The municipal bond market was expected to remain quiet on Thursday, with only a few smaller-sized bond sales set to be priced in the primary, and action in the secondary expected to remain muted.

Secondary market

Treasuries were mixed on Thursday. The yield on the two-year Treasury was flat from 1.41% on Wednesday, the 10-year Treasury yield rose to 2.37% from 2.33% and the yield on the 30-year Treasury bond increased to 2.90% from 2.85%.

Top-quality municipal bonds finished mixed on Wednesday. The yield on the 10-year benchmark muni general obligation rose one basis point to 2.02% from 2.01% on Monday, while the 30-year GO yield was unchanged from 2.80%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 86.6%, compared with 85.8% on Monday, while the 30-year muni to Treasury ratio stood at 98.1% versus 97.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 47,754 trades on Wednesday on volume of $8.12 billion.

Primary market

In the negotiated sector on Thursday, Citigroup is set to price the biggest deal of the week — Denton, Texas’ $77 million of Series 2017 permanent improvement refunding bonds.

The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

In the competitive arena on Thursday, Stamford, Conn., is selling $30 million of general obligation bonds in two separate sales.

The offerings consist of $25 million of Issue of 2017 Series A GOs and $5 million of Issue of 2017 Series B GOs.

The deals are rated AAA by S&P and Fitch Ratings.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $386.7 million to $7.10 billion on Thursday. The total is comprised of $2.61 billion of competitive sales and $4.49 billion of negotiated deals.

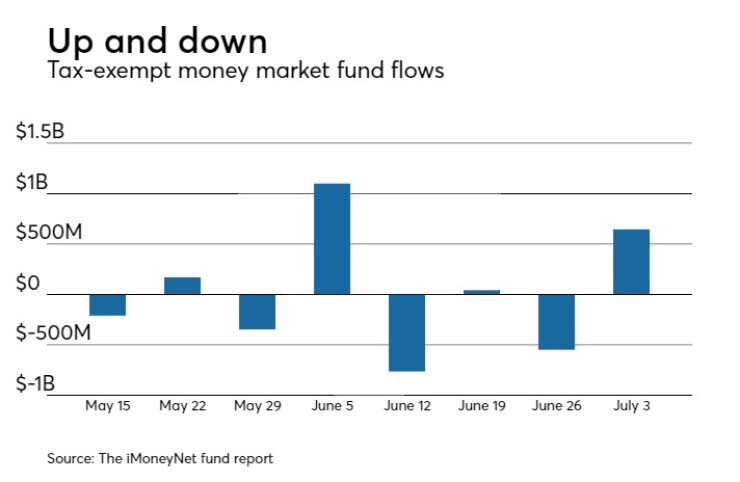

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $645.7 million, bringing total net assets to $129.81 billion in the week ended July 3, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $549.1 million to $129.16 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds jumped to 0.43% from 0.39% in the previous week.

The total net assets of the 852 weekly reporting taxable money funds decreased $1.17 billion to $2.466 trillion in the week ended July 4, after an inflow of $10.56 billion to $2.467 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.62% from 0.60% in the prior week.

Overall, the combined total net assets of the 1,084 weekly reporting money funds decreased $520.9 million to $2.595 trillion in the week ended July 4, after inflows of $10.01 billion to $2.596 trillion in the prior week.