Municipal bonds were mixed at mid-session with some Puerto Rico issues trading higher as the primary saw a bevy of new deals hit the screens.

Primary market

Bank of America Merrill Lynch priced the Lower Colorado River Authority, Texas’ $292.15 million of Series 2018 transportation contract refunding revenue bonds for the LCRA Transmission Services Corp. project.

Citigroup priced the Sacramento Municipal Utility District, Calif.’s $166.59 million of Series 2018F electric revenue refunding bonds.

JPMorgan Securities is expected to price the Tri-County Metropolitan Transportation District of Oregon’s $147.475 million of Series 2018A senior lien payroll tax revenue bonds.

Notes also feature prominently this week.

Stifel is set to price Riverside County, Calif.’s $340 million of 2018 tax and revenue anticipation notes.

Raymond James & Associates is expected to price the Houston Independent School District, Texas’ $200 million of maintenance tax notes.

Goldman Sachs received the official award on Los Angeles County’s $700 million of 2018-2019 tax and revenue anticipation notes.

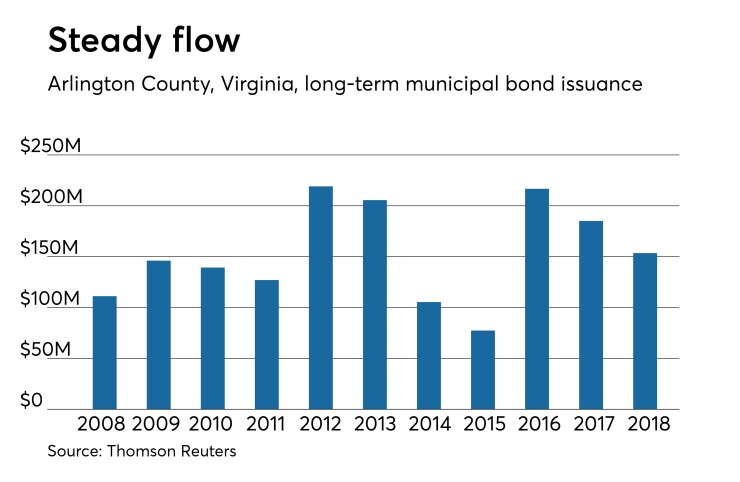

In the competitive arena, Arlington County, Va., sold $153.555 million of Series 2018 general obligation public improvement bonds.

Wells Fargo Securities won the bonds with a true interest cost of 2.99%.

Since 2008, Arlington County has sold about $1.69 billion of securities, with the most issuance occurring in 2012 when it sold $219 million and the least in 2015 when it sold $77 million.

Loudoun County, Va., sold $148.275 million of Series 2018A general obligation public improvement bonds.

Citi won the bonds with a TIC of 2.9802%.

Evergreen School District No. 114, Wash., sold $114.7 million of unlimited tax Series 2018 GOs under the Washington state school district credit enhancement program.

Citi won the bonds with a TIC of 3.192%.

The Illinois Regional Transportation Authority sold $134.025 million of Series 2018B GOs.

Morgan Stanley won the bonds with a TIC of 3.822%.

Wednesday’s bond sales

Texas:

California:

Virginia:

Washington:

Bond Buyer 30-day visible supply at $10.33B

The Bond Buyer's 30-day visible supply calendar decreased $3.20 billion to $10.33 billion on Wednesday. The total is comprised of $5.13 billion of competitive sales and $5.21 billion of negotiated deals.

Secondary market

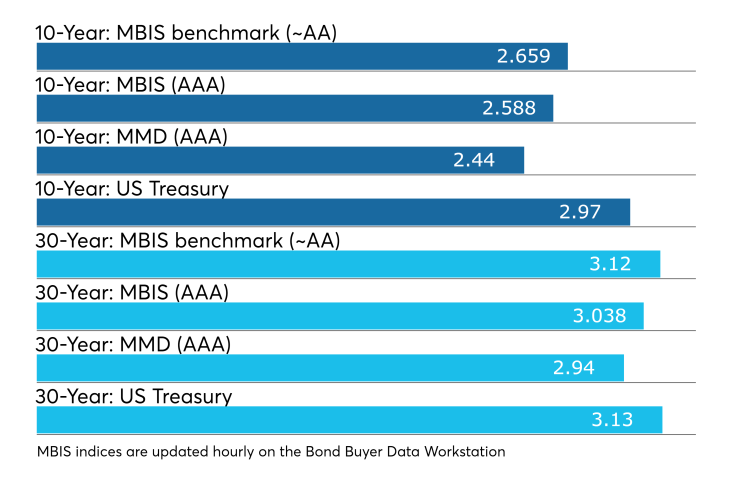

Municipal bonds were mixed on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- and two-year, 11- to 13-year and 17- to 30-year maturities, fell as much as one basis point in the three- to nine-year and 14- to 16-year maturities and were unchanged in the 10-year maturity.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale rising as much as one basis point in the one- and two-year, 12- and 13-year and 16- to 28-year maturities, falling in the three- to 11-year, 14-year and 30-year maturities and remaining unchanged in the 15-year and 29-year maturities.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed yields as much as two basis point higher in the 10-year general obligation muni and two to four basis points higher in the 30-year muni maturity.

Treasury bonds were weaker as stock prices traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 83.1% while the 30-year muni-to-Treasury ratio stood at 95.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Puerto Rico bonds trading higher

Bondholders representatives on Puerto Rico’s about $18 billion each of general obligation and the Puerto Rico Sales Tax Financing Corp. bonds have reached an agreement to settle a dispute over sales tax revenue, according to published reports.

In active trading on Wednesday, the benchmark Puerto Rico Commonwealth Series 2014 GO 8s of 2035 were trading at a high price of 42 cents on the dollar compared to 41.125 cents on Tuesday, according to the MSRB’s EMMA website. Volume totaled $32.37 million in 21 trades compared to $690,000 in six trades on Tuesday.

The COFINA Series 2007A revenue 5.25s of 2057 were trading at a high price of 76.25 cents on the dollar compared to 68 cents on Tuesday, according to the EMMA website. Volume totaled $60.71 million in 20 trades compared to $10,000 in two trades on Tuesday.

The COFINA Series 2007B revenue 6.05s of 2036 traded at a high price of 77 cents on the dollar compared to 69 cents on Tuesday, according to the EMMA website. Volume totaled $11.76 million in 15 trades compared to $20.02 million in 17 trades on Tuesday.

The COFINA Series 2011C current interest revenue 5.25s of 2040 traded at a high price of 75.25 cents on the dollar compared to 67.633 cents on Tuesday, according to the EMMA website. Volume totaled $26.21 million in 13 trades compared to $670,000 in six trades on Tuesday.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,356 trades on Tuesday on volume of $14.07 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 14.204% of the market, the Empire State taking 11.536% and the Lone Star State taking 10.074%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.