Municipal bond traders are waiting for the last of the large deals to price on Thursday as the second busiest week of the year heads to a close.

Secondary market

Treasuries were little changed on Thursday. The yield on the two-year Treasury dipped to 1.34% from 1.35% on Wednesday, the 10-year Treasury yield was unchanged from 2.15% and the yield on the 30-year Treasury bond was flat at 2.72%.

Top-quality municipal bonds finished unchanged on Wednesday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.86% on Tuesday, while the 30-year GO yield was flat from 2.70%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 86.3% on Wednesday, compared with 86.5% on Tuesday, while the 30-year muni to Treasury ratio stood at 99.2% versus 98.7%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,537 trades on Wednesday on volume of $15.52 billion.

Primary market

Citigroup is expected to price the Metropolitan Water District of Southern California’s $188 million of Series 2017B subordinate water revenue bonds.

The deal is rated AA-plus by S&P Global Ratings and Fitch Ratings.

In the competitive arena, the city and county of San Francisco, Calif., is selling $397.05 million of Series 2017B certificates of participation for the Moscone Convention Center expansion project.

The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

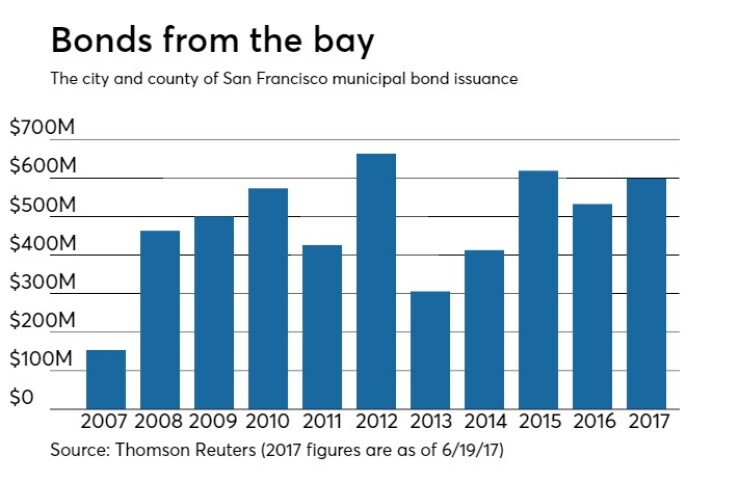

Since 2007 San Francisco has sold roughly $5.28 billion of securities, with the highest issuance in 2012 when it sold $663 million.

The issuance was lowest in 2007 when it sold $154 million. With Thursday’s sale, San Francisco has surpassed last year’s issuance total.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $2.57 billion to $7.59 billion on Thursday. The total is comprised of $2.75 billion of competitive sales and $4.83 billion of negotiated deals.

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $41.9 million, bringing total net assets to $129.71 billion in the week ended June 19, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $764.1 million to $129.67 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds jumped to 0.34% from 0.30% in the previous week.

The total net assets of the 851 weekly reporting taxable money funds decreased $39.28 billion to $2.457 trillion in the week ended June 20, after an outflow of $5.24 billion to $2.496 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.57% from 0.49% in the prior week.

Overall, the combined total net assets of the 1,083 weekly reporting money funds decreased $39.24 billion to $2.586 trillion in the week ended June 20, after outflows of $6.01 billion to $2.626 trillion in the prior week.