Municipal bond traders will be seeing the last of this week’s larger deals come to market on Thursday, with North Carolina competitively selling more than $550 million of bonds in a single offering.

Secondary market

Treasuries were mixed on Thursday. The yield on the two-year Treasury was unchanged from 1.35% on Tuesday, the 10-year Treasury yield dropped to 2.24% from 2.26% and the yield on the 30-year Treasury bond decreased to 2.82% from 2.84%.

Top-quality municipal bonds ended stronger on Wednesday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.93% from 1.94% on Tuesday, while the 30-year GO yield dropped one basis point to 2.73% from 2.74%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 85.1%, compared with 85.8% on Tuesday, while the 30-year muni to Treasury ratio stood at 95.9% versus 96.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,349 trades on Wednesday on volume of $13.19 billion.

Primary market

In the competitive arena on Thursday, the state of North Carolina is selling $554.03 million of Series 2017B limited obligation refunding bonds.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

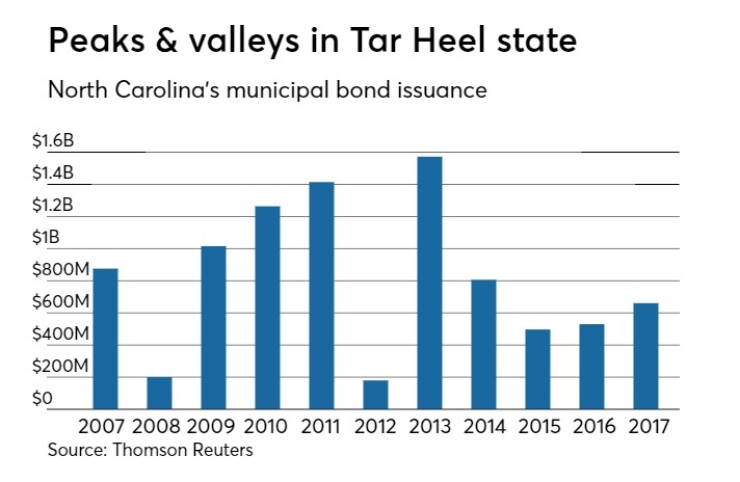

Since 2007, the Tar Heel state has issued almost $9 billion of debt, with the most issuance occurring in 2013 when it sold $1.57 billion. It sold the least amount of securities in 2012 when it issued about $180 million of bonds.

In the negotiated sector, Wells Fargo Securities is expected to price the California Educational Facilities Authority’s $123.06 million of Series 2017A taxable and Series 2017B tax-exempt revenue bonds for Santa Clara University.

The deal is rated Aa3 by Moody’s.

Morgan Stanley is expected to price the Massachusetts Housing Finance Agency’s $121.62 million of single-family housing revenue bonds, 2017 Series 187 not subject to the alternative minimum tax, 2017 Series 188 AMT bonds and 2017 Series 189 non-AMT bonds.

The deal is rated Aa1 by Moody’s and AA by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $979.4 million to $5.41 billion on Wednesday. The total is comprised of $2.23 billion of competitive sales and $3.18 billion of negotiated deals.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $200.5 million, bringing total net assets to $129.98 billion in the week ended July 17, according to The Money Fund Report, a service of iMoneyNet.com.

This outflow followed an inflow of $365.4 million to $130.18 billion in the previous week.

The average, seven-day simple yield for the 231 weekly reporting tax-exempt funds declined to 0.36% from 0.39% in the previous week.

The total net assets of the 852 weekly reporting taxable money funds increased $1.10 billion to $2.469 trillion in the week ended July 11, after an inflow of $1.88 billion to $2.468 trillion the week before.

The average, seven-day simple yield for the taxable money funds was unchanged at 0.63% from the prior week.

Overall, the combined total net assets of the 1,083 weekly reporting money funds increased $896.3 million to $2.599 trillion in the week ended July 11, after inflows of $2.24 billion to $2.598 trillion in the prior week.