Municipal bond volume is estimated to rise for the first full week of August, as buyers eagerly await next week’s new issues. Ipreo forecasts weekly bond volume at $7.5 billion, up from a revised total of $4.1 billion in the past week, according to updated data from Thomson Reuters. The calendar is composed of $5.8 billion of negotiated deals and $1.7 billion of competitive sales.

With investors clamoring for paper and August bringing with it an estimated $51 billion in redemptions, the supply demand imbalance should continue to prove favorable for municipal performance, according to Jim Colby, senior municipal strategist and portfolio manager at Van Eck.

“Normally, the June and July time frames are when you see the larger disparity between supply and cash, but now it’s the month of August,” Colby told The Bond Buyer. “That should bode well for the month and the remainder of the year for municipal performance — whether it’s investment grade or high yield.”

He said chasing fewer bonds keeps yields under control and prices stable.

“If those dollars that return to SMAs, banks, and insurance companies in the form of coupons and bond calls go back into the same asset class, it keeps the market from being volatile and keeps them fully invested,” he explained.

He said the market technicals should be especially supportive of the high yield market. “High yield has done pretty well yield to date — performance is not hitting the ball out of the park, but comparing munis to other asset classes, we look pretty good,” Colby said.

The high-yield market in particular, he said, has held up well in light of the refinancings that have taken a significant portion of bonds out of the high yield secondary universe.

Tobacco issues were called in California and New Jersey, which were yielding 7% and generating high income for exchange traded funds, like Colby’s, and mutual funds in general.

“What that has done is put pressure on remaining high yield inventory and move those valuations higher,” he said. “That bodes well for the high yield industry in munis in terms of performance.”

Primary market

JPMorgan Securities is expected to price the Wisconsin Health and Educational facilities Authority’s $1.23 billion issue for the Advocate Aurora Health Credit Group on Tuesday.

The deal is rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

New York City is issuing about $869.555 million of general obligation bonds. The deals consist of $809.555 million of Fiscal 2019 Series A and B, Fiscal 1994 Series M and Subseries H3 GOs slated to be priced by RBC Capital Markets on Wednesday after a two-day retail order period.

The city is also competitively selling $60 million of taxable Fiscal 2018 Series C GOs on Wednesday.

The deals are rated Aa2 by Moody’s and AA by S&P and Fitch.

Morgan Stanley is expected to price the Hawaii Airport System’s $413.62 million of revenue bonds, on Thursday, consisting of Series 2018A subject to the alternative minimum tax and Series 2018B non-AMT bonds.

The deal is rated A1 by Moody’s, AA-minus by S&P and A-plus by Fitch.

In the competitive arena, Minnesota is offering $619.37 million of GOs in three sales consisting of $397.37 million if Series 2018 various purpose bonds, $206 million of Series 2018B trunk highway bonds and $16 million of Series 2018C taxable various purpose bonds.

Public Resources Advisory Group is the financial advisor and Kutak Rock is the bond counsel.

The deals, which are selling on Tuesday, are rated AAA by S&P and Fitch.

Michigan is selling $$149.2 million of environmental program GOs on Tuesday.

Robert W. Baird is the financial advisor and Dickinson Wright is the bond counsel.

The deal is rated Aa1 by Moody’s and AA by S&P and Fitch.

Bond Buyer 30-day visible supply at $11.12B

The Bond Buyer's 30-day visible supply calendar increased $2.90 billion to $11.12 billion for Monday. The total is comprised of $2.88 billion of competitive sales and $8.24 billion of negotiated deals.

Secondary market

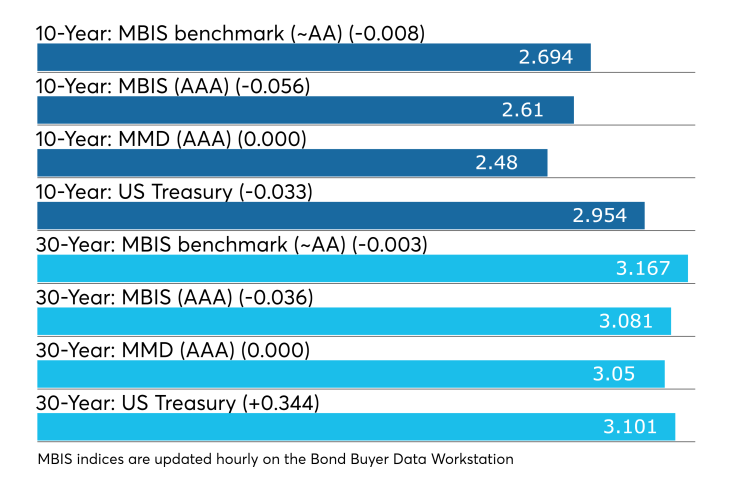

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities. High-grade munis were stronger, with yields calculated on MBIS’ AAA scale falling as much as three basis points across the curve.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation and the yield on the 30-year muni maturity both remaining unchanged.

Treasury bonds were mixed as stocks traded little changed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 83.1% while the 30-year muni-to-Treasury ratio stood at 97.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,488 trades on Thursday on volume of $16.65 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 18.136% of the market, the Empire State taking 13.659% and the Lone Star State taking 11.449%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Aug. 3 were from Puerto Rico, California and New York issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 22 times. In the revenue bond sector, the Los Angeles 4s of 2019 traded 73 times. And in the taxable bond sector, the DANY 4.946s of 2048 traded 69 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended Aug. 3, according to Markit.

On the bid side, the Puerto Rico Electric Power Authority revenue 5s of 2037 were quoted by 46 unique dealers. On the ask side, the NYC Transitional Finance Authority BARB 3.5s of 2047 were quoted by 332 dealers. And among two-sided quotes, the Bay Area Toll Authority taxable 6.907s of 2050 were quoted by 25 dealers.

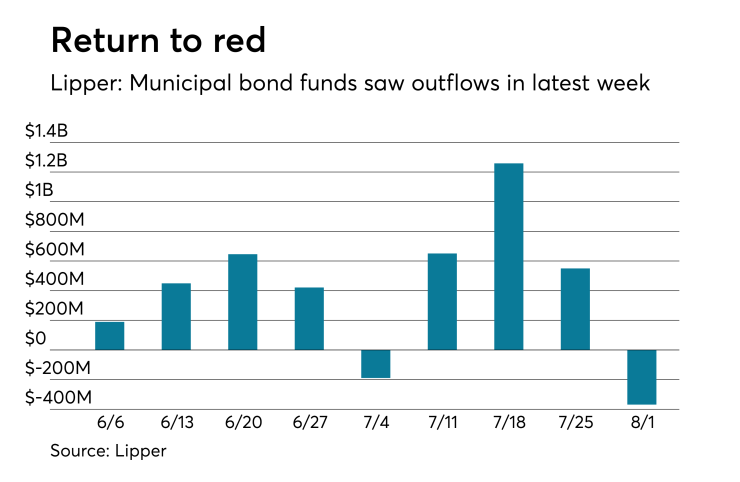

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds pulled back and took cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $368.353 million of outflows in the week ended Aug. 1, after inflows of $550.041 million in the previous week.

Exchange traded funds reported outflows of $115.709 million, after inflows of $130.955 million in the previous week. Ex-ETFs, muni funds saw $252.643 million of outflows, after inflows of $419.087 million in the previous week.

The four-week moving average remained positive at $522.791 million, after being in the green at $567.565 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $294.317 million in the latest week after inflows of $408.358 million in the previous week. Intermediate-term funds had inflows of $60.620 million after inflows of $117.106 million in the prior week.

National funds had outflows of $268.958 million after inflows of $494.716 million in the previous week. High-yield muni funds reported outflows of $78.037 million in the latest week, after inflows of $216.171 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.