Municipal bonds were stronger on Tuesday as California’s $1.7 billion tobacco bond deal was repriced and note deals from Idaho and Houston hit the market.

The primary saw “tremendous participation” on Wednesday, according to a New York municipal trader, who said anything with yield, like the California tobacco bonds, generated demand.

He said the tobacco deal saw $15 billion in orders and was five to six times oversubscribed, even after the deal was tightened 15 to 18 basis points from the initial scale.

In general, he said the muni market is “firm on the new issue side with lots of money around. There is lots of technical strength to the market, but most of it stays down on the front end of the curve and inside 10 years.”

While new issues were generating demand, the secondary market was relatively quiet. “It’s a tale of two cities,” the trader said.

Primary market

Citigroup priced and repriced the Golden State Tobacco Securitization Corp.’s $1.67 billion of Series 2018A-1 tobacco settlement asset-backed bonds, comprised of serial and turbo term bonds.

The serials were repriced as 5s to yield from 3.07% in 2030 to 3.29% in 2035.

The $250 million of turbo terms of 2036 were repriced as 3 1/2s at par.

The $1 billion of turbo terms of 2047 were split into $600 million of 5s, repriced to yield 4.70%, with a yield to maturity of approximately 4.931%; and $400 million of 5 1/4s, repriced to yield 4.50%, with a yield to maturity of approximately 5.073%.

The turbo 2036 bonds have a projected average life of 3.6 years with an expected final turbo redemption in 2025 while the turbo 2047 bonds have a projected average life of 20.38 years with an expected final turbo redemption in 2041.

S&P Global Ratings assigns the deal preliminary structured finance ratings as follows: BBB on the 2030 to 2035 serial maturities and BBB-minus to the 2036 turbo term bonds. S&P did not rate the 2047 turbo terms.

In the short-term competitive sector, Idaho sold $540 million of Series 2018 tax anticipation notes.

Bank of America Merrill Lynch won the TANs with a net interest cost of 1.5996%.

The deal is rated MIG1 by Moody’s Investors Service, SP1-plus by S&P and F1-plus by Fitch Ratings. Piper Jaffray is financial advisor and MSBT Law is bond counsel.

Houston sold $225 million of Series 2018 tax and revenue anticipation notes. The deal was won by eight groups.

The TRANs are rated MIG1 by Moody’s and F1-plus by Fitch. Financial advisors are Hilltop Securities and YaCari Consultants; bond counsel are Francisco G. Medina and Bracewell & Giuliani.

An Atlanta trader said that Tuesday’s Georgia deals were all well placed, except for about $150 million in balances between 2019 and 2029 that he noticed on Wednesday morning.

“It got pretty big numbers and was well distributed,” he said of the Georgia sale, adding that the minor balance was out of $1.5 billion total from the four deals.

“There’s seemingly always really good demand for state of Georgia GOs, particularly the longer maturities and in large block sizes," he said. "Those are two things that get a lot of interest.”

Georgia saw rates of 1.88% for the five-year tax-exempt bonds, 2.26% for the 10-year tax-exempts and 3.08% for the 20-year tax-exempt, for a blended rate of 3.01% for the tax-exempts. For the taxable bonds, rates were at 2.65% for the five-year taxables, 3.02% for the 10-years and 3.62% for the 20-years, for a blended rate of 3.54% for the taxable bonds.

The deal is rated triple-A by Moody’s, S&P and Fitch.

“Georgia’s fiscal leadership has made our bonds highly sought after among investors, and as a result, our low interest rates for borrowing save our taxpayers millions of dollars every year,” said Gov. Nathan Deal. “Thanks to conservative budgeting and investments that produce positive results, we continue to strengthen our reputation as the No. 1 state for business. Georgia is a well-managed and reliable state in which to invest and locate, and these ratings reflect this.”

Wednesday’s bond sales

California:

Idaho:

Texas:

Oppenheimer: Demand for munis strong

Oppenheimer & Co. says since demand remains strong for municipal securities and there hasn’t been a big rise in the new issue calendar, it’s expected there wasn’t much downward pressure on muni performance in June.

Supply is expected to be manageable throughout the summer, so munis may move closer to or see positive returns by the end of the summer, Jeffrey Lipton, managing director and head of muni research and strategy at Oppenheimer & Co., wrote in a market comment.

“Looking at the muni yield curve provides some interesting observations, and potential opportunities; presently, the long-end of the curve can offer value as the 30-year benchmark relative value ratio stands very close to parity,” Lipton said. “Thus, there is an opportunity to lock in attractive long-term yields for those less-duration-conscious and buy-and-hold investors given a relative steepening of the muni yield curve over recent weeks.”

Oppenheimer said buyers can find value in munis while containing duration risk.

“Furthermore, for those more interest rate sensitive buyers, employing a ‘barbell strategy’ still makes sense,” Lipton said. “Here, investors can add protection on the short-end given a rise in rates, thus reducing reinvestment risk and lock in higher long-term returns if rates fall.”

He added that as municipal note season arrives, there are opportunities to take advantage of a segment of the market that has performed relatively well with ample liquidity given the concern over monetary policy.

ICI: Long-term muni funds see $326M inflow

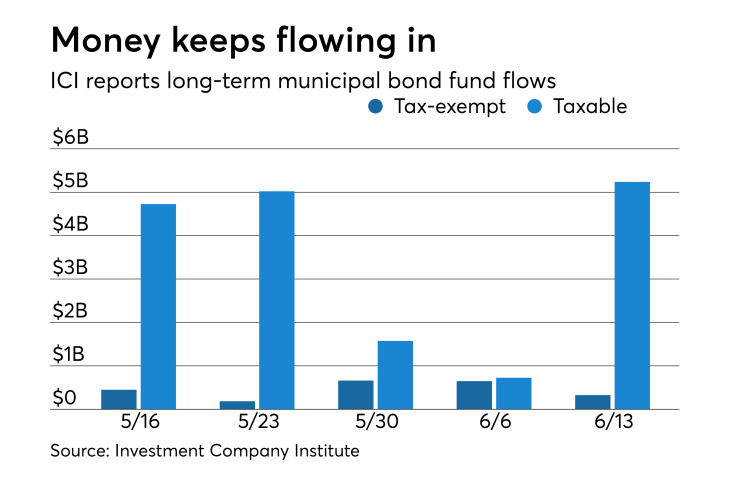

Long-term municipal bond funds saw an inflow of $326 million in the week ended June 13, the Investment Company Institute reported.

This followed an inflow of $648 million into the tax-exempt mutual funds in the week ended June 6 and inflows of $661 million, $185 million and $450 million in the three prior weeks.

Taxable bond funds saw an estimated inflow of $5.24 billion in the latest reporting week, after seeing an inflow of $726 million in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $9.94 billion for the week ended June 13 after outflows of $4.16 billion in the prior week.

Secondary market

The secondary market was firm and lethargic on Wednesday afternoon, according to a New York municipal trader, who said there were only six trades out of over 50 different line items worth $400 million dollars as trading was nearing close.

“The market has been up recently and traded off today, so everyone is awaiting new issues and not interested in the secondary market,” he explained.

Municipal bonds were stronger on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point across most of the curve.

Municipals had been softer Wednesday morning following Tuesday’s equity market meltdown that triggered a risk on, risk off trade amid a flurry of tax-exempt new-issuance that saw strong demand.

“Typically when you have an up day and then a softer day on Treasuries, the market struggles and tries to determine if the gains we saw yesterday are sustainable,” an Atlanta trader said. “We had a pretty firm benchmark drop in yields of four basis points yesterday, and municipals out-performed Treasuries, so today we’re taking a little breather,” he said.

One of the popular retail structures he has noticed in high demand was 3% discount bonds inside of 10 years.

“We’re starting to see a little backup in the market with that structure and coupon,” he said. “It’s not being distributed at as tight a spread as they have been coming.”

“We continue to see good demand in the front end of the curve -- particularly from individuals and firms that represent individuals, such as SMA accounts,” he continued.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed yields rising one basis point in the 10-year muni general obligation and remaining unchanged in the 30-year muni maturity.

Treasury bonds were weaker as stock prices turned mixed.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.5% while the 30-year muni-to-Treasury ratio stood at 96.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,042 trades on Tuesday on volume of $12.33 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 15.707% of the market, the Lone Star State taking 15.25% and the Empire State taking 12.464%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.