Municipals had a firmer tone on Thursday, tending to follow Treasuries more often than not, with high-grade securities exhibiting the strongest demand among retail investors, according to Howard Mackey, managing director at NW Financial Group in Hoboken, N.J.

He said market climate has improved since January — especially due to the high retail demand for triple-A-rated specialty state paper, including New Jersey, Maryland, and Georgia — which is trading at stronger levels, at or close to those on the generic triple-A scale tracked by Municipal Market Data.

“Some names, like Howard County, Md., which is triple-A-rated, traded five to seven over MMD and then re-traded at plus-5,” he said Thursday morning.

He said the bounceback was also evident in credits like New York City's recently issued general obligation bonds. As of Thursday, he said they were seen trading 28 basis points over the MMD scale. He attributed the tone to the recent flurry of new issuance in a somewhat tentative market.

“For high-grade paper, the market seems firm,” he said, adding that double and triple-A rated New Jersey paper is trading particularly well because of the “fair amount of demand and issuance.”

Even California paper is doing well, according to Mackey, who cited the Los Angeles International Airport offering, which offered 10-year paper at 40 basis points over the MMD scale. He called that “pretty decent” for paper subject to the alternative minimum tax.

Overall, he said the market fundamentals are in line for continued demand.

“There is still a backdrop of a calendar that is probably going to be significantly reduced for the year, so that’s going to help keep demand fairly constant,” Mackey said.

Primary Market

Bank of America Merrill Lynch priced Houston, Texas’ $417.84 million of airport system subordinate lien revenue and refunding bonds consisting of Series 2018A bonds subject to the alternative minimum tax and Series 2018B non-AMT bonds.

The $131.29 million of Series 2018A AMT bonds were priced as 5s to yield from 1.74% in 2019 to 3.63% in 2038 and 3.69% in 2041. The $286.55 million of Series 2018B non-AMT bonds were priced as 5s to yield from 1.64% in 2019 to 3.38% in 2038, 3.46% in 2043 and 3.51% in 2048.

The deal is rated A1 by Moody’s Investors Service and A by Fitch Ratings.

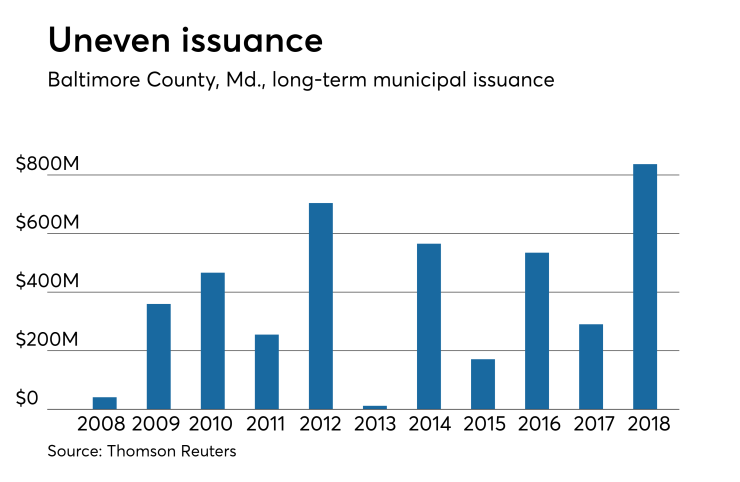

Baltimore County, Md., competitively sold about $837 million of bonds and notes in four offerings.

BAML won the $225 million of general obligation metropolitan district bonds, 80th issue, with a true interest cost of 3.5471%. The issue was priced to yield from 1.59% with a 5% coupon in 2020 to 3.43% with a 4% coupon in 2045; a 2048 term bond was priced as 4s to yield 3.46%.

Citigroup won the $121 million of 2018 GO consolidated public improvement bonds with a TIC of 3.1964%. The issue was priced to yield from 1.59% with a 5% coupon in 2020 to 3.38% with a 4% coupon in 2038.

Citi won the $246 million of Series 2018 consolidated public improvement GO bond anticipation notes with a TIC of 1.5046%.The BANs were priced as 4s to yield 1.45% in 2019.

And Citi won the $245 million of Series 2018 metropolitan district general bond anticipation notes with a TIC of 1.5046%. Pricing information was unavailable.

The bonds are rated triple-A by Moody’s, S&P Global Ratings and Fitch while the notes are rated MIG-1 by Moody’s, SP1-plus by S&P and F1-plus by Fitch.

Since 2008, the county has sold about $4 billion of bonds with the most issuance prior to this year occurring in 2012 when it sold $704.1 million. It sold the least amount of debt in 2013, when it issued $11.8 million.

Bentonville School District No. 6 of Benton County, Ark., sold $198 million of Series B refunding and construction bonds.

Wells Fargo Securities won the bonds with a TIC of 3.6590%. The issue was priced to yield from 1.44% with a 5% coupon in 2018 to 3.80% with a 4% coupon in 2042. A 2047 term bond was priced as 4s to yield 3.70% while a 2048 term was priced as 3 3/4s to yield 3.863%.

The deal is insured by the Arkansas school district enhancement program and rated Aa2 by Moody’s

RBC Capital Markets is set to price the New York State Thruway Authority’s $592.01 million of Series L general revenue refunding bonds after holding a retail order period on Wednesday.

The issue was priced for retail to yield from 1.41% with a 3% and 4% coupons in a split 2019 maturity to 3.70% with a 3.625% coupon and 3.34% with a 5% coupon in a split 2037 maturity.

The deal is rated A2 by Moody’s and A by Fitch.

Bond Buyer 30-day visible supply at $9.79B

The Bond Buyer's 30-day visible supply calendar decreased $581.5 million to $9.79 billion on Thursday. The total is comprised of $3.97 billion of competitive sales and $5.82 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,791 trades on Wednesday on volume of $11.47 billion.

New York, California and Texas were the states with the most trades, with Empire State taking 14.804% of the market, the Golden State taking 13.639% and the Lone Star State taking 7.795%.

Tax-exempt money market funds saw outflows

Tax-exempt money market funds experienced outflows of $306.6 million, lowering total net assets to $137.60 billion in the week ended Feb. 27, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $114.8 million on to $137.90 billion in the previous week.

The average, seven-day simple yield for the 197 weekly reporting tax-exempt funds increased to 0.63% from 0.56% the previous week.

The total net assets of the 826 weekly reporting taxable money funds increased $14.20 billion to $2.679 trillion in the week ended Feb. 26, after an inflow of $5.11 billion to $2.665 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 1.04% from 1.02% from the prior week.

Overall, the combined total net assets of the 1,023 weekly reporting money funds increased $13.89 billion to $2.817 trillion in the week ended Feb. 26, after inflows of $5.00 billion to $2.803 trillion in the prior week.

Treasury to sell bills

The Treasury Department said Thursday it will auction $51 billion 91-day bills and $45 billion 182-day discount bills on Monday.

Gary Siegel contributed to this report.

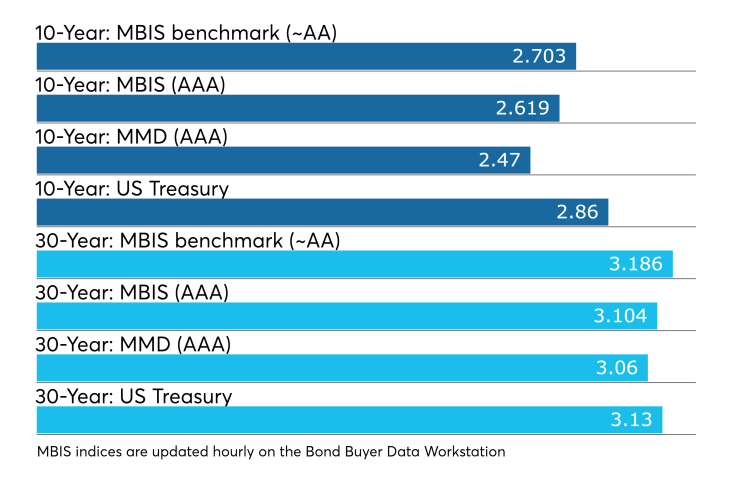

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.