BRADENTON, Fla. – After spending billions of bonds financing two new nuclear reactors, South Carolina’s largest public power agency terminated the work, surprising its private partner in the project and some analysts.

But the losses and the risks may not end there.

Opponents of the nuclear project at the V.C. Summer Nuclear Station say they will demand that regulators claw back rates imposed on customers to pay for the soon-to-be mothballed project, a move that could be a tough sell given that the charges are pledged to repay debt.

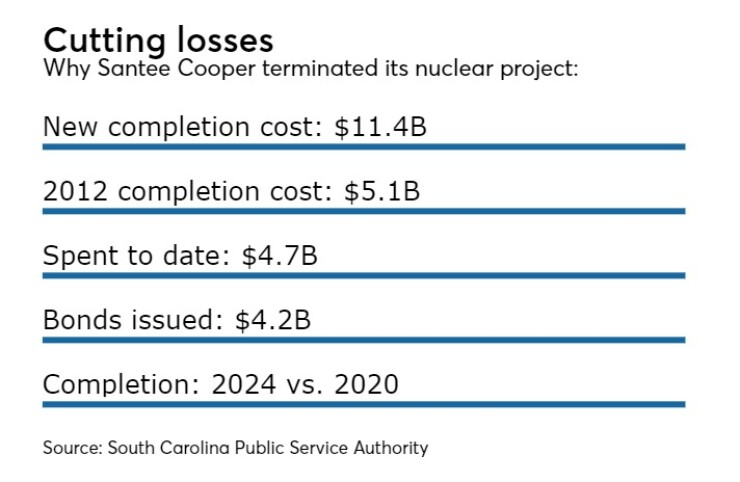

The South Carolina Public Service Authority’s Santee Cooper, a 45% stakeholder, opted out of the project entirely after spending $4.7 billion, saying that it had become uneconomical.

That view differed from an assessment by Santee Cooper's majority partner, SCANA Corp.’s South Carolina Electric & Gas, the investor-owned utility funding 55% of the project.

SCANA Chairman Kevin Marsh told the South Carolina Public Service Commission on Tuesday that his company wanted to complete one of the two units.

“In the end, Santee Cooper determined it was in its interests and that of its customers to suspend construction of the units,” he told regulators. “As a practical and financial matter, this left us no option but abandonment of both units.”

Santee Cooper said several reasons led it to pull the plug on the reactors since the application to build them was filed in 2008, including declining electricity demand, lower natural gas prices, and uncertainty about limits on greenhouse gas emissions from other forms of generation such as coal.

“Today, the business climate has changed considerably,” the state-run agency said.

Wells Fargo Senior Analyst Randy Gerardes said he was somewhat surprised that Santee Cooper pulled out of the project entirely, but it exemplifies the complexity of such projects.

“This highlights the challenges associated with nuclear,” he said. “It highlights who takes the risk and also the challenge of long-term planning for power. I think some people have a greater appreciation of that now.”

Gerardes said in April that he anticipated the project would be completed after the prime contractor, Toshiba Corp.-subsidiary Westinghouse Electric Co., filed for bankruptcy.

At the time, however, he said Santee Cooper and SCE&G did not know if they could cover cost overruns or whether Toshiba – facing its own financial difficulty – would fulfill its parental guarantee of Westinghouse’s obligations.

Just days before announcing an end to the project, SCE&G and Santee Cooper entered an agreement for Toshiba to guarantee $2.16 billion - $1.19 billion to SCE&G and $976 million to Santee Cooper – under the engineering, procurement, and construction contract that Westinghouse will reject in its Chapter 11 case.

The amount of the guarantee is about $500 million more than Toshiba agreed to before Westinghouse filed for bankrutpcy in March, Marsh told the PSC Tuesday.

Gerardes said that he was somewhat surprised that Santee Cooper pulled out of the project entirely, although he added that the current economic growth picture is “not particularly robust” and there’s less demand for electricity today than when the project was planned.

But for investors in the $4.2 billion of bonds issued by the South Carolina Public Service Authority to finance the nuclear units at V.C. Summer, the news isn’t all bad.

Santee Cooper said it intends to continue paying the bonds.

“We have seen some markets that indicate the bonds have rallied,” Gerardes said. “I think, in general, people are viewing this news as positive.”

On Tuesday, Moody's Investors Service affirmed its A1 rating on Santee Cooper’s $7.7 billion of outstanding bonds – more than $4 billion issued to finance its 45% stake in the nuclear units – while maintaining a negative outlook.

“From a credit perspective, we view the suspension as a credit positive for Santee Cooper,” said analyst Dan Aschenbach. “The decision eliminates significant construction risk overhang, and will ultimately result in lower retail rates than what otherwise may have happened under the nuclear build option.”

The negative outlook relates to lingering risks that remain for the public power agency, including whether Toshiba has the financial wherewithal to satisfy its obligations under its parental guaranty, Aschenbach said.

He also said uncertainty associated with Santee Cooper’s execution risk in suspending its participation in the construction project remains, and there is risk that customer reaction to the stranded cost will pressure the willingness of Santee Cooper’s board to approve the rate increases required to maintain sound financial metrics.

Gerardes said bondholders will be looking for ratepayers to make good on the bonds and the rates that will be necessary to cover additional capital costs for replacement capacity when it is needed.

But there will be competing interests for ratepayers’ dollars as environmental and taxpayer groups seek to recover through clawbacks some of the reported $9 billion they say have been paid in advance for the failed nuclear project.

“It’s time for money to be refunded as it was collected from [ratepayers] under the false pretense that advance payment for the nuclear project was sound,” said Tom Clements, senior advisor at Friends of the Earth. “The damage that this bungled project has caused to ratepayers and the state’s economy must be promptly addressed by SCE&G, Santee Cooper and regulators.”

Santee Cooper has argued that in the decade since deciding to participate in the nuclear project, it was experiencing rapid growth and forecasts indicated that growth would continue.

Natural gas prices were three times higher than today and were forecast to remain high, the agency said.

At the time, Congress was considering bills that would limit greenhouse gases emitted by coal and natural gas units, and Santee Cooper’s board approved a goal to meet 40% of customer energy needs by 2020 with non-greenhouse gas emitting resources, renewable energy sources, conservation and energy efficiency.

“Nuclear power is the only base load resource that is virtually emissions free,” agency officials said Monday.

But Santee Cooper also said its load forecast has slowed because of lingering impacts from the Great Recession and the conservation measures it launched in 2009.

Other major changes, the agency said, are that natural gas prices have plummeted after fracking began and the current political landscape has reduced the urgency for emissions-free base load generation.

“Generation diversity remains an important strategy for Santee Cooper, but the costs of these units are simply too much for our customers to bear,” said Leighton Lord, chairman of Santee Cooper’s board of directors. “Even considering these project challenges, Santee Cooper is proud of our role in this initial effort to restart a 30-years-dormant industry. Nuclear power needs to remain part of the U.S. energy mix.”