Municipal market participants are eagerly awaiting the new issue slate to start rolling, as issuance is expected to be around the weekly average.

Secondary market

U.S. Treasuries were mostly weaker on Monday morning. The yield on the two-year Treasury fell to 1.35% from 1.33% on Friday as the 10-year Treasury yield jumped to 2.22% from 2.20% while the yield on the 30-year Treasury bond increased to 2.87% from 2.85%.

Top-shelf municipal bonds finished weaker on Friday. The yield on the 10-year benchmark muni general obligation rose two basis points to 1.87% from 1.85% on Thursday, while the 30-year GO yield increased two basis points to 2.71% from 2.69%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 85.1% on Friday, compared with 84.4% on Thursday, while the 30-year muni to Treasury ratio stood at 95.0% versus 94.2%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 31,691 trades on Friday on volume of $7.749 billion.

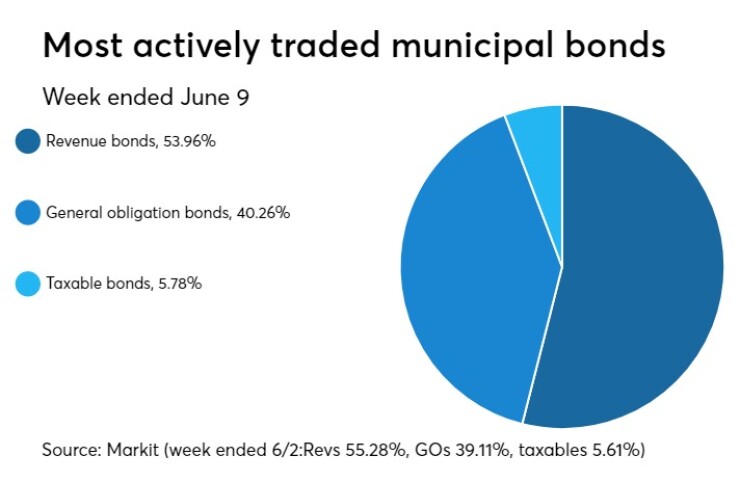

Prior week's actively traded issues

Revenue bonds comprised 53.96% of new issuance in the week ended June 9, down from 55.28% in the previous week, according to

Primary market

Ipreo estimates volume will slip slightly to $6.01 billion, after a revised total of $6.49 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $4.93 billion of negotiated deals and $1.08 billion of competitive sales.

There are 15 scheduled negotiated deals bond sales larger than $100 million and one competitive deal. The action is expected to start on Monday, something that doesn’t usually happen.

JPMorgan is slated to price the New York City Housing Development Corp.’s $272.73 million of multi-family housing revenue sustainable neighborhood bonds for retail investors on Monday, ahead of the institutional pricing on Tuesday. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Fifth Third Securities are expected to price the county of New Hanover, N.C.’s $213.76 million of hospital revenue bonds for the New Hanover Regional Medical Center. It is anticipated the deal will mature serially from 2018 through 2037 and feature terms in 2042 and 2047 and is rated A1 by Moody’s Investors Service and A-plus by S&P Global Ratings.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $2.30 billion to $11.34 billion on Monday. The total is comprised of $3.60 billion of competitive sales and $7.74 billion of negotiated deals.