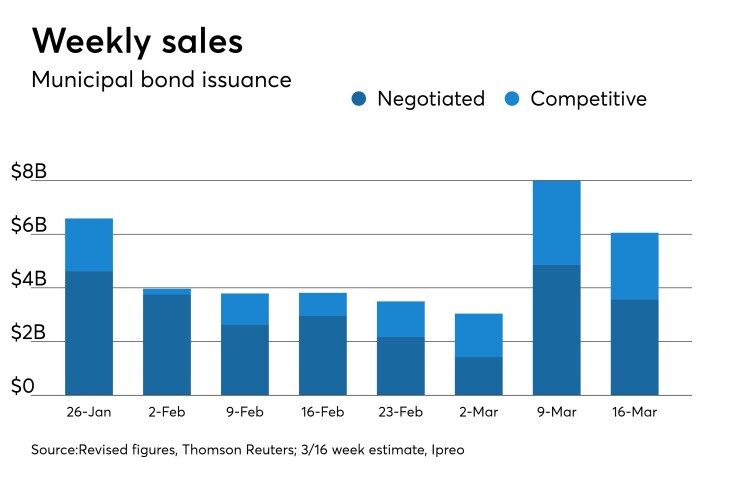

Coming off the biggest volume week of the year, municipals are ready for another steady batch of issuance. Although a second straight week of volume greater than $6 billion is on tap, observers said the issuance slump may not be over.

“I am not sure we are past the doldrums,” said Alan Schankel, managing director of research at Janney Capital Markets. “The 30-day visible supply is still under $10 billion. I can’t help but believe that things will pick up, but I see no confirmation so far" of a sustained rebound.

Ipreo estimates volume will drop to $6.05 billion, from the revised total of $7.99 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $3.57 billion of negotiated deals and $2.48 billion in competitive sales.

“Next week is certainly New York focused,“ Schankel said. “Despite the abundance of New York paper next week, I believe demand will be strong for both deals, fueled in part by increased in-state demand due to limitations on state tax deductibility resulting from December tax law.”

NY issuers account for the top 5 biggest deals of the week and $2.58 billion, or more than one third of the week’s volume. There are 15 sales scheduled $100 million or larger, with six coming via the competitive route.

Jefferies is scheduled to price the New York City Transitional Finance Authority’s $1 billion of building aid revenue bonds on Wednesday after a two-day retail order period. The deal is rated Aa2 by Moody’s Investors Service, AA by S&P Global Ratings and AA by Fitch Ratings.

On Tuesday, the Dormitory Authority of the State of New York is expected to sell a total of $1.33 billion in five separate sales.

Jefferies is going for the hat trick, as the firm is scheduled to price the University of Connecticut’s $152 million of student fee revenue bonds on Wednesday after a two-day retail order period, as well as the Golden State Tobacco Securitization Corp.’s $110.775 million on Thursday. The deals are rated Aa2 by Moody’s and AA-minus by S&P and A1 by Moody’s and A-plus by S&P and Fitch, respectively.

“I’ll also be looking to see how the University of Connecticut deal is received in the context of the state’s fiscal challenges,” said Schankel. “Despite some dependence on state aid, the bond is a revenues issue that will carry higher ratings than the state itself.”

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended March 9 were from California and Oklahoma issuers, according to

In the GO bond sector, the California 3.625s of 2047 traded 145 times. In the revenue bond sector, the Oklahoma Development Financing Authority 5.5s of 2057 traded 64 times. And in the taxable bond sector, the Oklahoma DFA 5.45s of 2028 traded 70 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended March 9, according to Markit.

On the bid side, the Puerto Rico Highway and Transportation Authority revenue 5s of 2032 were quoted by 49 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 87 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 27 unique dealers.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,125 trades on Thursday on volume of $11.65 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 16.58% of the market, the Lone Star State taking 11.475% and the Empire State taking 9.929%.

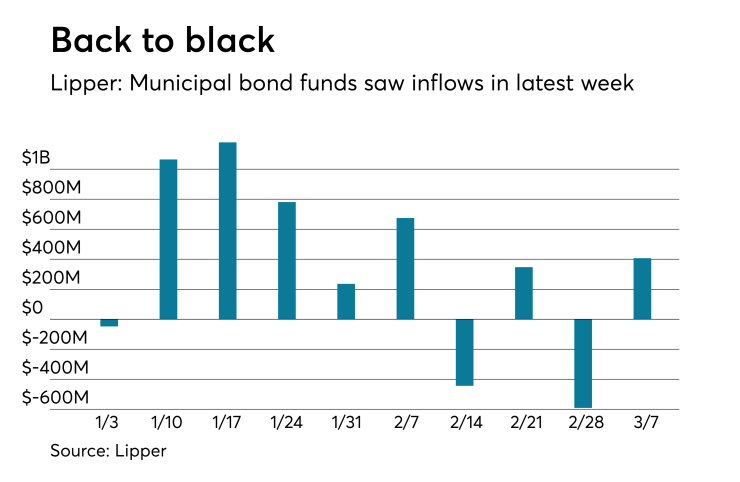

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds reversed course and put cash back into the funds in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $406.753 million of inflows in the week of March 7, after outflows of $590.943 million in the previous week.

Exchange traded funds reported outflows of $97.946 million, after inflows of $1.276 million in the previous week. Ex-ETFs, muni funds saw $504.699 million of inflows, after outflows of $592.219 million in the previous week.

The four-week moving average remained negative at -$70.049 million, after being in the red at -$3.010 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $218.275 million in the latest week after outflows of $492.084 million in the previous week. Intermediate-term funds had inflows of $201.010 million after inflows of $29.617 million in the prior week.

National funds had inflows of $383.340 million after outflows of $373.190 million in the previous week. High-yield muni funds reported inflows of $127.660 million in the latest week, after outflows of $221.998 million the previous week.

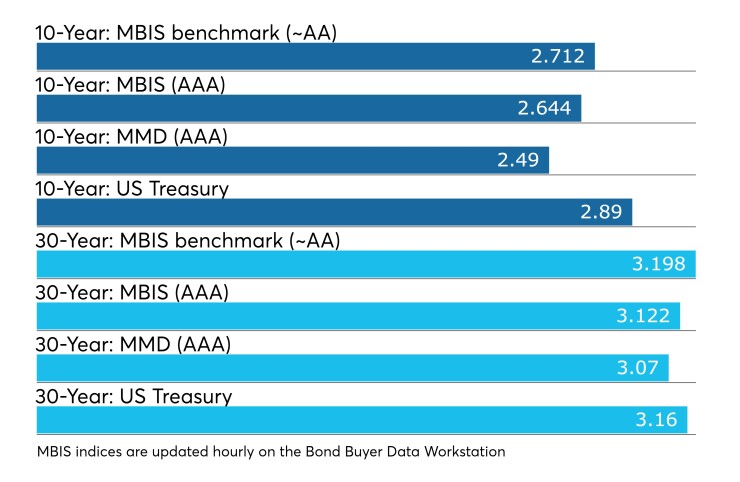

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.