The July 4 holiday will delay but won’t put a damper on the need for tax-exempt product, said Paul Clark, a portfolio manager at Ziegler Capital Markets in San Francisco.

Demand has been strong following last year’s tax law changes, as “munis are the last tax savings after tax reform and munis in general are strong, especially in high-taxed states,” he said.

“With a lot of July 1 money coming due it’s going to be a grab fest,” though it probably won’t happen until the second week in July, he said.

Clark said he's is finding value and opportunity in the secondary market for his separately managed account clients and prefers bonds with shorter calls in the current rising interest rate environment. “We want to keep our duration in check,” he said.

Although he passed on some Los Angeles notes he saw in the secondary because they didn’t fit his clients’ investment parameters, he said he would keep an eye out for some follow-through in the secondary on the Los Angeles' general obligation bonds, even though the California market is trading on the expensive side.

“California levels are rich versus the general market,” because reinvestment needs are forcing investors to pay up for the state's paper, he said..

Primary market

The municipal bond market will be taking a breather as the Fourth of July holiday falls right in the middle of the upcoming week, curtailing primary activity.

Ipreo estimates weekly bond volume at $73.8 million, down from a revised total of $4.69 billion this week, according to updated data from Thomson Reuters. The calendar contains no negotiated deals, just competitive sales. Financial markets will be closed on Wednesday in observance of Independence Day and the municipal bond market will close early on Tuesday.

Longer term, The Bond Buyer's 30-day visible supply calendar totals $2.02 billion, comprised of $1.38 billion of competitive sales and $635.2 million of negotiated deals.

Secondary market

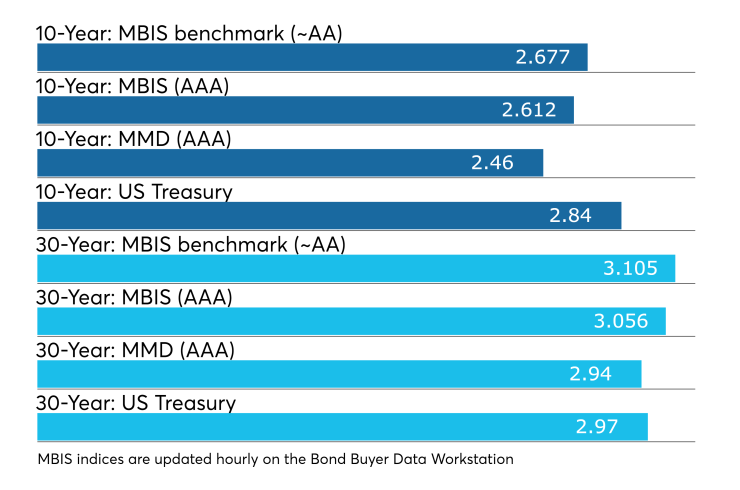

Municipal bonds were stronger on Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities. High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point all across the curve.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield falling by one basis point and remaining unchanged in the 30-year muni maturity.

Treasury bonds were little changed as stock prices traded higher.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 86.3% while the 30-year muni-to-Treasury ratio stood at 98.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

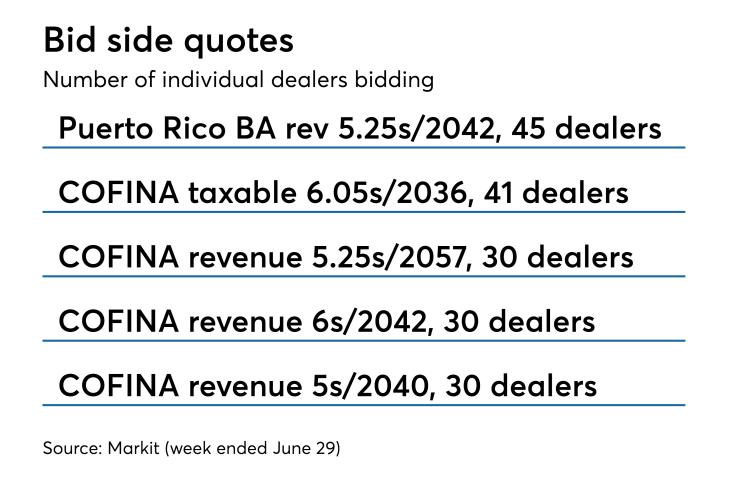

Week's actively quoted issues

Puerto Rico, Florida and California names were among the most actively quoted bonds in the week ended June 29, according to Markit.

On the bid side, the Puerto Rico Buildings Authority revenue 5.25s of 2042 were quoted by 45 unique dealers. On the ask side, the Florida Hurricane Catastrophe Fund Financing Corp. taxable 2.995s of 2020 were quoted by 116 dealers. And among two-sided quotes, the California taxable 7.6s of 2040 were quoted by 28 dealers.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended June 29 were from California, West Virginia and Puerto Rico issuers, according to

In the GO bond sector, the Los Angeles 4s of 2019 traded 175 times. In the revenue bond sector, the West Virginia Hospital Finance Authority 4s of 2051 traded 40 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp.6.05s of 2036 traded 23 times

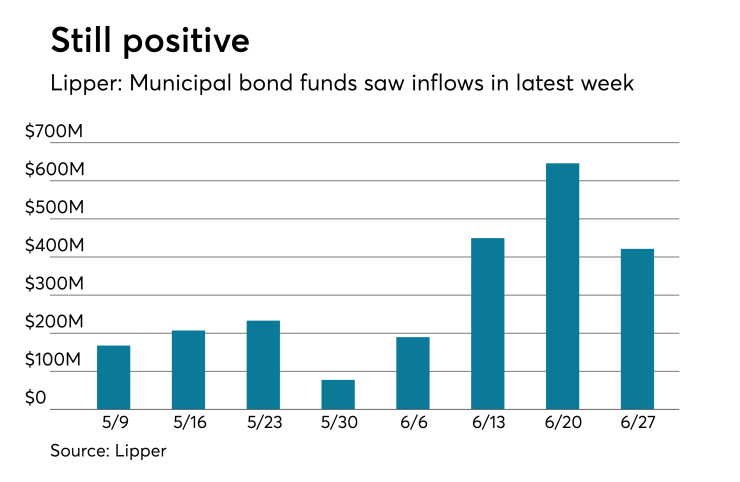

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds continued to show confidence and again put cash into the funds in the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $421.387 million of inflows in the week ended June 20, after inflows of $646.014 million in the previous week.

Exchange traded funds reported inflows of $216.906 million, after inflows of $410.136 million in the previous week. Ex-ETFs, muni funds saw $204.481 million of inflows, after inflows of $235.878 million in the previous week.

The four-week moving average remained positive at $426.625 million, after being in the green at $340.591 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $357.320 million in the latest week after inflows of $606.057 million in the previous week. Intermediate-term funds had inflows of $84.352 million after inflows of $105.799 million in the prior week.

National funds had inflows of $426.190 million after inflows of $684.818 million in the previous week. High-yield muni funds reported inflows of $179.487 million in the latest week, after inflows of $268.850 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.