Municipal bonds were little changed Tuesday as traders saw big note and bond deals hit the market, led by issuers in California and New York.

Primary market

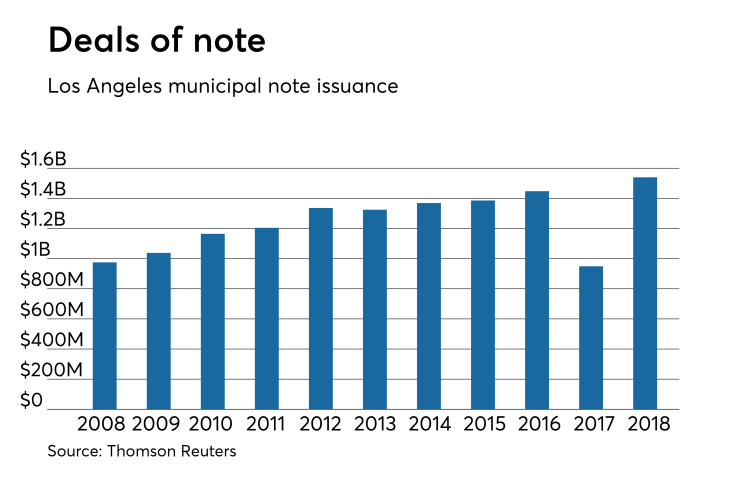

Los Angeles sold $1.54 billion of 2018 tax and revenue anticipation notes. The notes are due June 27, 2019. Details were not immediately available.

The financial advisor is Montague DeRose & Associates; bond counsel is Squire Patton. The TRANs are rated MIG1 by Moody’s Investors Service and SP1-plus by S&P Global Ratings.

Since 2008, the city has sold over $13 billion of notes, with the most issuance occurring in 2016 when it sold $1.45 billion of notes. It sold the least amount of notes in 2017, when it issued $949.1 million.

On Wednesday, the city will sell $321.81 million of general obligation bonds, consisting of $276.24 million of Series 2018A taxable social bonds; $34.995 million of tax-exempt Series 2018B GO refunding bonds; and $10.57 million of taxable Series 2018C GO refunding bonds.

Financial advisors are Public Resources Advisory Group and Omnicap Group; bond counsel is Nixon Peabody. The bonds are rated AA by S&P.

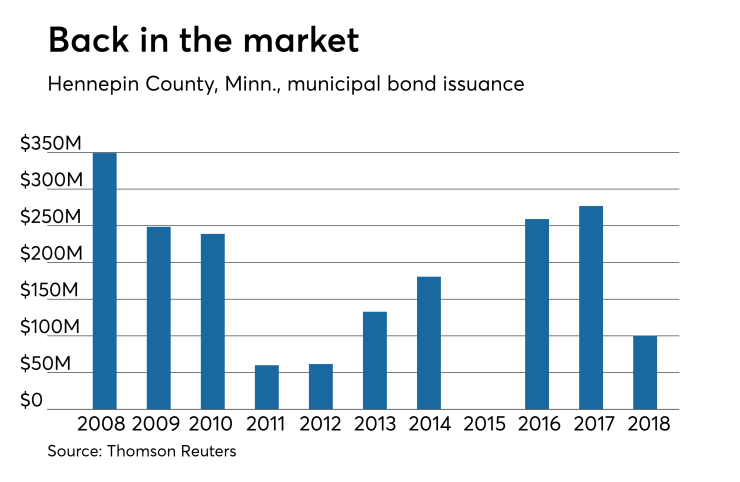

Hennepin County, Minn., sold $100 million of Series 2018A general obligation bonds.

Jefferies won the bonds with a true interest cost of 3.2959%.

PFM Financial Advisors is the FA while Dorsey & Whitney is bond counsel. The deal is rated AAA by S&P and Fitch Ratings.

Since 2008, the county has sold over $1.8 billion of bonds with the most issuance occurring in 2008, when it sold $349.1 million. It did not come to market in 2015.

In the negotiated sector, Raymond James & Associates priced for retail the Dormitory Authority of the State of New York’s $343.08 million of Series 2018-1 municipal health facilities improvement program lease revenue bonds, New York City issue.

The deal will be priced for institutional investors on Wednesday. The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Barclays Capital priced the Connecticut Health and Educational Facilities Authority’s $300 million of revenue bonds for Yale University. The deal is rated triple-A by Moody’s and S&P.

Citigroup priced the Port Authority of Guam’s $54.72 million of Series 2018A&B port revenue bonds.

The deal is rated Baa2 by Moody’s and A by S&P.

Tuesday’s bond sales

New York:

Connecticut:

Guam:

Minnesota:

Bond Buyer 30-day visible supply at $6.61B

The Bond Buyer's 30-day visible supply calendar decreased $332.1 million to $6.61 billion on Tuesday. The total is comprised of $2.41 billion of competitive sales and $4.21 billion of negotiated deals.

Secondary market

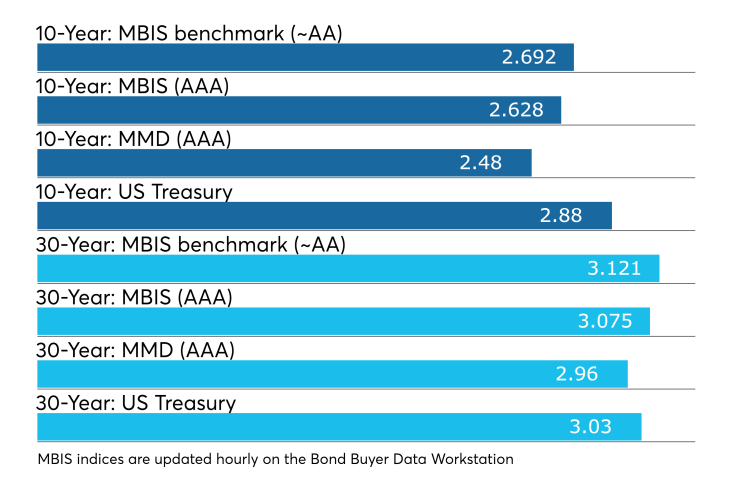

Municipal bonds were mixed on Tuesday, according to a midday read of the MBIS benchmark scale. High-grade munis were slightly weaker according to yields calculated on MBIS’ AAA scale

Municipals were weaker along Municipal Market Data’s AAA benchmark scale, which showed yields rising as much as one basis point in both the 10-year muni general obligation and the 30-year muni maturity.

Treasury bonds were little changed as stock prices rose.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.3% while the 30-year muni-to-Treasury ratio stood at 96.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,369 trades on Monday on volume of $8.39 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 16.557% of the market, the Empire State taking 11.851% and the Lone Star State taking 10.407%.

Treasury sells $35B 4-week bills

The Treasury Department Tuesday auctioned $35 billion of four-week bills at a 1.770% high yield, a price of 99.862333.

The coupon equivalent was 1.797%. The bid-to-cover ratio was 3.05.

Tenders at the high rate were allotted 89.94%. The median rate was 1.760%. The low rate was 1.730%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.