Traders and underwriters said Monday came and went with little activity in the municipal market as investors geared up for a busy week ahead.

“The market looks like it’s pretty much unchanged on the day; no better or weaker tone to it,” Pete Stare of Hilltop Securities said on Monday afternoon. He pointed to a full competitive calendar, which he noted includes over 50 deals on Tuesday. “Overall everyone is getting teed-up for tomorrow.”

He mentioned the state of Georgia’s tax-exempt and taxable deals, as well as two tax-exempt deals from Denver as appealing on Tuesday because of their size and timing.

“Those trades are going to dictate the tone of the market [on Tuesday]” he said.

Overall, Stare said institutional demand is decent, though somewhat lackluster after the top tax rate was cut.

“We are beginning to see some of the effects of tax legislation,” with the drop in corporate tax rates constraining purchases of municipal bonds by banks and other larger institutions, Stare said.

Others observers said investors were still focused on the short end of the market, and will remain there due to uncertainty and market pressures as well as summer reinvestment season.

According to Peter Delahunt, managing director of municipals at Raymond James & Associates, the continued day-to-day impact from the negative net supply could have some misleading undertones when it comes to future performance.

“The misleading aspect to the negative net supply mantra is that it doesn’t incorporate duration; the coupon payments and principal payments that are rolling off are all short-dated holdings,” Delahunt said.

“Those short-dated bonds and the coupon payments act as cash, and cash doesn’t necessarily have to be reinvested out long, especially when there is a lot of anxiety in the market,” he said, pointing to concern over inflation, a tariff war, rising interest rates, and other pressures.

“People are keeping money short, and we see evidence of this in the front end of the curve where there is outperformance,” Delahunt said. “It’s a market where the demand and flow is strong moving down the curve and has become a bit more apathetic longer out on the curve. There tends to be slower trading activity as you get past eight years.”

Primary market

On Monday, underwriters circulated a premarketing scale on the Golden State Tobacco Securitization Corp.’s $1.699 billion of Series 2018A-1 tobacco settlement asset-backed bonds consisting of serial bonds and turbo term bonds.

S&P Global Ratings assigned the bonds structured finance preliminary ratings as follows: BBB to the 2030 to 2035 serial maturities and a BBB-minus rating to the 2036 turbo term bonds. S&P did not rate the turbo term bonds due June 1, 2047.

The serial bonds were being premarketed as 5s to yield from 3.32% in 2030 to 3.54% in 2035.

The $500 million of turbo terms of 2036 were being premarketed at par to yield 3.625%. The $1 billion of turbo terms of 2047 were split and being premarketed as $500 million of 5s to yield approximately 5.066% and as $500 million of 5 1/4s to yield 4.70%. The turbo 2036 bonds have an a projected average life of 3.75 years while the turbo 2047 bonds have an a projected average life of 20.88 years

On Tuesday, Georgia is coming to market with about $1.23 billion of general obligation bonds in four competitive sales.

The deals consist of $428.95 million of Series 2018A Tranche 2 GOs, $411.655 million of Series 2018A Tranche 1 GOs, $210.445 million of Series 2018B Tranche 1 taxable GOs and $178.65 million of Series 2018B Tranche 2 taxable GOs.

The deals are rated triple-A by Moody’s Investors Service, S&P and Fitch Ratings. The financial advisors are Public Resources Advisory Group and Terminus Municipal Advisors; bond counsel is Gray Pannell.

Also Tuesday, the city and county of Denver, Colo., is selling $264.74 of GOs in two sales. The deals consist of $193 million of Series 2018A elevate Denver GOs and $71.74 million of Series 2018B justice system facilities refunding GOs.

The deals are rated AAA by Fitch. Financial advisors are Hilltop Securities; bond counsel are Greenberg Traurig and Becker Stowe.

And New Mexico is selling $123.45 million of Series 2018A severance tax bonds.

Financial advisors are Fiscal Strategies Group and Public Resources Advisory Group; bond counsel are Sherman & Howard and Rodey Dickason.

In the negotiated sector on Tuesday, Bank of America Merrill Lynch is set to price Massachusetts’ $225 million of Series 2018A rail enhancement and accelerated bridge programs commonwealth transportation find revenue bonds for retail investors ahead of the institutional pricing on Wednesday.

The deal is rated Aa1 by Moody’s and AAA by S&P and Kroll Bond Rating Agency.

Prior week's top underwriters

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Citigroup, JPMorgan Securities, Raymond James & Associates and Morgan Stanley, according to Thomson Reuters data.

In the week of June 10 to June 16, BAML underwrote $1.26 billion, Citi $976.6 million, JPMorgan $947.1 million, Raymond James $597.4 million, and Morgan Stanley $553.2 million.

Bond issuance off 17.1% year-over-year

Municipal bond issuance year to date totals $146 billion as of June 14, down 17.1% compared to the same period last year, according to a Bank of America Merrill Lynch research report released Monday.

Sophie Yan, a municipal research strategist at BAML , said that 28% of the total issuance so far this year has been related to refundings, compared to 53.3% in the same period last year.

Looking at performance, the ICE BAML U.S. Municipal Securities Index returned negative 0.605% for the year to date, outperforming both the ICE BAML U.S. Treasury and Agency Master Index and the ICE BAML U.S. Corporate Index which had total return of negative 1.707% and negative 3.211%, respectively. The best performance in munis for the year to date period has been in the one- to three-year maturities and in the BBB-rated sector.

Secondary market

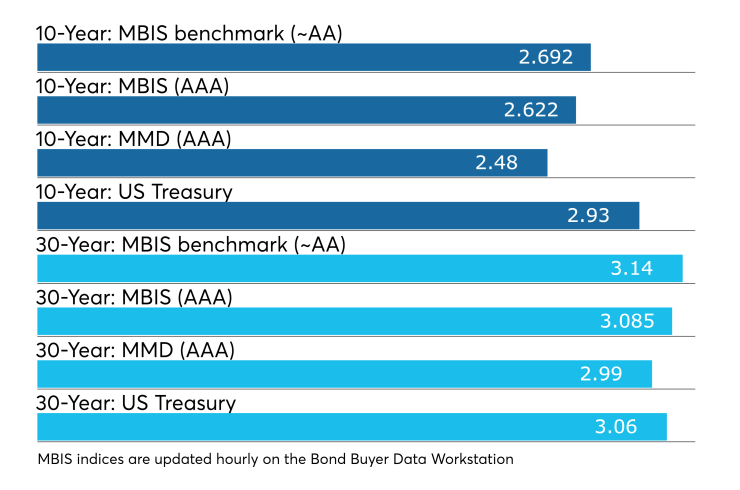

Municipal bonds were stronger on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities. High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point all across the curve.

Municipals were unchanged on Municipal Market Data’s AAA benchmark scale, which showed yields steady in the 10-year muni general obligation and in the 30-year muni maturity.

Treasury bonds were stronger as stock prices were lower.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.9% while the 30-year muni-to-Treasury ratio stood at 98.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 33,729 trades on Friday on volume of $11.20 billion.

New York, California and Texas were the states with the most trades, with the Empire State taking 17.213% of the market, the Golden State taking 12.668% and the Lone Star State taking 7.898%.

Prior week's actively traded issues

Revenue bonds comprised 54.91% of new issuance in the week ended June 15, down from 55.36% in the previous week, according to

Some of the most actively traded bonds by type were from Puerto Rico and Nevada issuers.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 55 times. In the revenue bond sector, the Reno, Nev. 4s of 2058 traded 45 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp.6.05s of 2036 traded 84 times.

Treasury to sell $35B 4-week bills

The Treasury Department said it will sell $35 billion of four-week discount bills on Tuesday. There are currently $89.997 billion of four-week bills outstanding. The 28-day bills are due July 12 and are dated June 14 with an original issue date of Jan. 11.

Treasury auctions discount bills

The Treasury Department sold $48 billion of 91-day and $42 billion of 182-day discount bills on Monday.

The three-month bills incurred a 1.900% high rate with a coupon equivalent of 1.936%. The price for the 91s was 99.519722. The median bid was 1.880% and the low bid was 1.850%. Tenders at the high rate were allotted 79.88%. The bid-to-cover ratio was 3.12.

The six-month bills incurred a 2.075% high rate with a coupon equivalent of 2.126%. The price for the 182s was 98.950972. The median bid was 2.040% and the low bid was 2.00%. Tenders at the high rate were allotted 72.11%. The bid-to-cover ratio was 2.78.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.