Muni volume is getting a boost during the traditionally slow Thanksgiving holiday week as one of the nation's biggest issuers looks to beat the tax reform clock with an advanced refunding.

The New York Metropolitan Transportation Authority' $2 billion sale will account for almost half of the planned volume, as the city's subway and bus operator looks to lower borrowing costs with a type of deal that may be banned after this year under pending tax reform legislation.

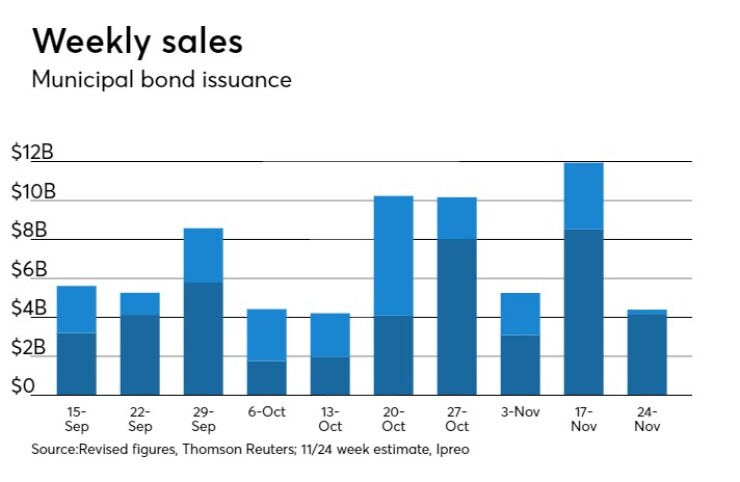

Ipreo estimates volume will dip to $4.18 billion from the revised total of $8.52 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $3.96 billion of negotiated deals and $217.1 million in competitive sales.

Bank of America Merrill Lynch is expected to price the MTA’s revenue advance refunding green bonds in a two day pricing period starting on Monday. The deal is rated A1 by Moody’s Investors Service, AA-minus by S&P Global Ratings, AA-minus by Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

“We’ve been doing advance refundings from time to time over the last few years when favorable market conditions have prevailed, in order to continually lower the costs of our debt portfolio,” said an MTA spokesperson. “Advance refundings have proven to be an important tool that we have used to help control the costs of our debt portfolio, and the anticipated tax reform in Washington that would eliminate advance refundings has us concerned.”

He said the MTA is increasing its efforts to take advantage of advance refunding opportunities before the end of the year. “Current low rates and strong investor appetite for bonds, plus the anticipated tax reform in Washington, have prompted us to prepare this transaction.”

The MTA jumping into do a deal while they still can might be a sign of things to come for the primary market. In the event that the tax reform bill advances, the clock may be counting down for advance refunding and private activity bonds. This is likely to lead to a surge volume in early December, analysts said.

“There is so much demand I think it would be welcome if we see a back-up in yields [with this big wave of issuance],” said Dawn Mangerson, senior portfolio manager at McDonnell Investment Management. “There are enough market participants to absorb the paper.”

Wells Fargo is slated to price the Commonwealth of Virginia Transportation Board’s $479.41 million of federal transportation gran anticipation revenue and refunding notes on Tuesday. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

BAML is also scheduled to price North Broward Hospital District’s $318 million of revenue bonds on Monday. The deal is rated Baa2 by Moody’s and BBB-plus by S&P.

Higher yielding deals from hospitals and electric power providers have been met with "especially strong demand as of late,” said Mangerson. “We continue to be in a reach-for-yield environment, as the spread compression is continuing.”

Secondary market

Top shelf municipal bonds ended flat on Friday. The yield on the 10-year benchmark muni general obligation was unchanged from 2.00%on Thursday, while the 30-year GO yield was steady from 2.69%, according to the final read of Municipal Market Data’s triple-A scale.

U.S. Treasuries were narrowly mixed on Friday. The yield on the two-year Treasury rose to 1.73% from 1.71% on Thursday, the 10-year Treasury yield decreased to 2.35% from 2.36% and the yield on the 30-year Treasury decreased to 2.79% from 2.80%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.0% compared with 84.9% on Thursday, while the 30-year muni-to-Treasury ratio stood at 96.2% versus 96.1%, according to MMD.

AP-MBIS 10-year muni at 2.288%, 30-year at 2.795%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was mixed in late trade.

The 10-year muni benchmark yield rose to 2.288% on Friday from the final read of 2.279% on Thursday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Nov. 17 were from Puerto Rico, Ohio and New Jersey, according to

In the GO bond sector, the Puerto Rico 8s of 2035 were traded 26 times. In the revenue bond sector, the Ohio Air Quality Development Authority 4.5s of 2048 were traded 70 times. And in the taxable bond sector, the New Jersey Educational Facilities Authority 3.836s of 2047 were traded 17 times.

Week's actively quoted issues

Puerto Rico, Pennsylvania and Illinois names were among the most actively quoted bonds in the week ended Nov. 17, according to Markit.

On the bid side, Puerto Rico Public Buildings Authority revenue 5.25s of 2042 were quoted by 43 unique dealers. On the ask side, Pennsylvania Turnpike Commission revenue 4s of 2039 were quoted by 319 dealers. And among two-sided quotes, Illinois taxable 5.1s of 2033 were quoted by 21 unique dealers.

Lipper: Muni bond funds see inflows

Investors in municipal bond funds again put cash back into the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters saw $417.719 million of inflows in the week of Nov.15, after inflows of $463.044 million in the previous week.

Exchange traded funds reported inflows of $23.098 million, after inflows of $35.922 million in the previous week. Ex-ETFs, muni funds saw $394.621 million of inflows, after inflows of $427.122 million in the previous week.

The four-week moving average was positive at $121.942 million, after being in the green at $151.552 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $373.985 million in the latest week after inflows of $315.728 million in the previous week. Intermediate-term funds had outflows of $1.017 million after inflows of $100.973 million in the prior week.

National funds had inflows of $453.793 million after inflows of $462.979 million in the previous week.

High-yield muni funds reported inflows of $203.559 million in the latest week, after inflows of $206.612 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on The Bond Buyer Data Workstation.