Municipal bond buyers on Tuesday snapped up deals from New Jersey, New York City and Texas issuers.

New issues continued to be the focus for investors, leaving the secondary market in a state of inactivity, according to a New York trader.

“I heard the Houston, Texas, deal did very well, but the secondary market is very quiet, flat, and dead,” he said. “There’s not much different; it’s a very static market.”

Fred Yosca, managing director at BNY Mellon Capital Markets said that this week’s calendar is offsetting the otherwise lackluster seasonal pattern — with strong demand stemming from the July reinvestment period driving new issues.

"What buyside interest there is is driven by the primary market demand,” said Fred Yosca, managing director at BNY Mellon Capital Markets. He added that issues from New York and New Jersey are getting the most attention.

“The customer interest is focused there,” he said. “Away from that, it’s really sleepy. Even the brokers aren’t calling.”

Yosca said the New York Transitional Finance Authority deal was highly sought after — with significant interest on the short end.

Primary market

Morgan Stanley priced and repriced the New Jersey Transportation Trust Fund Authority’s $1.21 billion of Series 2018A federal highway reimbursement revenue refunding notes.

The deal consists of tax-exempt GARVEE notes not subject to the alternative minimum tax.

The notes are rated Baa1 by Moody’s Investors Service, A-plus by S&P Global Ratings and A-minus by Fitch Ratings.

Ramirez & Co. priced and repriced the New York City Transitional Finance Authority’s $919.77 million of tax-exempt Fiscal 2019 Series S-1 and Fiscal 2019 Series S-2 Subseries S-2A building aid revenue bonds after a two-day retail order period.

The NYC TFA also competitively sold $111.455 million of taxable Fiscal 2019 Subseries S-2B BARBs. Citigroup won the bonds with a true interest cost of 3.1233%.

The BARBs are rated Aa2 by Moody’s and AA by S&P and Fitch.

During the two-day retail order period for the tax-exempt bonds, the TFA said it received $702 million of retail orders, of which around $415 million was usable. During the institutional order period, TFA said it received about $513 million of priority orders.

“Given the strong investor demand for the 2028, 2029 and 2030 maturities with an optional call in 2021, TFA reduced yields for these maturities by 3 basis points during the institutional re-pricing,” the TFA said in a statement.

Siebert Cisneros Shank & Co. priced $572.15 million of Houston Series 2018C airport system subordinate lien revenue refunding bonds, subject to the AMT and the Series 2018D non-AMT bonds on Tuesday. The deal is rated A1 by Moody’s and A by Fitch.

Since 2008, the city has sold about $15 billion of bonds, with the most issuance occurring in 2014 when it sold $2.52 billion of debt. It sold the least amount in 2015 when it issued $485.1 million of bonds.

Jefferies priced the Ohio Water Development Authority’s $166.52 million of fresh water Series 2018 water development revenue bonds. The deal is rated AAA by Moody’s and S&P.

In the competitive arena on Tuesday, Los Angeles sold $110.53 million of Series 2018A solid waste resources revenue bonds. Citigroup won the bonds with a TIC of 2.4843%. The deal is rated Aa2 by Moody’s and AA by Kroll Bond Rating Agency. The financial advisors are Fieldman, Rolapp & Associates and Urban Futures; the bond counsel is Orrick Herrington.

The Suffolk County Water Authority, N.Y., sold $100 million of Series 2018A water system revenue bonds. Bank of America Merrill Lynch won the bonds with a TIC of 3.5643%. The deal is rated AAA by S&P and Fitch. The financial advisor is Goldman Sachs; the bond counsel is Harris Beach.

Tuesday’s sales

New Jersey:

New York:

Texas:

Ohio:

California:

Bond Buyer 30-day visible supply at $11.36B

The Bond Buyer's 30-day visible supply calendar decreased $1.43 billion to $11.36 billion on Wednesday. The total is comprised of $3.88 billion of competitive sales and $7.49 billion of negotiated deals.

Secondary market

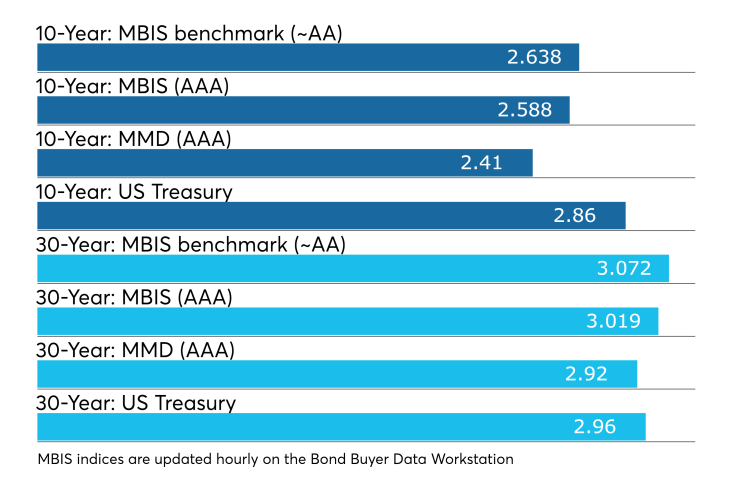

Municipal bonds were mixed on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one- to nine-year, 11- to 15-year and 29- to 30-year maturities, rose less than a basis point in the 17- to 28-year maturities, and remained unchanged in the 10-year and 16-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale falling less than one basis point in the one- to nine-year and 14-year maturities, rising less than a basis point in the 10- to 12-year and 15- to 30-year maturities and remaining unchanged in the 13-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield remaining unchanged while the yield on the 30-year muni maturity rose by one basis point.

Treasury bonds were weaker Tuesday as stocks traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.3% while the 30-year muni-to-Treasury ratio stood at 98.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,375 trades on Monday on volume of $9.61 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 14.972% of the market, the Empire State taking 11.221% and the Lone Star State taking 9.936%.

Treasury sells $26B year-bills, $45B 4-week bills

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.335% high yield, a price of 97.639056. The coupon equivalent was 2.410%. The bid-to-cover ratio was 3.03.

Tenders at the high rate were allotted 85.10%. The median yield was 2.310%. The low yield was 2.280%.

Treasury also auctioned $45 billion of four-week bills at a 1.880% high yield, a price of 99.853778. The coupon equivalent was 1.909%. The bid-to-cover ratio was 2.91.

Tenders at the high rate were allotted 78.87%. The median rate was 1.860%. The low rate was 1.830%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.