Good timing and strong retail participation set the stage for a strong reception of Indianapolis and Marion County's $623 million of tax-exempt bonds.

The consolidated city-county government priced the deal Thursday after a retail order period Wednesday. It consists of $610 million of bonds for the long-anticipated justice center project, plus roughly $13 million of bonds to finance an assessment and intervention center.

The finance team received $3 billion in orders, allowing it to trim yields from the initial pricing.

“The timing on this sale was impeccable in that there was really very low supply of about $3 billion and with the Federal Reserve notes coming out and saying they are not raising rates.” said Evercore Wealth Management Municipal Bond Research Director Howard Cure. “I think that really increased the institutional buyers demand at the rates they were showing. They couldn’t have timed it much better."

A 2024 maturity in the Aa1 and AAA-rated deal with a 5% coupon landed at a yield of 1.76%, or five basis points over the Municipal Market Data's top-rated benchmark. A 2044 maturity with a 5% coupon landed a yield of 2.97% or 22 basis points over MMD. A 2054 maturity with a 5% coupon landed a yield of 3.20% or 40 basis points over MMD, according to MMD's daily market close column.

Bank of America Merrill Lynch and UBS Financial Services are co-senior managers. Faegre Baker Daniels LLP is bond counsel. Sycamore Advisors LLC is the financial advisor.

Most maturities were repriced 5 to 7 basis points lower across most of the curve but the team did not reprice the 30-year and the 35-year maturities, said Diana Hamilton, president of Sycamore Advisors.

The city and county took retail orders on Wednesday with more than $218 million in orders received including $53 million from Indiana buyers. Hamilton said it was “incredibly strong” retail participation for an Indiana deal.

Hamilton said the city was pushing for retail participation.

"From the city's perspective, they wanted this deal to have local support and from a pricing standpoint, strong retail participation gives us a good anchor for the deal going into the institutional order period," Hamilton said.

"The project itself as interesting as it is about the city and county taking over what was a privatized facility, I don’t think it is coming into play very much," Cure added.

The Federal Reserve on Wednesday scaled back their projected interest-rate increases this year to zero and said they would end the drawdown of the central bank's bond holdings in September after holding policy steady.

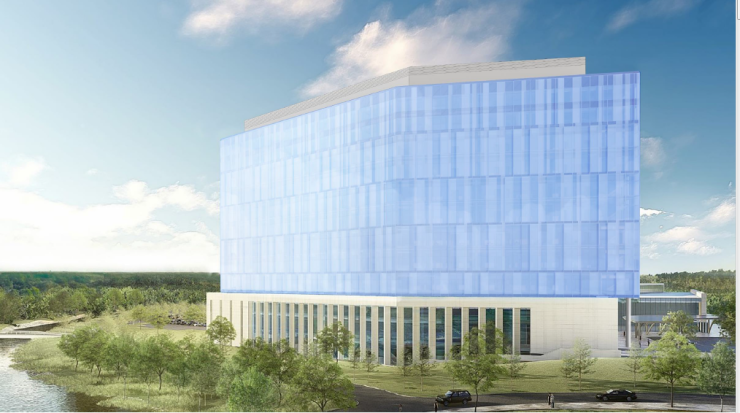

The bonds tap a new revenue pledge to fund a criminal justice complex billed as a cornerstone of reform plans.

The $610 million, 35-year, Series A bonds that finance construction of the city-county’s adult detention facility and local courthouse are secured by lease rental payments, which are repaid with a local income tax. The deal marks the first time the city has pledged the revenue source to secure bond payments.

The $12.6 million, 20-year, Series B bonds that finance the assessment and intervention center will be secured by lease rental payments backed by a property tax. The center will be operated by the Marion County Health and Hospital Corporation.

“It is ultimately appropriation with some abatement risk but I don’t think people are concerned about that because it is pretty typical structure,” Cure said.