The municipal bond market will see more volume head its way than it has in a while, as almost $10 billion of new deals are set to hit the screens this week.

The new issue calendar totals $9.9 billion, consisting of $4.3 billion of negotiated deals and $5.6 billion of competitive sales.

Five issuers — the New York City Transitional Finance Authority, the New York Metropolitan Transportation Authority and the states of California, Illinois and Massachusetts — account for over half of this week’s new volume.

Secondary market

U.S. Treasuries were weaker on Monday. The yield on the two-year Treasury rose to 1.53% from 1.50% on Friday, the 10-year Treasury yield gained to 2.29% from 2.28% and yield on the 30-year Treasury bond increased to 2.82% from 2.81%.

Top-shelf municipal bonds finished stronger on Friday. The yield on the 10-year benchmark muni general obligation fell two basis points to 1.96% from 1.98% on Thursday, while the 30-year GO yield dropped four basis points to 2.74% from 2.78%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 86.0% compared with 85.3% on Thursday, while the 30-year muni-to-Treasury ratio stood at 97.2% versus 97.5%, according to MMD.

AP-MBIS 10-year muni dips to 2.29%

The Associated Press-MBIS 10-year municipal benchmark 5% general obligation was at 2.29% in early activity on Monday, unchanged from the final read of 2.29% on Friday, according to

The AP-MBIS index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the Bond Buyer Data Workstation.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 32,753 trades on Friday on volume of $12.55 billion.

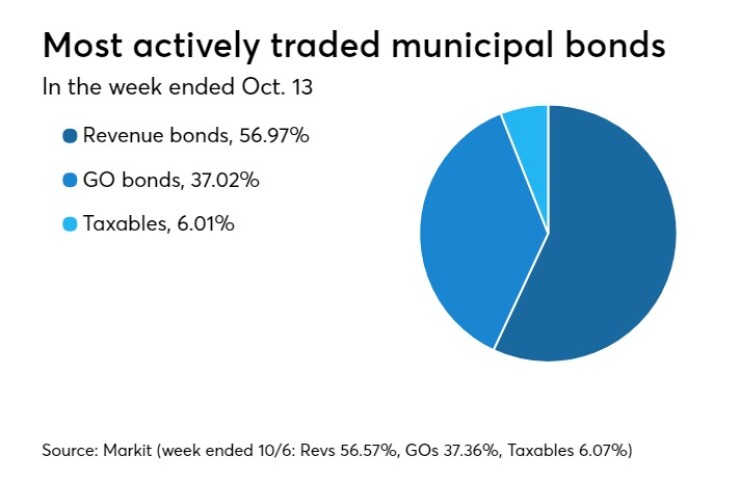

Prior week's actively traded issues

Revenue bonds comprised 56.97% of new issuance in the week ended Oct. 13, up from 56.57% in the previous week, according to

Some of the most actively traded bonds by type were from Puerto Rico, California and Illinois issuers.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 28 times. In the revenue bond sector, the San Francisco Airports Commission 5s of 2047 were traded 73 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 17 times.

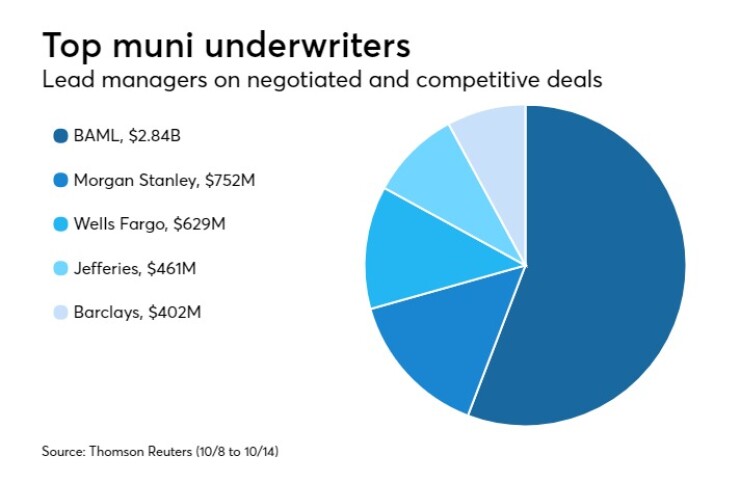

Previous week's top underwriters

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Morgan Stanley, Wells Fargo Securities, Jefferies, and Barclays Capital, according to Thomson Reuters data.

In the week of Oct. 8 to Oct. 14, BAML underwrote $2.84 billion, Morgan Stanley $752.1 million, Wells Fargo $628.5 million, Jefferies $461.3 million, and Barclays $402.4 million.

Primary market

Action revs up on Tuesday, as two big states on the opposite ends of the credit spectrum sell bonds in the competitive arena.

California is coming to market with $1.59 billion of various purpose general obligation bonds in three separate sales.

The offerings consist of $557.22 million of tax-exempt Bid Group B $64 million GOs and $493.22 million refunding GOs; $522.53 million of tax-exempt Bid Group C $134.66 million GOs and $387.88 million refunding GOs; and $508.57 million of Bid Group A taxable GOs.

The deals are rated Aa3 by Moody’s Investors Service, and AA-minus by S&P Global Ratings and Fitch Ratings.

Illinois is selling $1.5 billion of GOs in three separate sales.

The offerings consist of $500 million Series of November 2017A GOs, $500 million of Series of November 2017B GOs and $500 million of Series of November 2017C GOs.

The deals are rated Baa3 by Moody’s, BBB-minus by S&P and BBB by Fitch.

Also on Tuesday, the Virginia Public School Authority is selling $116.01 million of 1997 Resolution Series 2017C school financing bonds.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

In the negotiated sector, Goldman Sachs is set to price the New York City Transitional Finance Authority’s $850 million of Fiscal 2018 Series B Subseries B-1 future tax secured subordinate bonds for retail investors on Monday.

The deal has a two-day retail order period before being priced for institutions on Wednesday.

TFA will also competitively sell on Wednesday $140 million of taxable Fiscal 2018 Series B Subseries B-2 future tax secured subordinate bonds.

The competitive deal is rated Aa1 by Moody’s and AAA by S&P and Fitch.

Also this week, Massachusetts is selling $818.125 million of bonds in three competitive offerings on Wednesday while the New York Metropolitan Transportation Authority is selling $1 billion of notes in two deals on Thursday.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $1.27 billion to $16.72 billion on Monday. The total is comprised of $7.13 billion of competitive sales and $9.59 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.