Market participants are waiting for the last major deal of the week to price while also hoping for some clarity of the tax reform situation.

Secondary market

U.S. Treasuries were weaker on Thursday morning. The yield on the two-year Treasury rose to 1.65% from 1.64%, the 10-year Treasury yield rose to 2.33% from 2.32% and the yield on the 30-year Treasury increased to 2.80% from 2.78%.

Top-quality municipal bonds were stronger to close out Wednesday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.91% from 1.92% on Tuesday, while the 30-year GO yield dropped two basis points to 2.58% from 2.60%, according to a final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 82.3% compared with 83.3% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 92.7% versus 93.9%, according to MMD.

AP-MBIS 10-year muni at 2.226%, 30-year at 2.738%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was stronger in early trading Thursday.

The 10-year muni benchmark yield fell to 2.226% from the final read of 2.231% on Wednesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,112 trades on Wednesday on volume of $13.33 billion.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $2.84 billion to $6.17 billion on Thursday. The total is comprised of $3.01 billion of competitive sales and $3.16 billion of negotiated deals.

Primary market

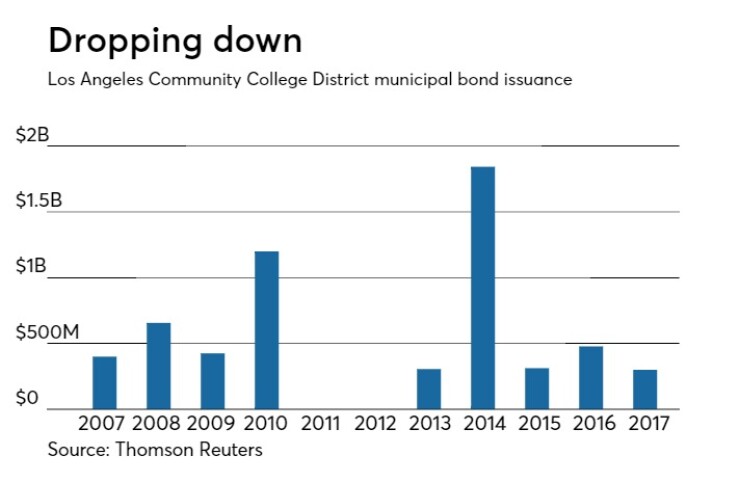

There is only one large deal left on the calendar that is scheduled to price on Thursday. Citigroup is set to price the Los Angeles Community College District’s $300 million of 2008 election general obligation bonds and 2016 election GO bonds featuring tax-exempt and taxable bonds.

Since 2007, the Los Angeles CCD has sold about $5.9 billion of debt with the most issuance occurring in 2014 when it sold $1.8 billion. The district did not come to market in 2011 or 2012.

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $1.03 billion, raising total net assets to $129.24 billion in the week ended Nov. 6, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $133.1 million to $128.20 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds slipped to 0.47% from 0.48% the previous week.

The total net assets of the 833 weekly reporting taxable money funds increased $553.9 million to $2.581 trillion in the week ended Nov. 7, after an outflow of $9.12 billion to $2.580 trillion the week before.

The average, seven-day simple yield for the taxable money funds was unchanged at 0.70% from the prior week.

Overall, the combined total net assets of the 1,032 weekly reporting money funds increased $1.59 billion to $2.710 trillion in the week ended Nov. 7, after inflows of $9.25 billion to $2.708 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.