Top-quality municipal bonds were stronger at mid-session, traders said, as more deals came to market.

Primary market

Goldman Sachs priced the Port Authority of New York and New Jersey’s $829.695 million of consolidated bonds.

The $729.695 million of Series 205 bonds were priced as 5s to yield from 0.95% in 2018 to 2.94% in 2037. A 2039 maturity was priced as 5 1/4s to yield 2.88%; a split 2042 maturity was priced as 5 1/4s to yield 2.94% and as 5s to yield 3.10%; a 2047 maturity was priced as 5s to yield 3.10%; and a split 2057 maturity was priced as 5s to yield 3.31% and as 5 1/4s to yield 3.21%.

The $100 million of Series 206 bonds subject to the alternative minimum tax were priced as 5s to yield from 2.64% in 2028 to 3.21% in 2037, 3.28% in 2042 and 3.34% in 2047.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

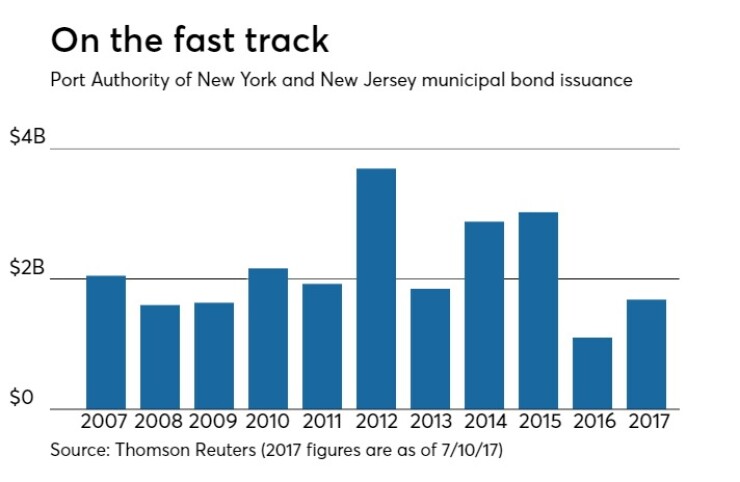

Since 2007, the Port Authority has sold $23.61 billion of securities, with the greatest issuance in 2012 when it sold $3.69 billion. The authority has sold over $1 billion every year during that time span, with the lowest occurring in 2016 when it sold $1.10 billion. With Thursday’s sale, it is over the $1 billion mark for this year and has surpassed last year’s total issuance.

Raymond James & Associates priced

The issue was priced to yield from 1.43% with a 5% coupon in 2019 to 3.73% with a 4% coupon in 2037; a 2042 maturity was priced as 4s to yield 3.83%. The 2018 maturity was offered as a sealed bid

The deal is rated AA by S&P and A by Fitch.

Citigroup priced the Pennsylvania Turnpike Commission’s $768.195 million of subordinate revenue and motor license fund-enhanced subordinate special revenue refunding bonds.

The $379.62 million of Subseries B-1 of 2017 revenue bonds were priced to yield from 1.84% with a 5% coupon in 2022 to 3.56% with a 5% coupon in 2037. A term bond in 2042 was priced to yield 3.66% with a 5% coupon and a term bond in 2047 was priced to yield 3.61% with a 5.25% coupon. This series is rated A3 by Moody’s and A-minus by Fitch.

The $343.13 million of Subseries B-2 of 2017 revenue bonds were priced to yield from 1.16% with a 5% coupon in 2018 to 3.36% with a 5% coupon in 2035. The bonds were also priced to yield from 3.76% with a 4% coupon in 2037 to 3.95% with a 4% coupon in 2039. This series is rated A3 by Moody’s and A-minus by Fitch, with the exception of the 2033-2035 and 2037 maturities totaling $152.645 million, which are insured by Assured Guaranty Municipal Corp. and rated A2 by Moody’s and AA by S&P.

The $45.46 million of motor license fund-enhanced refunding bonds were priced to yield from 1.89% with a 5% coupon in 2023 to 2.76% with a 5% coupon in 2028. This series was rated A2 by Moody’s and AA-minus by Fitch.

Piper Jaffray is expected to price the Greater Albany School District No. 89, Ore.’s $159 million of Series 2017 GOs. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

In the competitive arena, the state of North Carolina sold $107.01 million of Series 2017A general obligation refunding bonds.

Citi won the deal with a true interest cost of 1.39%. The issue was priced as 5s to yield from 0.80% in 2018 to 1.44% in 2023. The deal is rated triple-A by Moody’s, S&P and Fitch.

BAML received the written award on the state of Hawaii’s $249.81 million of Series 2017A taxable airports system customer facility charge revenue bonds.

The issue was priced at par to yield from 1.701% in 2018 to 3.775% in 2032, 3.894% in 2037 and 4.144% in 2047. The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.099 billion to $9.76 billion on Thursday. The total is comprised of $3.76 billion of competitive sales and $6.00 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation fell as much as one basis point from 2.03% on Wednesday, while the 30-year GO yield dropped as much as one basis point from 2.83%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 1.37% from 1.35% on Wednesday, the 10-year Treasury yield rose to 2.36% from 2.32% and the yield on the 30-year Treasury bond increased to 2.92% from 2.89%.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 87.3%, compared with 87.0% on Tuesday, while the 30-year muni to Treasury ratio stood at 97.8% versus 97.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,845 trades on Wednesday on volume of $13.63 billion.

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $365.4 million, bringing total net assets to $130.18 billion in the week ended July 10, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $645.7 million to $129.81 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds dropped to 0.39% from 0.43% in the previous week.

The total net assets of the 852 weekly reporting taxable money funds increased $1.88 billion to $2.468 trillion in the week ended July 11, after an outflow of $1.17 billion to $2.466 trillion the week before.

The average, seven-day simple yield for the taxable money funds inched up to 0.63% from 0.62% in the prior week.

Overall, the combined total net assets of the 1,084 weekly reporting money funds increased $2.24 billion to $2.598 trillion in the week ended July 11, after outflows of $520.9 million to $2.596 trillion in the prior week.