CHICAGO – The collective funded ratios of all Illinois public pension funds falls under 50%, a figure that captures the heavy weight of unfunded pension burdens on local and state government balance sheets.

The collective liabilities of public pension funds statewide grew by $17 billion to $185.2 billion in fiscal 2016 from $168.2 billion in fiscal 2015, and the collective funded ratio deteriorated to 47.9% from 49.4%, according a

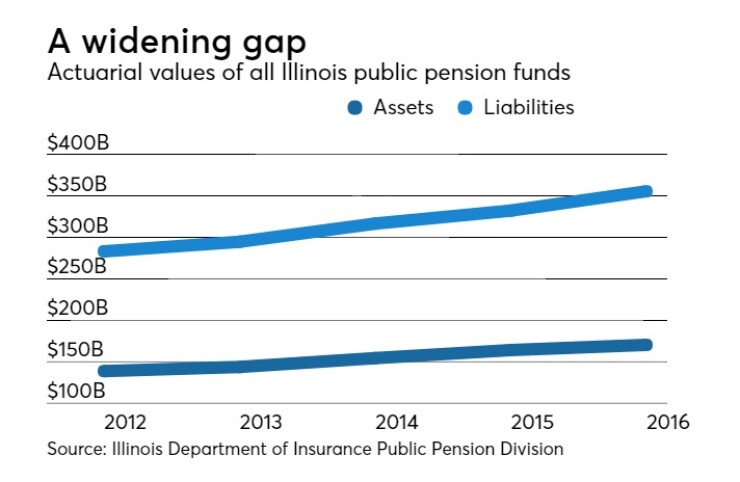

Accrued liabilities totaled $355.4 billion in fiscal 2016 compared to $332.2 billion in 2015 while assets totaled $170.2 billion in 2016 compared to $163.9 billion in fiscal 2015.

The 908-page 2017 biennial report published in October by Public Pension Division of the Illinois Department of Insurance provides an examination of the financial status of all 671 public pension funds in the state and also the collective data.

The weak status of funds statewide has strained Chicago and Illinois ratings. It’s a key rating driver for the state government which is rated at Baa3/BBB-minus/BBB, and Chicago’s pension woes were a primary factor behind Moody’s Investors Service decision to drop the city to junk in 2015.

The pressures extend statewide. Moody’s said it’s downgraded about 15% of its portfolio of Illinois cities in 2017 and “among cities we’ve downgraded, pensions have been the primary ratings driver,” said analyst David Levett.

Illinois is second only to Pennsylvania in the number of public systems and funds. The state report includes 15 large funds or systems and 656 funds that serve suburban and downstate police officers and firefighters.

The large systems are: the state government’s five pension fund system for teachers, state employees, judges, General Assembly members, and public universities; Chicago’s four systems, covering municipal employees, laborers, police, and firefighters; the Chicago Public Schools’ teachers fund; the Chicago Park District fund; the Cook County’s employees fund and forest preserve fund; the Metropolitan Water Reclamation District fund; and the Illinois Municipal Retirement Fund.

There are both positive and weak standouts among the 15. Only the Illinois Municipal Retirement Fund enjoyed what’s considered a healthy funded ratio at 90%. The poorest funded ratio came from the small General Assembly fund which was at 16%. The Chicago police fund and firefighters fund follow at funded ratios of 28.2% and 23.4%, respectively.

Only five other large funds exceed a 50% funded ratio. Cook County’s funds are at 55.4% and 60% funded ratios, the city laborers’ fund is at 53%, the Chicago teachers fund is at 51.9 %, and the water reclamation district is at 55.2%.

Of the $185.2 billion unfunded tab, large funds make up $175.3 billion with the state’s five funds alone accounting for $126.5 billion.

The suburban and downstate police and fire funds account for the remaining $9.9 billion of the $185.2 billion total tab.

The large funds’ unfunded obligations rose to $175.3 billion from $158.7 billion in fiscal 2015 and the funded ratio declined to 47.2% from 48.8%.

The suburban public safety funds saw their unfunded liabilities grow slightly to $9.9 billion from $9.5 billion while the funded ratio nearly held steady at 57.6% in fiscal 2016 compared to 57.4% in 2015.

The report is unique in that it presents a collective view of the overall health of all the state’s retirement funds.

Fresher data will soon be available. In November, the state’s five funds will report their fiscal 2017 unfunded liabilities and submit their requests to the state for fiscal 2019 contributions. The state’s largest fund, which covers all teachers outside Chicago, has already reported that its funded ratio improved slightly to 40.2% in fiscal 2017 from 39.8% in fiscal 2016 while its unfunded liabilities rose to $73.4 billion compared to $71.4 billion for fiscal 2016.

The General Assembly’s non-partisan Commission on Forecasting and Accountability later this year or early next year will release its examination of the Chicago area, Cook County, and Illinois Municipal Retirement System’s latest data as well as a review of the state’s latest data. The Chicago Civic Federation also traditionally publishes a review of the local Chicago area funds and also the state pension system.

The overall unfunded liability levels are not expected to show much improvement any time soon.

Lawmakers previously enacted reforms that cut benefits and raised employee contributions but the Illinois Supreme Court voided the changes in May 2015.

Moody’s Investors Service noted in an October report that looked at states’ flexibility on pensions and court ruling the tough road Illinois faces due to the court’s ruling “that benefits in place when an employee is hired are protected from being diminished or impaired under the state's constitution.”

“State court decisions that uphold or overturn reform efforts, and the extent to which benefit changes are an option for improving pension funding, can significantly affect the credit quality of governments within a given state. The pace of legislative reform efforts and corresponding judicial decisions is elevated and ongoing across the country,” read the report.

The state is considering a reform model that asks employees to forgo compounded cost of living increases in exchange for salary increases to still be counted toward their pensionable salary upon retirement. It’s unclear whether lawmakers will vote on the plan in their next session and if eventually enacted it would face legal challenge from unions.

Under the current funding schedule established by lawmakers in 1995, the state is required to make contributions to bring the system to 90% by fiscal year 2045 but the funding schedule is backloaded.

Gov. Bruce Rauner told a business group recently that he would pursue federal legislation that would allow states to bypass the state constitutional protections of pension benefits to reorganize and restructure pensions. He wanted the measure included in the Republican tax overhaul. Several market participants said such legislation would face a tough road and face a constitutional challenge.

The administration later back-tracked on whether actual legislation was being pitched and Illinois’ congressional Republicans were quoted as saying they are focused on a tax overhaul, not pension restructuring.

“There’s not a specific proposal. It’s all part of conversations that have taken place in D.C. for a long time, is my understanding,” Rauner spokeswoman Patty Schuh said.

Chicago has put in place over the last two years funding plans that phase in a shift to an actuarially based contribution in the next few years with the goal of reaching a 90% funded ratio in 40 years, but it will take decades to reach healthier funded ratios toward the 90% goal.

Cook County is setting aside revenue from a sales tax hike to supplement contributions but it needs state approval to finalize its pension funding overhaul.

Suburban and downstate municipalities have warned of the deep strains they face to meet a state-imposed mandate that began in 2015 to begin funding their police and fire funds at actuarial levels to reach a 90% funded ratio in the coming decades.

“The numbers pretty much speak for themselves and are just another reminder of what municipal investors should already be well aware of – that Illinois and many of its biggest local governments face a pretty daunting task in the years ahead that is going to be painful for many obligors to address,” said Tom Schuette, co-head of investment research and strategy at Gurtin Municipal Bond Management. “The problem has grown worse during a fairly positive economic environment, which makes it all the more concerning on whether or not these obligors will be able to increase the resources devoted to solving the mess they have created during the next downturn.”