Several of the week's biggest municipal bond deals hit an uncertain market on Wednesday as Los Angeles Schools and Utah Transit sold bonds while New York City held a second day of orders for retail investors.

Buyside sources said retail investors were playing a guessing game with the muni market, as they pondered the pace of future interest rate hikes.

This week’s

On Wednesday, Bank of America Merrill Lynch priced the biggest deal of the day, the Los Angeles School District’s

A Southeast trader said the deal had some balances toward the end of the day, as investors stashed their cash away for a rainy day.

"From what I can tell, everyone is worried about the Fed tightening in March. The long end of the Treasury market is off significantly right now," he said Wednesday afternoon, citing the 10-year Treasury at a 2.95% and the 30-year at a 3.22%.

Things looked a little better on the muni side, he said.

"The short end is stable in here, but there is still a lot of cash waiting on the sidelines," he said.

“The LAUSD deal was struggling a bit early on today, it only did about $250 million yesterday in retail and they were hoping for around $400 million,” said one New York trader. “In the end, the levels were not enough to sway investors who are still sitting on sidelines.”

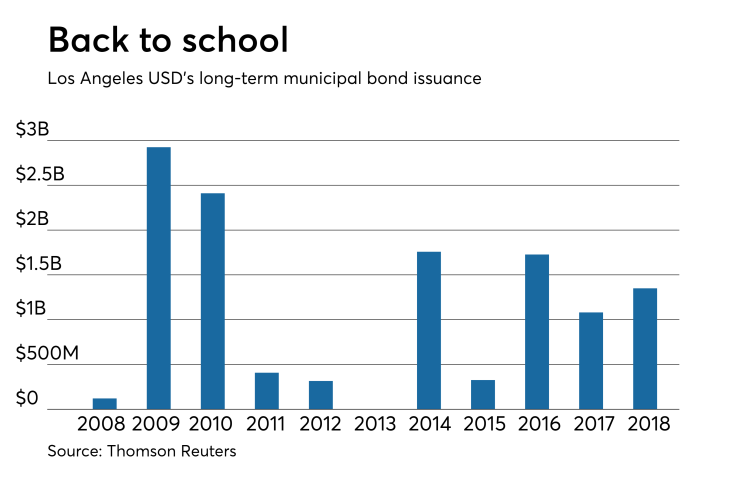

Since 2008, LAUSD has sold about $12 billion of bonds with the most issuance occurring in 2009 when it sold $2.92 billion of debt. The school district did not come to market in 2013.

Meanwhile, Jefferies held a second retail order period on New York City’s

While the second day of the retail order period for the $700 million NYC GO deal was underway, another New York trader said, the deal was not receiving the typical response from investors. “I’m hearing it’s doing OK, but usually these things are a blow-out.”

The final maturity in the retail scale was offered at a 3.50% coupon to yield 3.60%.

The trader said that investors were tentative about making investment decisions and were waiting on the sidelines for better guidance.

“Without the new issuance, these people don’t know what to do,” he said. “We aren’t used to this not seeing issuance.

“If [retail buyers] can hold out and procrastinate they will do it. They don’t like mysteries,” especially the uncertainty of higher rates, he said.

NYC will also competitively sell $250 million of taxable fixed-rate bonds in two separate offerings on Thursday, consisting of $188.11 million and $61.89 million GOs.

On Wednesday, BAML priced Energy Northwest’s

BAML also priced the Intermountain Power Agency, Utah’s

Wells Fargo Securities priced the Utah Transit Authority’s

Citi priced the Palm Beach County School Board, Fla.’s

In the competitive arena on Wednesday, Wake County sold

The New Mexico Finance Authority sold

“There has been less demand than I thought most anticipated,” said another New York trader on Wednesday. “Yields are higher and 2018 looks like a higher interest rate environment year as well,” he said.

Bond Buyer 30-day visible supply at $7.09B

The Bond Buyer's 30-day visible supply calendar decreased $1.48 billion to $7.09 billion on Thursday. The total is comprised of $2.33 billion of competitive sales and $4.75 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,999 trades on Tuesday on volume of $9.10 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 12.962% of the market, the Empire State taking 11.618%, and the Lone Star State taking 11.403%.

Treasury sells re-opened 2-year FRNs, 5-year notes

The Treasury Department Wednesday auctioned $15 billion of one-year 11-month floating rate notes with a high discount margin of 0.016%, at a zero spread, a price of 99.968842. The bid-to-cover ratio was 2.75.

Tenders at the high margin were allotted 53.72%. The median discount margin was zero. The low discount margin was negative 0.020%.

The index determination date is Feb. 12 and the index determination rate is 1.570%.

Treasury also auctioned $35 billion of five-year notes, with a 2 5/8% coupon, a 2.658% high yield, a price of 99.846446. The bid-to-cover ratio was 2.44.

Tenders at the high yield were allotted 45.30%. All competitive tenders at lower yields were accepted in full. The median yield was 2.617%. The low yield was 2.188%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.