CHICAGO — Municipal bond issuers in the Midwest sold $23.4 billion of debt in the first half of 2018, a 28.3% drop from the previous year, according to Thomson Reuters data.

Issuance was down in all five regions after the new federal tax law axed advance refundings, but the Midwest fell the furthest.

New-money volume picked up some speed in the region, rising 2.1% to $17.3 billion, but refunding bond volume plummeted 42.8% to $4.6 billion while combined new money/refunding deals dropped 79.6% to $1.6 billion.

Midwest issuers sold $10.6 billion in the first quarter in 631 issues, down 27.7% year-over-year, and $12.9 billion in the second quarter in 960 transactions, a 28.8% drop.

“That’s the story. As expected, the lack of refundings took a major chunk out of bond issuance in the Midwest like the rest of the country,” said Richard Ciccarone, president of Merritt Research Services LLC.

While new money rose slightly, Ciccarone said the lack of a more healthy increase signals that perhaps issuers are not as fearful that interest rates will rise much further. Early in the year as rates were on the rise, some predicted issuers would rush to market.

While the Fed has raised the federal funds rate and more hikes are expected, the yield curve has not steepened “and that gives credibility to skeptics who feel that interest rates are not going to rise much” which could, in turn, could curb issuers’ rush to get to market, Ciccarone said.

Current refundings may not offer much hope for an uptick because 2008 rates were low so the current market may not offer much savings for those bonds with traditional 10-year calls, Ciccarone added.

A series of new deals could bolster the second half. Chicago is planning up to $2 billion of airport debt, about $900 billion of water and sewer debt, a $750 million sales tax securitization, and is mulling over a possible pension obligation bond deal for as much as $10 billion. If the city moves forward with a pension deal, Chief Financial Officer Carole Brown said she wants to get into the market before the end of the year.

Illinois is selling $920 million this week and the newly merged Advocate and Aurora Health Systems recently sold more than $1 billion.

Among the Midwest's 11 states, only Minnesota, Iowa and North Dakota recorded higher volume. Minnesota saw issuance rise 30.1% to $3.3 billion, Iowa was up 6.8% to $1.7 billion and issuance from North Dakota climbed 9.7% to $372 million. Ohio was the region's top source of muni issuance, with Illinois close behind, with both coming in a little under $4.3 billion.

Minnesota’s growth was primarily fueled by education borrowing, which more than doubled to $1.7 billion.

The Illinois drought — issuance was down 26.1% — is due in part to low state government borrowing as its existing capital program winds down and lawmakers haven't replaced it as they struggle simply to enact operating budgets amid political bickering.

Indiana volume dropped 45% to $1 billion.

Tim Sutton, director of bond pricing in Umbaugh’s Indianapolis office, said like elsewhere it was due to the refunding drought.

“If you look at Indiana, everything that was eligible to be refunded was refunded — there was a rush of activity in Indiana [in 2017] like every other state to get ahead of the change in the laws” that eliminated advance refundings, Sutton said.

Many states in the Midwest are awaiting federal action on infrastructure funding, Sutton said.

“State, cities and local governments have plans on things that they would like to do in terms of infrastructure and a lot of the bigger projects are being slow-walked, waiting for Washington D.C. to see what they are going to come up with,” Sutton said.

Sutton said his firm typically sees a spike in Indiana-based borrowing later in the year.

In both Michigan and Ohio, volume was down a bit more than 19%.

The Ohio drop-off is due in part to a boost the numbers saw last year in the first half when MetroHealth issued $1 billion, said Sam Adams, a vice president with KeyBanc Capital Markets. Without the deal, Adams says that first half issuance for 2018 is actually a little down, but relatively similar to last year’s volumes.

Adams expects a notable drop in issuance in the second half of 2018 relative to the second half of 2017 for two reasons: at the end of last year there was a rush to issue to beat the deadline for advance refundings and there is no real driver for a lot of new issuance in Ohio right now.

“It’s a lot of business-as-usual kind of new-money issuance in the general muni space, but issuers don’t have advance refunding saving opportunities anymore,” Adams said.

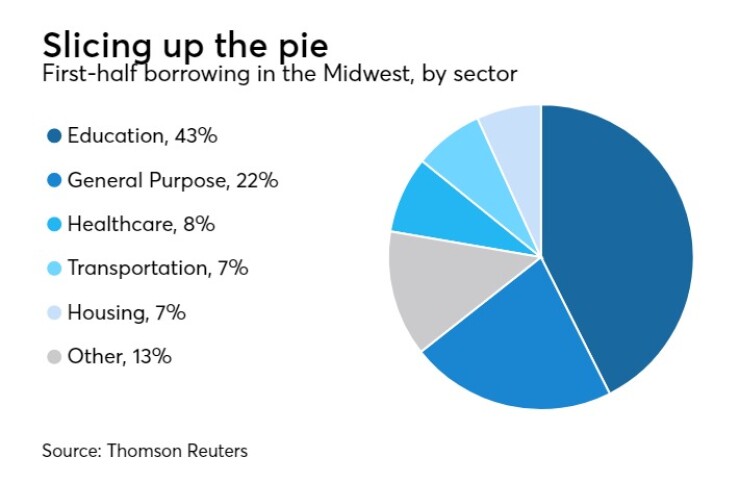

The education sector accounted for nearly $10 billion of borrowing in the region, followed by debt Thomson Reuters classes as general purpose at $5.1 billion.

Tax-exempt bonds accounted for $20.8 billion of volume, down 25.5%, and taxable debt for $2.2 billion, off 45.3%. While taxables have yet to pick up steam, some believe they could gain as issuers look to replace advance refundings.

Debt Thomson Reuters classes as revenue bonds accounted for $10.3 billion of volume, a drop of 46.1%, while $13.2 billion were classed as general obligation securities, a 3.8% decline.

Chicago’s $680 million issue in January through its Sales Tax Securitization Corp. with Goldman Sachs in the lead spot was the top deal for the first half. That single deal made it the Midwest's top-volume issuer of the first half.

The Chicago Board of Education’s $562 million May sale followed in second. Illinois’ $500 million competitive sale in April won by Bank of America Merrill Lynch was third.

The Ohio Turnpike and Infrastructure Commission’s $500 million January sale was fourth and Ohio’s $370 million March sale was fifth.

Ohio and the Ohio Public Facilities Commission took the second and third slots among top issuers in the region. The Chicago Public Schools and Illinois state government followed.

Bank of America Merrill Lynch — the first-place finisher for the same period last year — took the top spot among the region’s senior managers, credited by Thomson Reuters with deals valued at $2.9 billion. JPMorgan followed at $2.1 billion, Stifel Nicolaus came in third with $1.7 billion, Robert W. Baird & Co. was fourth with nearly $1.7 billion, and Citi was fifth with $1.4 billion.

PFM Financial Advisors — the first-place finisher for the first half of 2017 — took the top spot among financial advisors, credited with nearly $4 billion, followed by Ehlers & Associates with $1.8 billion, and Springsted Inc. with $1.2 billion. Umbaugh LLP took the fourth spot with $1.1 billion and Acacia Financial Group rounded out the top five with $1.1 billion.

Chapman and Cutler LLP — the second-place finisher for the first half last year — captured the top spot among bond counsel, credited with deals valued at $1.6 billion followed by Gilmore & Bell PC with nearly $1.6 billion and Kutak Rock LLP with nearly $1.5 billion. Squire Patton Boggs with $1.3 billion and Miller Canfield with $1.2 billion rounded out the top five.