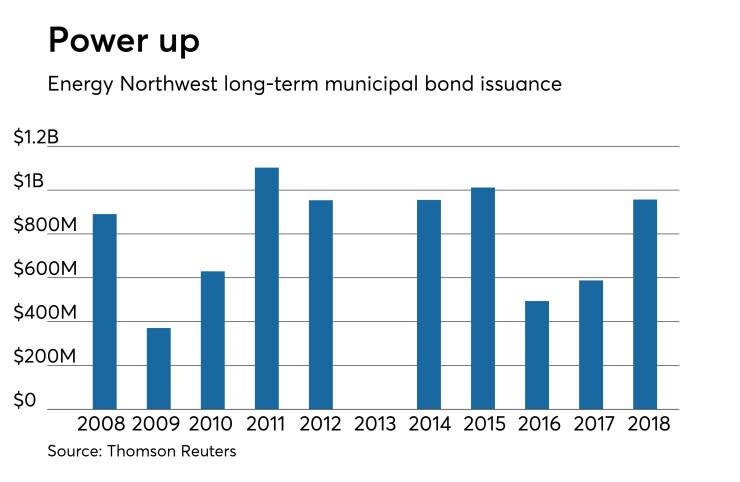

JPMorgan is expected to price the largest deal of the week — Energy Northwest’s $635 million of taxable and tax-exempt electric revenue refunding bonds. The deal is still being worked on but is expected to price at some point today, but as of press time no further information was available. The deal is rated Aa1 by Moody’s, AA-minus by S&P and AA by Fitch.

Since 2008, Energy Northwest has sold about $7.99 billion of securities, with the most issuance occurring in 2011 when it sold $1.1 billion. The Pacific Northwest issuer did not come to market at all in 2013.

There were two notable sales in the competitive arena. The Maryland Department of Transportation sold $130 million of consolidated transportation bonds, which were won by Bank of America Merrill Lynch with a true interest cost 2.77%. The deal is rated Aa1 by Moody’s, AAA by S&P and AA-plus by Fitch.

The Virginia Public Schools Authority sold $116.66 million of special obligation school financing bonds for Prince William County, which were won by Citi with a TIC of 2.97%. The deal is rated triple-A by the three big rating agencies.

Wednesday’s bond sales

New York:

Maryland:

Virginia:

Secondary market

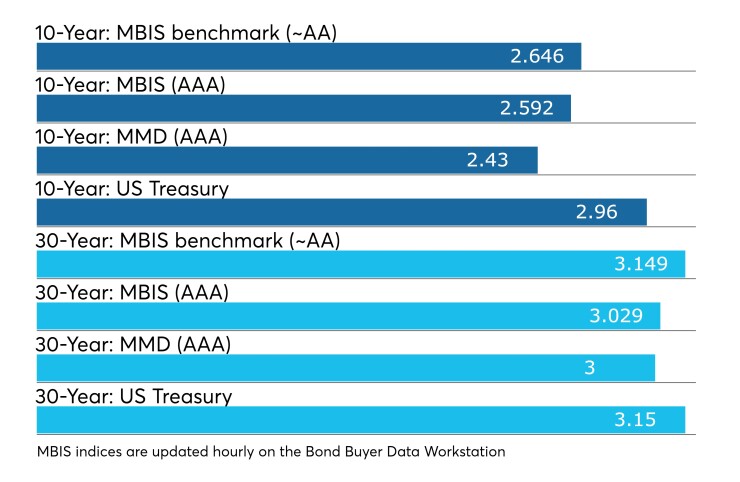

Municipal bonds were mostly weaker on Wednesday, according to a midday read of the MBIS benchmark scale.

Benchmark muni yields rose by no more than one basis point in 23 maturities, as the three-through ten-year spots on the curve decreased by less than one basis point.

Things were different with the high-grade munis as 22 maturities decreased by no more than a basis point. The one- and ten-year maturities increased by no more than a basis point and the remaining five spots on the curve were flat.

Municipals were weaker according to Municipal Market Data’s AAA benchmark scale, which showed the 10-year general obligation muni yield as much as one basis point higher and the 30-year muni maturity as much two basis points higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 81.9% while the 30-year muni-to-Treasury ratio stood at 95.1%, according to MMD.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,513 trades on Tuesday on volume of $10.401 billion.

New York California and Texas were the states with the most trades, with the Empire State taking 15.465% of the market, the Golden State taking 14.434% and the Lone Star State taking 11.104%.

NYC TFA to sell $1.3B of bonds

The New York City Transitional Finance Authority announced details of its upcoming sale of $1.275 billion of tax-exempt and taxable future tax secured subordinate bonds.

The NYC TFA intends to competitively sell about $1.1 billion of Fiscal 2018 Series C tax-exempt and taxable fixed rate bonds on Tuesday, May 15.

Proceeds from the bond sale will be used to fund capital projects.

The deals will be sold in the following subseries:

- $122,090,000 Subseries C-1 tax-exempt bonds

- $329,220,000 Subseries C-2 tax-exempt bonds

- $398,690,000 Subseries C-3 tax-exempt bonds

- $137,400,000 Subseries C-4 taxable bonds

- $112,600,000 Subseries C-5 taxable bonds

During the week of May 28, TFA plans to sell $100 million of tax-exempt variable rate demand bonds.

TFA also intends to sell $75 million of tax-exempt index rate bonds through a private placement, bringing the total bond sale to $1.275 billion.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.