The holiday-shortened week with the usual accompanying low issuance shouldn’t overwhelm demand, putting the municipal market in a good spot at midyear.

Ipreo estimates volume will drop to $3.41 billion, from the revised total of $6.59 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $2.48 billion of negotiated deals and $930 million in competitive sales.

“It will be a little slow coming off the holiday and everything but the market is firming up, getting stronger and stronger,” said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management. “There is not a lot of supply around to meet all the supplies and calls coming up in June, making the strong technicals even more so.”

That the increase in supply in the past two weeks was easily taken down, he said, with most deals oversubscribed.

“What the Federal Reserve does after June will be key,” he said. With June’s rate increase baked in, the question is whether there will be one or two more this year.

“We are more and more bullish on bonds,” Heckman said. “There were a lot of people who were negative on bonds and skeptical on how much the Fed would raise; if we get any sustainable move with yields going the other direction, there will be a lot of folks caught on the front end, scrambling to try and extend durations.”

Transportation deals top the calendar.

On Thursday, Barclays is scheduled to price the Metropolitan Washington Airports Authority’s $578 million of airport system revenue and refunding alternative minimum tax bonds. The deal is rated Aa3 by Moody's Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

On Wednesday, Bank of America Merrill Lynch is slated to price the South Carolina State Ports Authority's $325 million of revenue AMT bonds. The deal is rated A1 by Moody's and A-plus by S&P.

The largest competitive deal will take place Thursday, when the Virginia Transportation Board sells $149.605 million of capital project revenue bonds.

Secondary market

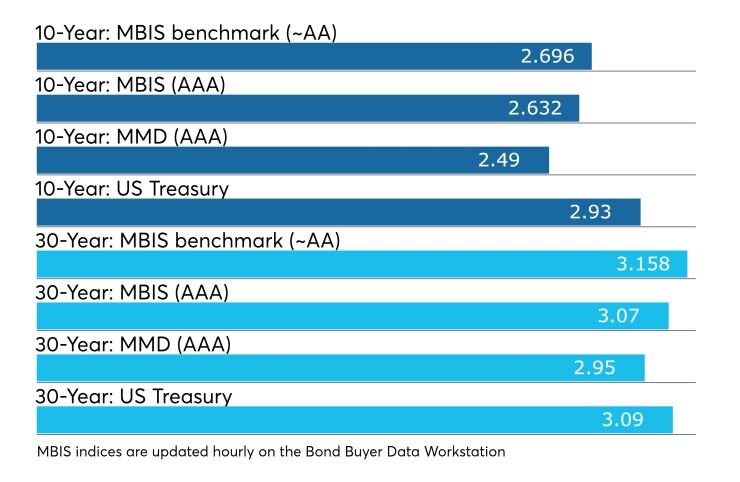

Municipal bonds were stronger on Friday, according to a late read of the MBIS benchmark scale.

Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities on both the benchmark and MBIS’ AAA scale.

Municipals were also stronger along Municipal Market Data’s AAA benchmark scale, which showed yields falling as much as two basis points in the 10-year general obligation muni and dropping four basis points in the 30-year muni maturity.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.0% while the 30-year muni-to-Treasury ratio stood at 95.5%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasuries with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasuries; if it is below 100%, munis are yielding less.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended May 25 were from Illinois and California issuers, according to

In the GO bond sector, the Chicago Board of Education 5s of 2035 traded 43 times. In the revenue bond sector, the Regents of the University of California 5s of 2048 traded 50 times. And in the taxable bond sector, the Illinois 5.1s of 2033 traded 17 times.

Week's actively quoted issues

Puerto Rico, Virginia and New York names were among the most actively quoted bonds in the week ended May 25, according to Markit.

On the bid side, the Puerto Rico Public Buildings Authority revenue 5.25s of 2042 were quoted by 38 unique dealers. On the ask side, the Virginia Public School Authority revenue 3.125s of 2034 were quoted by 259 dealers. And among two-sided quotes, the New York Metropolitan Transportation Authority taxable 5.871s of 2039 were quoted by 19 dealers.

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds again showed confidence and put cash into the funds in the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $232.801 million of inflows in the week ended May 16, after inflows of $206.948 million in the previous week.

Exchange traded funds reported inflows of $105.053 million, after outflows of $110.620 million in the previous week. Ex-ETFs, muni funds saw $127.748 million of inflows, after inflows of $317.568 million in the previous week.

The four-week moving average remained positive at $65.590 million, after being in the green at $64.760 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $154.282 million in the latest week after inflows of $264.239 million in the previous week. Intermediate-term funds had inflows of $141.916 million after inflows of $10.742 million in the prior week.

National funds had inflows of $301.718 million after inflows of $240.367 million in the previous week. High-yield muni funds reported inflows of $166.008 million in the latest week, after inflows of $415.493 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.