Consumers’ inflation expectations held, but respondents’ optimism about income and spending slid, according to the May Survey of Consumer Expectations, released by the Federal Reserve Bank of New York on Monday.

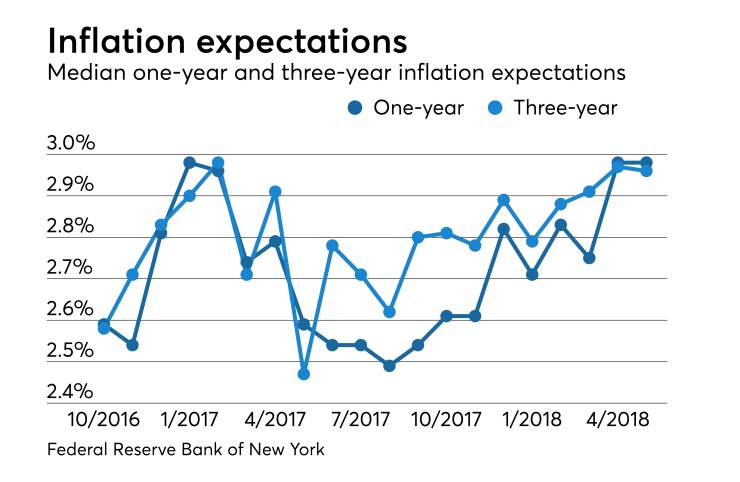

Median inflation expectations remained 3.0% for a one-year period and a three-year horizon.

“Inflation uncertainty increased to its highest level since March 2017,” according to a release.

Turning to labor, the expected earnings growth for one-year fell to 2.5% from 2.7%. The mean perceived probability of losing one’s job in the next 12 months grew to 14.0% from 13.7%, while the mean probability of leaving one’s job voluntarily in the next 12 months gained to 21.4% from 20.5%.

The probability of finding a job, if one lost his/her current job, rose to 59.9% from 57.1%. The series high of 60.1 was hit in November 2017.

Median one-year ahead home prices are expected to grow 3.7%, unchanged from last month, the Fed said, above its 12-month average of 3.3%.

Median household spending expectations decreased to 3.0% from 3.3%. Income growth expectations fell to 2.6% from 2.9%.

13.7% of respondents expect their financial situation to deteriorate somewhat, compared to 11.8% in the prior survey, while 42% see stock prices rising, off its 12-month average if 43%, according to the survey.