The municipal bond market is prepped to see some supply hit the screens on Wednesday, led off by issuers in Indiana and Florida.

Secondary market

Treasuries were stronger on Wednesday. The yield on the two-year Treasury dipped to 1.31% from 1.32% on Tuesday, the 10-year Treasury yield declined to 2.19% from 2.21% and the yield on the 30-year Treasury bond decreased to 2.76% from 2.79%.

Top-shelf municipal bonds ended unchanged on Tuesday. The yield on the 10-year benchmark muni general obligation was steady from 1.90% on Monday, while the 30-year GO yield was flat from 2.75%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 85.9%, compared with 87.2% on Monday, while the 30-year muni-to-Treasury ratio stood at 98.6% versus 99.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,779 trades on Tuesday on volume of $11.54 billion.

Primary Market

Goldman Sachs is set to price the Indiana Finance Authority’s $178.5 million of highway revenue refunding bonds on Wednesday.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

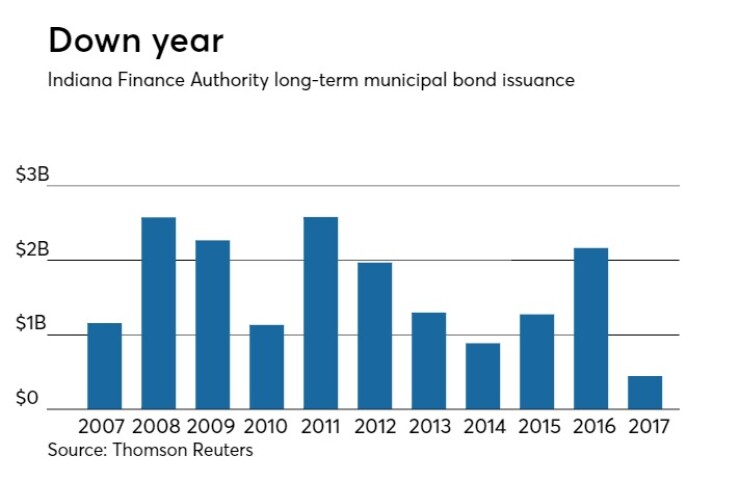

Since 2007, the IFA has sold $17.76 billion of securities, with the most issuance occurring in 2011 when it sold $2.58 billion. Prior to this year, the authority sold the least amount in 2014 when it offered $887 million.

Bank of America Merrill Lynch is expected to price the Tampa-Hillsborough Expressway Authority, Fla.’s $163 million of Series 2017 reveue bonds.

The deal is rated A2 by Moody’s and A-plus by S&P.

Roosevelt & Cross is expected to price the Erie County Fiscal Stability Authority, N.Y.’s $151.61 million of Series 2017C sales tax and state aid secured refunding bonds and Series 2017D sales tax and state aid secured bonds.

The deal is rated Aa1 by Moody’s and AAA by S&P.

Morgan Stanley is set to price the Oregon Department of Transportation’s $133.58 million of Series 2017C second lien highway user tax revenue refunding bonds.

The deal is rated Aa1 by Moody’s, AAA by S&P and AA-plus by Fitch.

In the competitive arena, the Florida Board of Education will sell $260.02 million of Series 2017B full faith and credit public education capital outlay refunding bonds.

The deal is rated Aa1 by Moody’s and AAA by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.68 billion to $10.23 billion on Wednesday. The total is comprised of $3.04 billion of competitive sales and $7.20 billion of negotiated deals.