DALLAS – Fort Worth, Texas, took a one-notch downgrade to Aa3 from Moody’s Investors Service, which kept the outlook negative due to ongoing pension problems.

The rating action affects $657 million of Moody's-rated debt, the agency said.

“The downgrade to Aa3 reflects the city's large and growing unfunded pension liability and growing fixed cost burden, which includes annual pension, OPEB and debt service requirements,” Moody’s analyst Nathan Phelps wrote in the July 13 report.

“The negative outlook reflects our expectation that, absent pension reform and increased contributions, the city's unfunded pension liability and increasing fixed costs will pressure operations,” Phelps added.

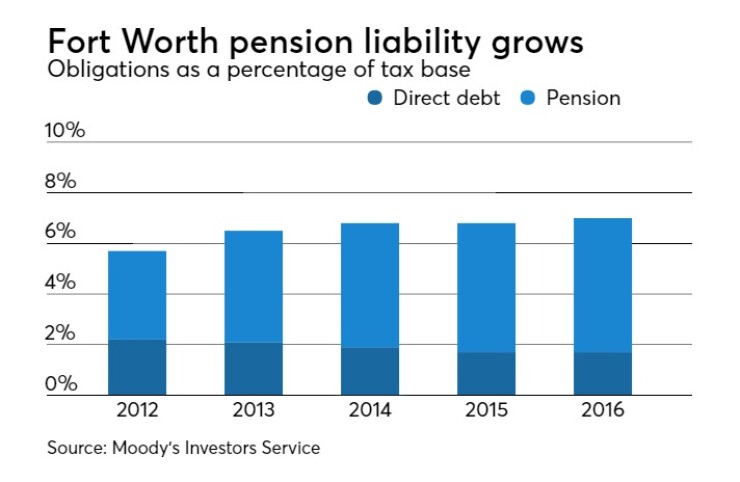

Fort Worth’s direct debt burden at the end of 2016 was $834.8 million, including $763.4 million of limited tax bonds, Moody’s said. The city’s direct debt burden is 1.7% of 2017 full tax-base value and reflects the solid waste system's support of roughly $4 million of outstanding general obligation limited tax debt.

The city’s Employees' Retirement Fund includes separate single employer defined benefit plans. The city contributes 19.74% of retirement eligible wages to the ERF for municipal and firefighter employees, and 20.46% for police. Municipal employees and firefighters contribute 8.25% of retirement eligible wages, and police officers contribute 8.73%. The pension plans are administered by the 13-member Retirement Fund Board of Trustees made up of four active members, three retired members and six trustees appointed by the City Council.

“Unfunded pension liabilities represent a significant portion of the city’s balance sheet leverage and are expected to continue growing, absent an increase in contribution levels or a reduction to the benefit structure,” Phelps said. “Based on fiscal 2016 results, we expect the city’s reported net pension liability to reach roughly $1.6 billion on its own fiscal 2017 balance sheet, compared to $1.4 billion in fiscal 2016 and $1.1 billion four years ago.”

The adjusted net pension liability is projected to increase to $3.6 billion, compared to $3.2 billion in fiscal 2016. The pension funds get 13% of their support from the city's enterprise fund.

The city's fixed costs including annual debt service, pension and other post-employment benefit contributions are “elevated,” according to Moody’s.

In fiscal 2016, required fixed costs were 28.5% of operating fund revenues including the actuarially determined pension contribution.

To protect the pension plan, the City Council reduced benefits earned on a prospective basis in 2011 and 2014. The city is conducting a pension study to seek reductions in the unfunded liability. Recommendations are expected near the end of the year.

“The city's ability to exercise similar authority and implement meaningful changes to address its growing unfunded pension liability will be an important consideration in future reviews,” Phelps said.

S&P Global Ratings and Fitch Ratings rate Fort Worth’s general obligation bonds AA-plus with a stable outlook.

While the Texas Legislature approved pension reform bills for Houston and Dallas, Fort Worth’s pension system has not been restructured. All three cities have suffered ratings downgrades due to pension obligations.

The seat of triple-A-rated Tarrant County, Fort Worth’s 345 square miles reaches into parts of Denton, Parker, Johnson and Wise counties. The current population is estimated at 796,614.