CHICAGO – The results of bond deals sold this week by two Illinois borrowers with state ties cast a stark light on the price paid by the issuer with a stronger link.

The Illinois Metropolitan Pier and Exposition Authority sold $475 million of BB-plus/BBB-minus rated revenue bonds on Tuesday and the Illinois State Toll Highway Authority sold $300 million of AA-minus/Aa3 rated revenue-backed paper on Wednesday.

Both have links to the state, with Gov. Bruce Rauner responsible for the appointment of some board members, and both enjoy strong revenue stream backings.

Only the MPEA’s rating is directly tied to the state government's, and it paid the piper at pricing time.

On the MPEA deal, the 11-year yield of 3.76% represented a 167 basis point spread to the AAA benchmark and an 80 basis point spread to the BBB. The 25 year maturity yield of 4.85% landed at a 221bp spread to the AAA and a 138bp spread to the BBB. On the long end that went out to 2057, the deal paid uninsured rates of 4.4% to 5.25% depending on the structure.

The tollway issues revenue bonds that are insulated and separate from the state budget. Its 2.35% yield on its 11-year maturity landed at a 25 basis point spread to the Municipal Market Data AAA benchmark of 2.10% and five points over the AA benchmark. The 3.15% yield on the long 25-year bond represented a 50bp spread to the AAA and 29 basis points over the AA.

The deal was rated Aa3 by Moody’s Investors Service and AA-minus by both S&P Global Ratings and Fitch Ratings.

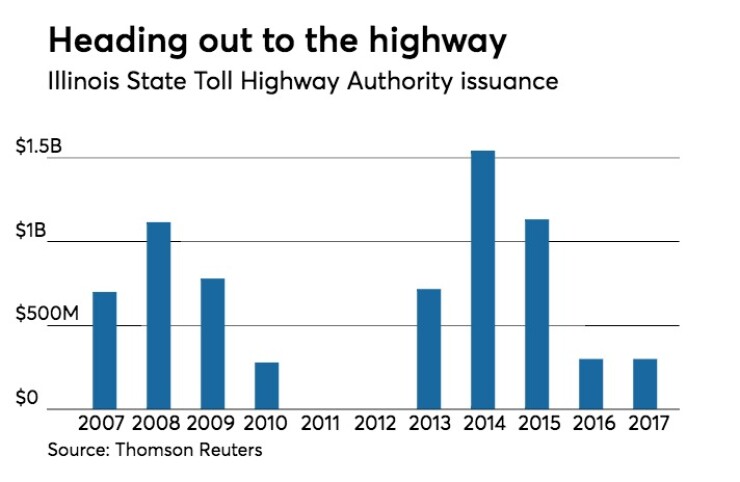

“The Tollway’s good credit rating and solid coverage ratios allow us to obtain excellent interest rates so we can continue moving forward with our Move Illinois capital program,” executive director Greg Bedalov said in a statement Thursday. Proceeds will finance ongoing capital projects under its ongoing $14 billion Move Illinois program. It relies on about $5.7 billion of revenue bonds backed by toll revenues.

Met Pier benefits from a direct pledge of healthy state sales tax collections on top of its own tourist-related taxes, which was once enough to land a triple-A rating. Its rating status plunged during the state budget impasse when monthly payments were temporarily halted without a state budget appropriation. The impasse highlighted a flaw in how funds are released to repay bonds, and Fitch and S&P dropped its ratings in 2015 to one notch below the state’s general obligation rating. That means a junk-level BB-plus rating from S&P, and BBB-minus from Fitch.

MPEA saw its spreads widen from its first post-downgrade sale in 2015. The authority’s 30-year current interest bond paid a yield of 4.87%, 162 basis points over the MMD AAA. In the authority’s 2012 deal, its 30-year current interest bond paid a 4.15% yield, 119 basis points over MMD.

The tollway’s spread penalties are in line with what is demanded for most Illinois-based credits, even those with higher grade ratings, like the tollway. They had widened as the state’s historic budget impasse dragged on earlier this year, but have narrowed and are more in-line with traditional levels.

The MPEA deal to take out a short-term hotel financing and to refund debt marked the agency’s first public offering since one of its ratings sank to junk due to the state’s general obligation credit deterioration. In 2015, the state's GO rating was high enough to keep the Met Pier bonds at investment grade despite the one-notch linkage.