The municipal bond market focused in on two big issuers from New York on Wednesday, while prices were little changed in secondary action.

“New issues were priced favorably and garnered a lot of attention, but the secondary was quiet and didn’t really have a direction,” a New York trader said.

Primary market

JPMorgan Securities priced and repriced the New York City Transitional Finance Authority’s $850 million of Fiscal 2019 Series A Subseries A1 tax-exempt future tax secured subordinate bonds.

The TFA also competitively sold $300 million of taxable bonds.

Barclays Capital won the $165.725 million of Fiscal 2019 Series A Subseries A3 future tax secured subordinate bonds with a true interest cost of 3.8884%. Goldman Sachs won the $134.275 million of Fiscal 2019 Series A Subseries A2 future tax secured subordinate bonds with a TIC of 3.5369%. The financial advisors are Public Resources Advisory Group and Acacia Financial Group; the bond counsel is Norton Rose.

The deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

The New York trader said the TFA dea generated strong demand, though it was hard to tell if the sales represented summer reinvestment or just general pent-up demand.

“From the flows I think there is some positive money coming into the market,” he said. “But, how much is being put to work and how much is on the sidelines, it’s hard to tell.”

Bank of America Merrill Lynch priced the Dormitory Authority of the State of New York’s Series 2018A tax-exempt and Series 2018B taxable revenue bonds for the Montefiore Obligated Group. The deal is rated Baa2 by Moody’s and BBB by S&P.

JPMorgan priced the Idaho Health Facilities Authority’s $316.45 million of Series 2018A tax-exempt and Series 2018B taxable revenue bonds for St. Luke’s Health System on Wednesday. The deal is rated A3 by Moody’s and A-minus by S&P.

Wells Fargo Securities priced Maine’s $96.03 million of Series 2018D GOs. The deal is rated Aa2 by Moody’s and AA by S&P.

In the competitive arena Johnson County, Kansas, sold $246.24 million of Series 2018A unlimited tax general obligation bonds. BAML won the bonds with a TIC of 3.2963%.

The deal is rated AAA by Fitch. The financial advisor is Springstead; the bond counsel is Gilmore & Bell.

Virginia sold $106.975 million of Series 2018 unlimited tax GOs. Citigroup won the deal with a TIC of 2.8350%.

The deal is rated triple-A by Moody’s, S&P and Fitch. The financial advisor is Public Resources Advisory Group; the bond counsel is Christian & Barton.

Since 2008, the state has sold about 2.1 billion of debt, with the most issuance occurring in 2009 when it sold $412.5 million. The state didn’t come to market in 2017.

Wednesday’s sales

New York

Idaho

Kansas

Maine

Bond Buyer 30-day visible supply at $5.35B

The Bond Buyer's 30-day visible supply calendar decreased $2.73 billion to $5.35 billion for Thursday. The total is comprised of $2.64 billion of competitive sales and $2.71 billion of negotiated deals.

Secondary market

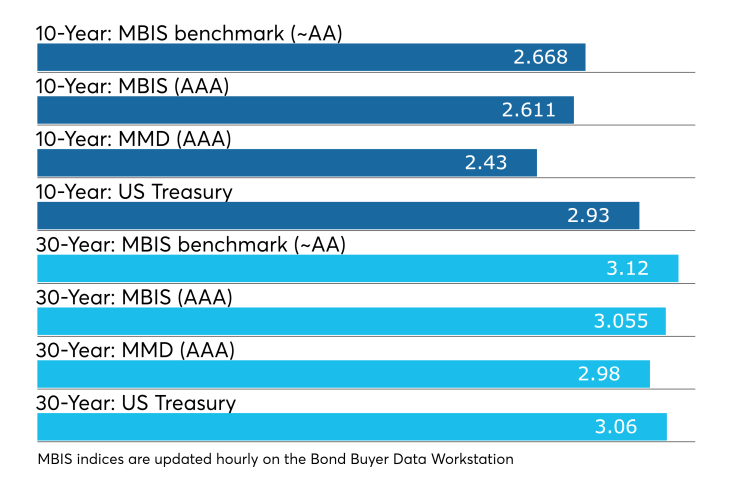

Municipal bonds were little changed on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one- to seven-year maturities, rose less than a basis point in the 10-year and 19- to 30-year maturities and remained unchanged in the eight- to nine-year and 11- to 18-year maturities.

High-grade munis were mixed, with yields calculated on MBIS’ AAA scale falling less than one basis point in the one- to 15-year and 27- to 30-year maturities, rising less than a basis point in the 17- to 25-year maturities and remaining unchanged in the 16-year and 26-year maturities.

“The secondary is showing limited transactions as investors are in kind of a holding pattern,” the New York trade said. “We had a selloff in previous sessions; now people are comfortable with the two-way flow but it’s hard to tell if it’s really higher or lower. I think the market is just steady.”

Earlier, a New Jersey trader said the market felt “sideways” as investors awaited the new issue pricings, pointing to the NYC TFA offering and the Idaho sale. "These deals should be retail friendly and will look cheap,” relative to comparable deals in recent weeks, the trader said. “I think there are a few maturities on the long end that will get some good attention, especially the 4% coupons.”

“It’s the dog days of summer,” he said. “The appetite is still there and there is still money to spend.”

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed both the 10-year muni general obligation yield and the yield on the 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stocks traded higher.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 82.9% while the 30-year muni-to-Treasury ratio stood at 97.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,333 trades on Tuesday on volume of $12.77 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 17.702% of the market, Lone Star State taking 11.858% and the Empire State taking 11.03%.

Treasury sells 2-year FRNs, 5-year notes

The Treasury Department Wednesday auctioned $18 billion of two-year floating rate notes with a high discount margin of 0.043%, at a 0.043% spread, a price of par. The bid-to-cover ratio was 2.79.

Tenders at the high margin were allotted 92.77%. The median discount margin was 0.035%. The low discount margin was zero. The index determination date is July 23 and the index determination rate is 1.970%.

Treasury also auctioned $36 billion of five-year notes, with a 2 3/4% coupon, a 2.815% high yield, a price of 99.698805. The bid-to-cover ratio was 2.61.

Tenders at the high yield were allotted 71.20%. All competitive tenders at lower yields were accepted in full. The median yield was 2.779%. The low yield was 2.710%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.