As benchmark tax-free yields inched higher Tuesday, the municipal bond market was waiting for the Federal Open Market Committee meeting with bated breath, anticipating higher rates loom at the conclusion of Wednesday’s meeting.

“The dominant market tone is one of wait-and-see ahead of tomorrow's FOMC announcement, with a 20-25 basis point increase in the Fed Funds rate baked into market sentiment,” Alan Schankel, managing director at Janney Capital Markets, said on Tuesday afternoon. Until then he said activity was expected to be light.

Most analysts expect the Federal Open Market Committee will raise its federal funds rate target rate to a range of 1.75% to 2%, with the possibility of at least one more increase this year.

“I expect that most of the week's modest calendar will have priced before the FOMC announcement, so post-meeting activity will be more secondary oriented,” Schankel said.

Barring a surprise from the Fed, he expects strong and solid investor demand in the days following the meeting.

“Investors with reinvestment cash may become more enthusiastic about adding some duration following the recent surge in short-end demand — depending on what kind of guidance on inflation is communicated by the FOMC gurus,” Schankel said.

Primary market

Raymond James & Associates priced the New York City Municipal Water Finance Authority’s $373.66 million of Fiscal 2018 Series FF water and sewer system second resolution revenue bonds for institutions after holding a one-day retail order period.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings. The credit carries stable outlooks from the three main rating agencies.

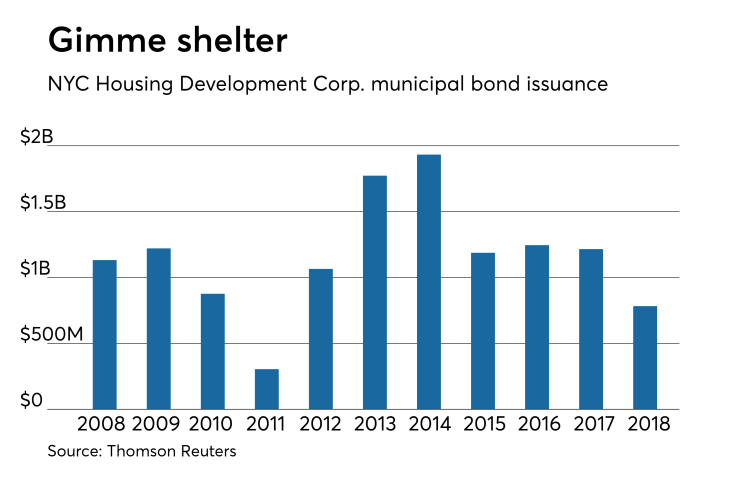

JPMorgan Securities priced the New York City Housing Development Corp.’s $550.55 million of Series 2018C multi-family housing revenue sustainable neighborhood bonds for institutions after holding a one-day retail order period.

The bonds are rated Aa2 by Moody’s and AA-plus by S&P.

Bank of America Merrill Lynch priced the NYC HDC’s $75 million of Series 2018D taxable multi-family housing revenue bonds, sustainable neighborhood bonds.

The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Since 2008, the HDC has issued about $12.7 billion of bonds, with the most issuance occurring in 2014 when it sold $1.93 billion. It sold the least amount bonds in 2011 when it offered $304.7 million.

Jefferies priced the Northside Independent School District, Texas’ $123.68 million of Series 2018 variable-rate unlimited tax school building bonds. The bonds, backed by the Permanent School Fund Guarantee Program are rated triple-A by Moody’s and S&P.

JPMorgan priced the South Carolina Jobs-Economic Development Authority’s $146.99 million of Series 2018 hospital refunding and improvement revenue bonds for McLeod Health.

The deal is rated AA by S&P and AA-minus by Fitch.

In the competitive arena on Tuesday, Maine sold $97.435 million of Series 2018B general obligation bonds. Wells Fargo Securities won the bonds with a TIC of 2.2969%.

Maine also sold $15.5 million of Series 2018A taxable GOs, which Citigroup won with a TIC of 2.5386%.

The Federal Way School District No. 210, Wash., sold $140.27 million of Series 2018 GOs on Tuesday.

Bank of America Merrill Lynch won the bonds with a TIC of 3.4798%.

Tuesday’s bond sales

New York:

Texas:

South Carolina:

Maine:

Washington:

Bond Buyer 30-day visible supply at $6.65B

The Bond Buyer's 30-day visible supply calendar decreased $2.57 billion to $6.65 billion on Wednesday. The total is comprised of $3.52 billion of competitive sales and $3.14 billion of negotiated deals.

Secondary market

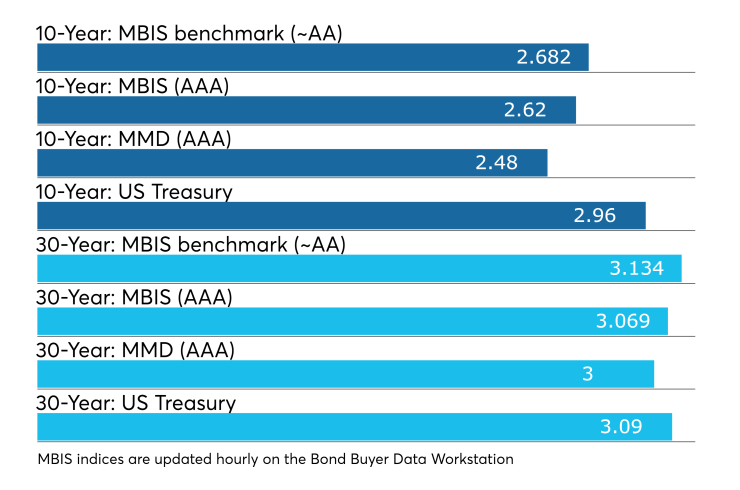

Municipal bonds were mostly weaker on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- and two-year and nine to 30-year maturities and fell as much as one basis point in the three- to eight-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS’ AAA scale rising in the one-year and nine- to 30-year maturities and falling as much as one basis point in the two- to eight-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed yields rising two basis points in both the 10-year muni general obligation and the 30-year muni GO maturities.

Treasury bonds were little changed as stock prices were almost flat.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.9% while the 30-year muni-to-Treasury ratio stood at 97.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,979 trades on Monday on volume of $8.91 billion.

New York, California and Texas were the states with the most trades, with the Empire State taking 11.97% of the market, Golden State taking 11.596% and the Lone Star State taking 8.097%.

Treasury auctions $14B re-opened 30-year bonds

The Treasury Department Thursday auctioned $14 billion of 29-year 11-month bonds with a 3 1/8% coupon at a 3.100% high yield, a price of 100.481809. The bid-to-cover ratio was 2.38.

Tenders at the high yield were allotted 81.29%. The median yield was 3.063%. The low yield was 2.888%.

Treasury sells $35B 4-week bills

The Treasury Department Tuesday auctioned $35 billion of four-week bills at a 1.790% high yield, a price of 99.860778. The coupon equivalent was 1.817%. The bid-to-cover ratio was 3.36.

Tenders at the high rate were allotted 24.75%. The median rate was 1.760%. The low rate was 1.750%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.